[ad_1]

EUR/USD Price, Chart, and Analysis

- US dollar strength in control of USD-pairs.

- Data is unlikely to prop up the Euro next week.

- All eyes are on Fed chair Powell next Friday.

The US dollar is in complete control across a range of financial markets going into the weekend as traders finally accept that a Fed pivot any time soon is not going to happen. US Treasury yields remain elevated and bid, while the US dollar basket (DXY) trades at highs last seen one month ago. When you pair the US dollar against a structurally weak Euro, then further downside for EUR/USD looks set as the path of least resistance.

EUR/USD Slides Further on Energy Woes and US Dollar Flex

The energy problem in Europe, touched on above, is getting worse with German year-ahead power trading at a fresh record high of EUR545/MWH. The German government warned that the economy is stagnating and the outlook is gloomy as energy prices soar and supply-chain disruptions continue. Adding to the Euro gloom, German PPI data released earlier today showed the price of goods and services sold in the wholesale market soar to record levels.

For all market-moving economic releases and events, see the DailyFX Calendar

Retail traders continue to build long positions in EUR/USD with net-long positions jumping higher and net-short positions being pared back heavily.

Retail trader data show67.76% of traders are net-long with the ratio of traders long to short at 2.10 to 1. The number of traders net-long is 15.11% higher than yesterday and 42.76% higher from last week, while the number of traders net-short is 10.40% lower than yesterday and 27.57% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

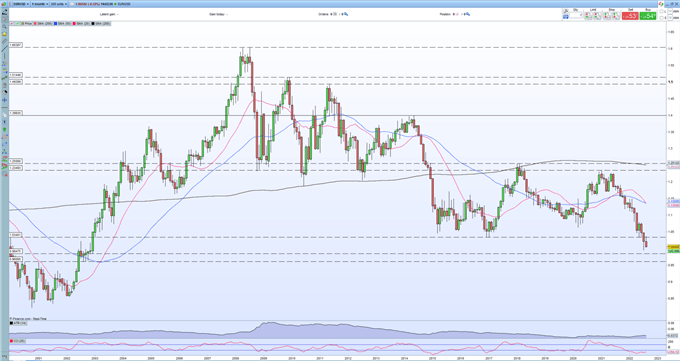

EUR/USD Parity Beckons Once Again

EUR/USD has already, briefly, broken parity once this year, and the current set-up suggests that not only will this level be broken again but this time the pair may stay below 1.000 for longer. The pair continue to print lower highs and lower lows, while all three simple moving averages are pointed lower in a bearish formation. The CCI indicator shows the pair to be heavily oversold and this needs to be washed out before EUR/USD takes the next leg lower. The first target is 0.99523, which may not provide too much support before 0.9845 and 0.9610 come into play, levels last seen two decades ago.

EUR/USD Monthly Price Chart – August 19, 2022

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.