[ad_1]

EUR/USD Price, Chart, and Analysis

Recommended by Nick Cawley

Download our brand new Q1 2023 guide

For all market-moving economic releases and events, see the DailyFX Calendar

German inflation fell for the second month in a row in December, according to the latest data released by the Federal Statistical Office (Destatis). Preliminary consumer price inflation y/y fell to 8.6% from 10% in November and came in below market expectations of 9.0%. EU-harmonized inflation also fell sharply to 9.6% from a prior month’s 11.3%. The final December results will be released on January 17, 2023.

Recommended by Nick Cawley

How to Trade EUR/USD

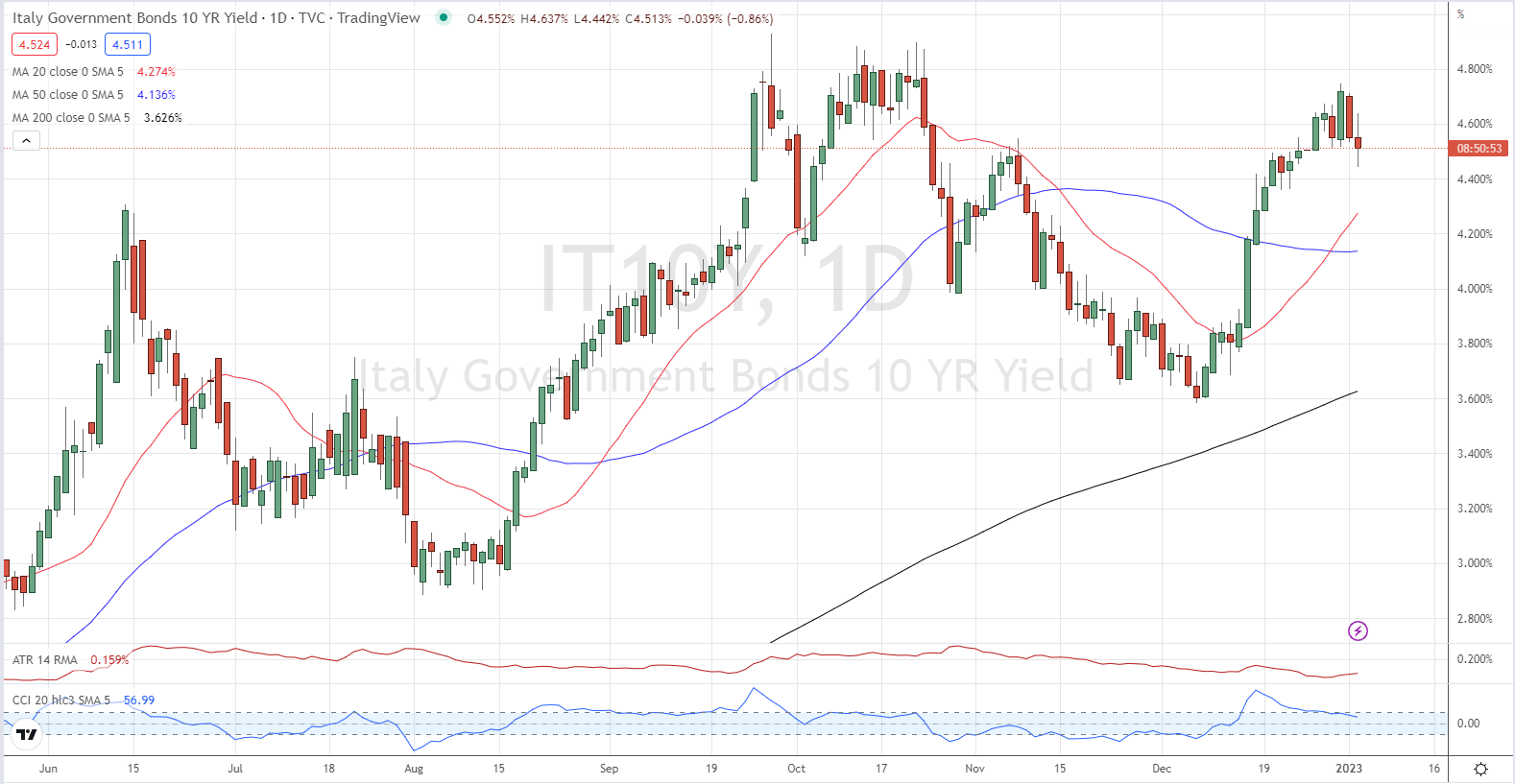

Euro-Zone government bond yields fell Monday, stemming a small part of their recent move higher as traders begin to pare back excessive ECB rate hike expectations. German 10-year Bund yields are 8 basis points lower on the day, while Italian 10-year BTPs are 11 basis points lower on the session.

Italian 10-Year BTP Yield, January 3, 2023

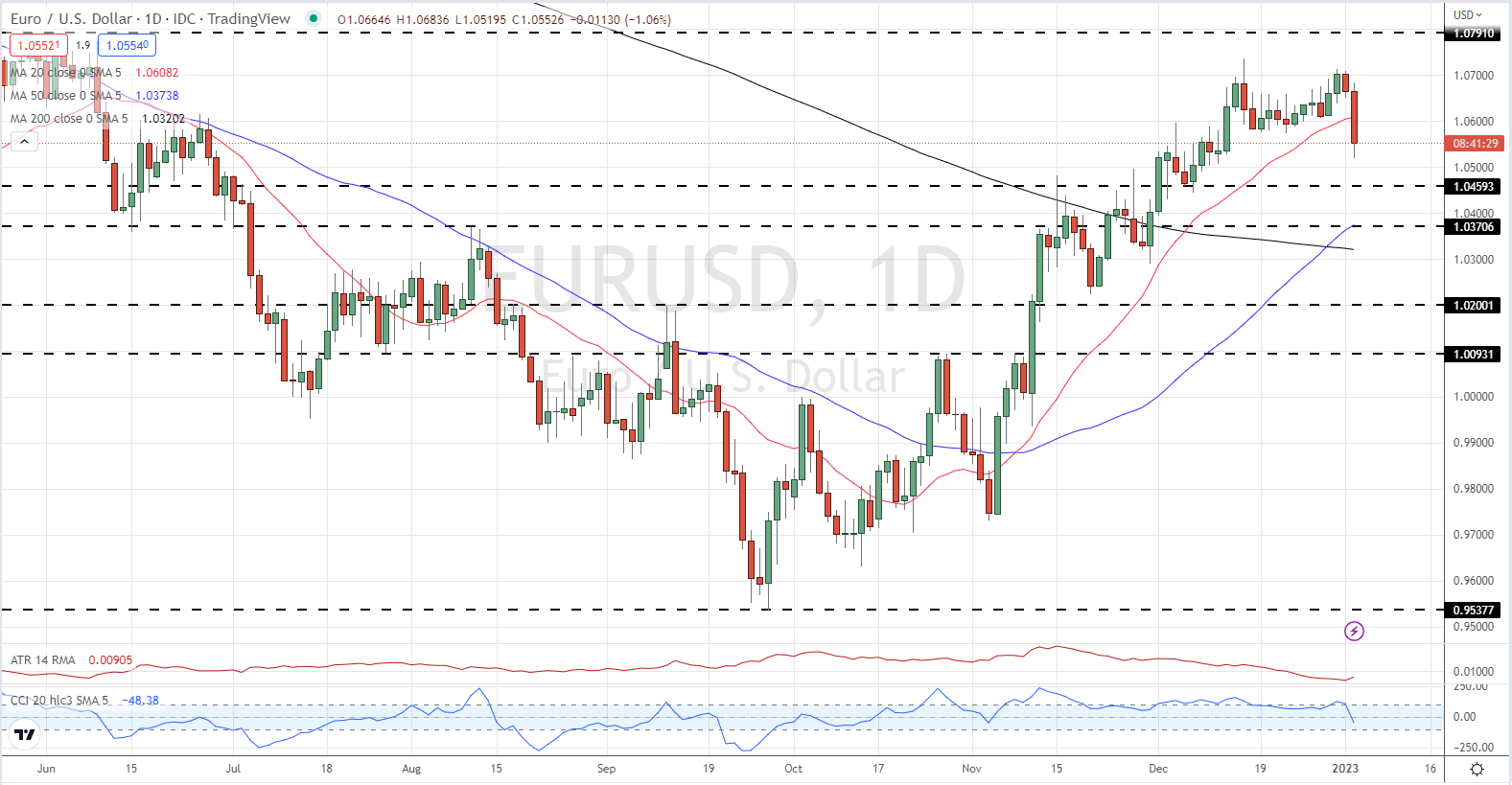

The single currency is under pressure against the US dollar today and today’s sell-off has seen EUR/USD wipe out all the last three weeks’ gains. The pair balked at breaking below 1.0500 today but may re-test this level if traders continue to price in a more dovish ECB. The technical set-up is mixed with the pair now below the 20-day sma while EUR/USD remains above both the 50- and 200-day moving averages. The 50-/200-day ma crossover produced a bullish ‘golden cross’ on December 29. EUR/USD may be looking to find an early range with 105.00-107.35 likely to produce support and resistance for now.

EUR/USD Daily Price Chart January 3, 2023

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 50% | -23% | 3% |

| Weekly | 30% | -19% | 0% |

Sharp Pick-Up in Net EUR/USD Long Positions

Retail trader data show 42.83% of traders are net-long with the ratio of traders short to long at 1.34 to 1.The number of traders net-long is 43.73% higher than yesterday and 26.26% higher from last week, while the number of traders net-short is 11.71% lower than yesterday and 9.37% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net short.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.