[ad_1]

Rand Dollar Outlook: USD/ZAR Influenced by a Slightly Higher Dollar Post NFP

Recommended by Tammy Da Costa

Get Your Free USD Forecast

US Employment Remains Robust After Strong NFP Report but Rand Resilience Holds

USD/ZAR is currently trading around 0.95% higher on the week as the safe-haven Dollar recuperated a portion of recent losses.

As monetary policy and recession fears continue to influence demand for emerging-market currencies, the economic docket has helped fuel the recent move.

DailyFX Economic Calendar

While the South African economy struggles to increase productivity due to extensive power outages (known as load shedding), the Rand has fared relatively well against the greenback.

Recommended by Tammy Da Costa

Trading Forex News: The Strategy

However, after falling below the 17.000 psychological level last month, the volatile pair fell to a weekly low of 16.781 before bulls stepped in.

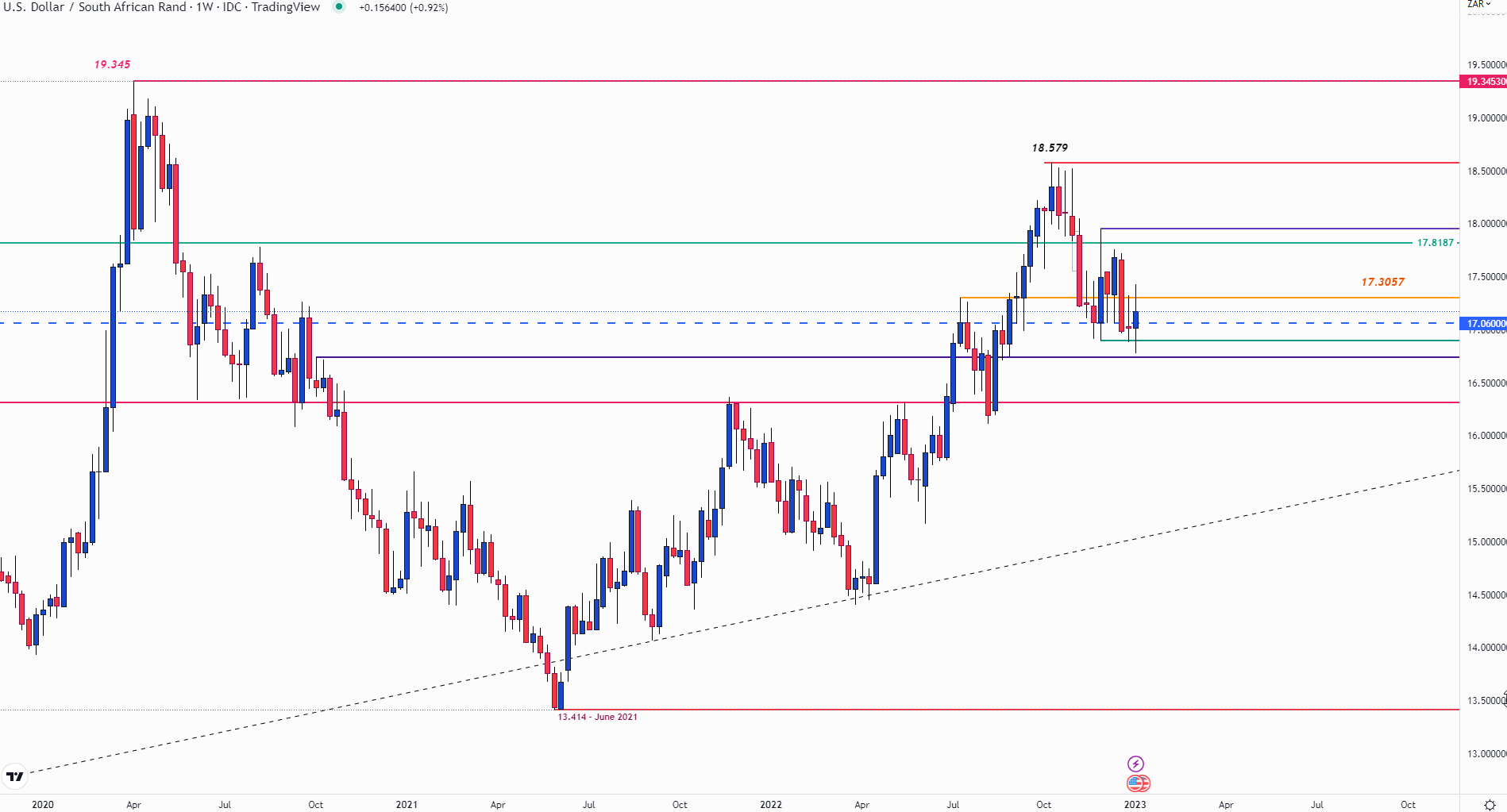

With the weekly chart highlighting important zones of support and resistance levels that may contribute to restoring momentum over the next few weeks.

USD/ZAR Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

Although the FOMC minutes and the release of December job data assisted in supporting the rebound, lower wage growth has limited gains. As the Federal Reserve prepares to hike rates at the next Fed meeting next month, participants have been pricing in a 25-basis point rate hike up until now.

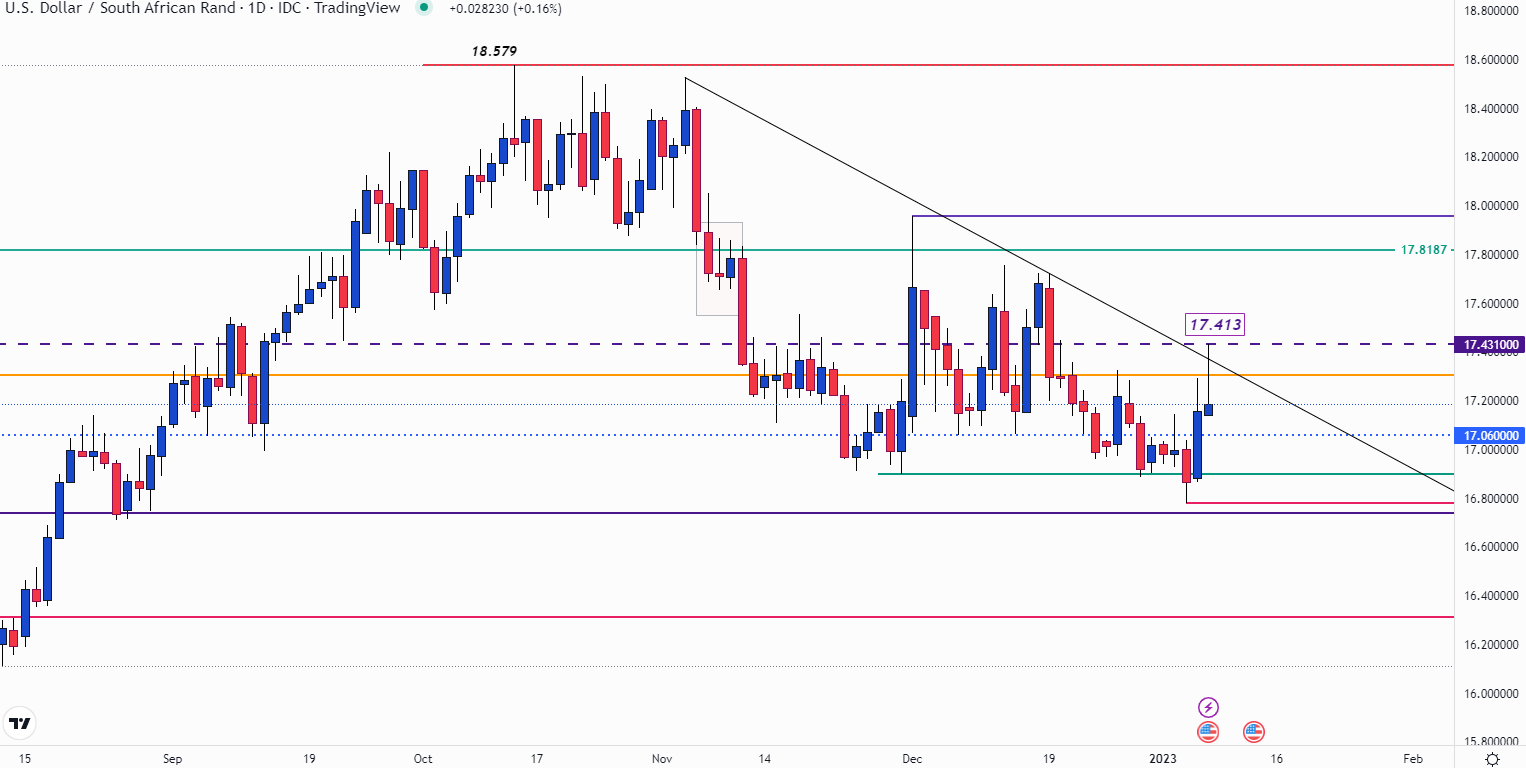

With the probability of another 50-basis point hike accompanied by another strong NFP (non-farm payrolls) report, USD/ZAR surged before peaking at 17.413.

A rejection of the high at trendline resistance highlights the significance of this zone. From the daily chart, a long candlewick suggests that bears aren’t ready to quit just yet. However, with a small body developing at the bottom of the daily candle, sellers aren’t in the clear just yet.

USD/ZAR Daily Chart

Chart prepared by Tammy Da Costa using TradingView

USD/ZAR Technical Levels

Looking ahead, both bulls and bears have technical barriers that could influence the short-term trend.

For bearish momentum to gain, a move below prior resistance now support at 17.06 may allow for a retest of 17.00 and a potential move towards the current low of 16.718.

Meanwhile, if USD/ZAR holds above 17.20, a move above the July high of 17.035 could see bulls retesting 17.413 and back towards 17.600.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.