[ad_1]

Christopher Jue/Getty Images Entertainment

Thesis

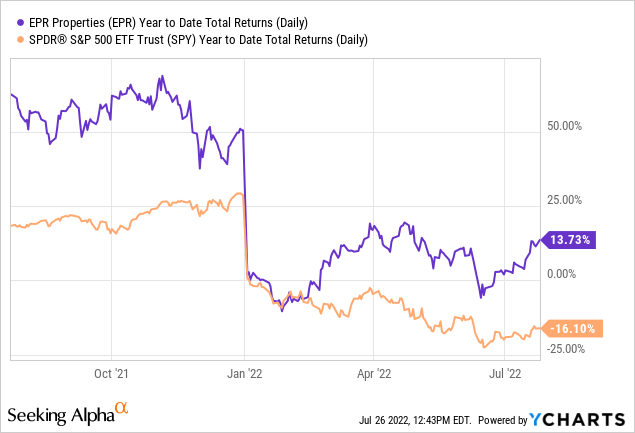

EPR Properties (NYSE:EPR) is a leading diversified experiential REIT, primarily focusing on megaplex theatre properties. The REIT has also rewarded investors who played to its strength on the post-pandemic reopening cadence, as EPR significantly outperformed the SPDR S&P 500 ETF (SPY) YTD.

Furthermore, the REIT is well-managed, with a sustainable payout ratio, and capable of sustainably funding its near-term growth. Notwithstanding, EPR remains well below its pre-COVID highs. We believe the market has de-rated EPR since June 2021, as its buying momentum has continued to fail at its intermediate resistance ($56).

Even though management is optimistic about navigating the worsening macro headwinds, coupled with rising interest rates, we believe the market is less certain. Notwithstanding, EPR seems to have attracted dip buyers consistently at its near-term support ($41), suggesting that significant long-term downside risks should be limited.

However, we believe EPR could continue to face significant selling pressure at its intermediate resistance (7.7% potential upside at writing) in the near term.

As a result, we rate EPR as a Hold for now and encourage investors to wait for a meaningful retracement before considering adding exposure.

EPR Outperformed The SPY Markedly YTD

As seen above, EPR posted a YTD gain of 13.73%, well above the SPY’s -16.1% gain. Therefore, EPR investors have capitalized astutely on the reopening cadence, despite worsening macro headwinds threatening consumer spending.

Despite the macro worries, management is confident that the REIT is primed to execute well in a recessionary environment exacerbated by high inflation rates. Management articulated (edited):

Most, if not all of our properties, are on the value side of Experiential. If you look at the theater industry historically, you can match it up for probably the last 30 to 35 years that theaters outperformed during the recession. It’s still the cheapest form of escapism. So we’ve had a few recessions. And generally speaking, our theater properties or our Experiential Properties have outperformed during these periods. (Nareit’s REITweek: 2022 Investor Conference)

But, Growth Is Still Expected To Moderate

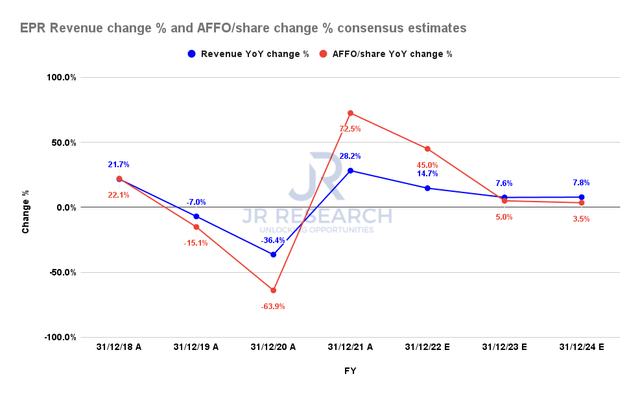

EPR revenue change % and AFFO/share change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that its AFFO per share growth could normalize from FY23 after recovering markedly in FY21-22. Therefore, we believe it could reduce further upside potential, despite its market outperformance in 2022.

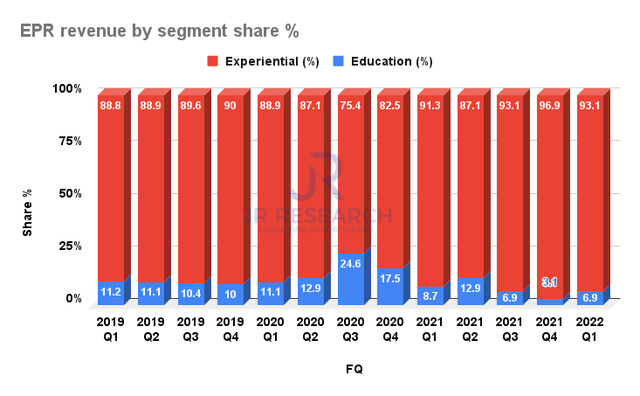

EPR revenue by segment share % (Company filings)

Furthermore, given its significant exposure as an experiential REIT, we believe the market has de-rated EPR in the current macro environment. Despite management’s confidence, EPR could still be impacted by higher interest rates and inflation, limiting its AFFO per share growth. The company also cautioned in its filings (edited):

Our long-term leases and loans typically contain provisions such as rent escalators, percentage rent or participating interest, designed to mitigate the adverse impact of inflation. However, these provisions may have limited effectiveness at mitigating the risk of high levels of inflation due to contractual limits on escalation, which exist on substantially all of our escalation provisions. (EPR Properties 10-Q)

EPR’s Price Action Suggests Limited Upside/Downside

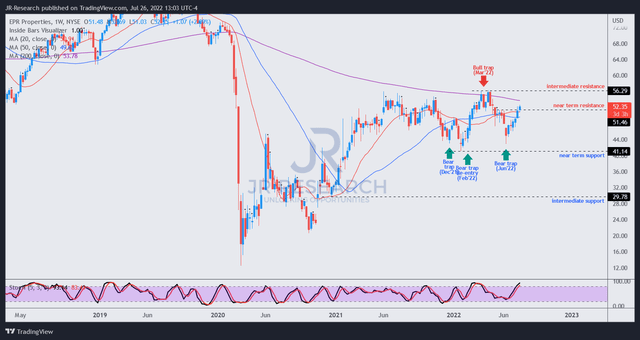

EPR price chart (weekly) (TradingView)

We observed that the market has consistently denied further buying upside at its intermediate resistance ($56). Notably, the market also set up a bull trap in March 2022 (indicating the market rejected buying momentum decisively), sending EPR tumbling to its June 2022 lows.

However, the market also seems supportive of stanching a further decline below its near-term support ($41). Therefore, we believe that it appears that EPR’s long-term downside risks remain well-contained.

Notwithstanding, we observed that EPR is testing its near-term resistance and is close to its intermediate resistance. Coupled with its medium-term technically overbought breadth conditions, we believe caution is warranted at the current levels.

Is EPR Stock A Buy, Sell, Or Hold?

EPR last traded at an NTM P/AFFO per share of 10.97x, markedly below its 5Y mean of 13x.

Notwithstanding, we observed that the market has consistently denied further buying upside at its intermediate resistance, at a P/AFFO per share of 11.8x. Therefore, the market appears to have de-rated EPR despite its robust market outperformance in 2022.

Given the limited upside/downside potential for EPR at the current levels, we rate it as a Hold for now. Investors considering adding exposure should wait patiently for a retracement first.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.