[ad_1]

Thierry Hebbelinck/iStock Editorial via Getty Images

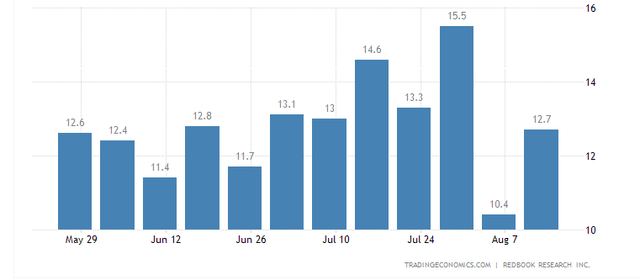

Retail earnings season isn’t over yet. Investors might wonder how the final handful of consumer stocks will report over the coming days before all eyes focus on Chair Powell at Jackson Hole on Friday. Guess?, Inc. (NYSE:GES) reports its Q2 results Wednesday after the bell. Bigger picture, though, retail profits have generally been better than expectations amid a currently-strong back-to-school shopping season. While there have been a few hiccups this reporting period, July’s Retail Sales data, and the latest weekly Johnson Redbook Report underscore resilience in consumer spending (although a chunk of high spending can be attributed to inflation).

A Jump In Redbook Retail Sales Last Week

Let’s dig into what answers Guess? might have Wednesday afternoon.

According to Fidelity Investments, Guess?, Inc. designs, markets, distributes, and licenses lifestyle collections of contemporary apparel and accessories for men, women, and children that reflect the American lifestyle and European fashion sensibilities. The company’s clothing collection includes jeans, pants, skirts, dresses, shorts, blouses, shirts, jackets, knitwear, and intimate apparel.

The Los Angeles-based $1.1 billion market cap, Specialty Retail industry company within the Consumer Discretionary sector trades at just a 7.9 trailing 12-month price-to-earnings ratio and boasts a 4.5% dividend yield, according to The Wall Street Journal. Importantly, ahead of earnings, GES has a massive 20.1% short float. The retailer missed EPS estimates back in May, but buyers stepped up in the $16-$17 range.

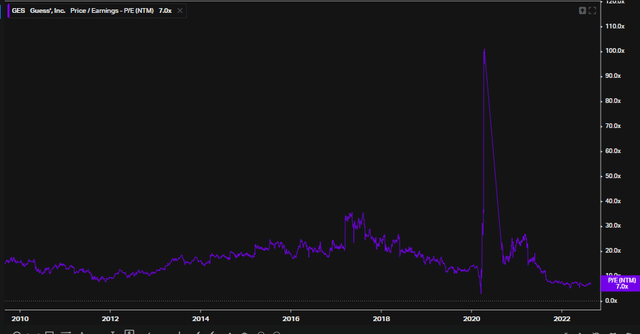

On valuation, the firm’s forward earnings multiple is very low relative to history, suggesting shares could be a buy here. Moreover, the price-to-earnings ratios both forward- and backward-looking are low compared to the sector median.

Guess? Historical Forward P/E Ratio: Inexpensive Vs History

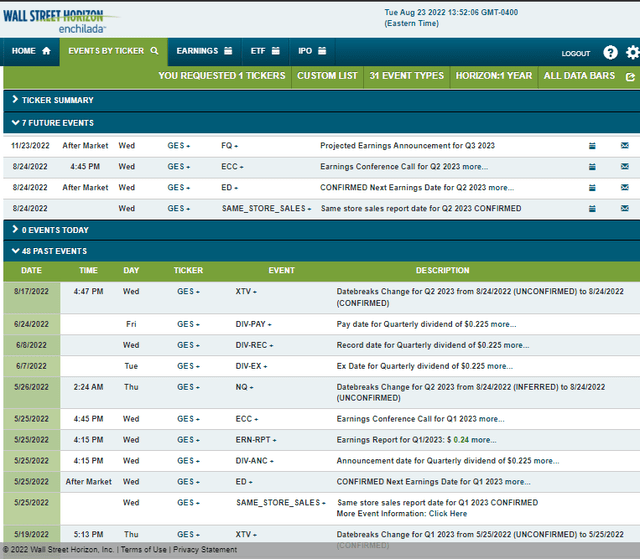

GES’s corporate event calendar is light aside from Wednesday evening’s earnings report, according to data provided by Wall Street Horizon. An earnings call takes place shortly after the announcement. You can listen live here.

GES Corporate Event Calendar: Earnings On Tap Wednesday AMC

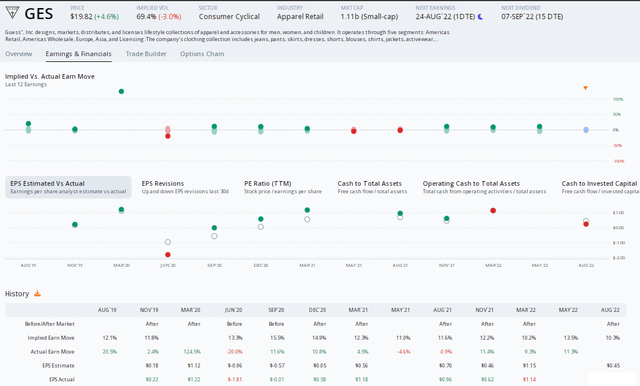

The options market implies a high 10.3% stock price move after the earnings are released using the nearest-expiring at-the-money straddle, according to Options Research & Technology Services (ORATS). Consensus estimates call for $0.45 of EPS, which would be down from the same quarter a year ago, per ORATS.

Guess? Earnings Preview: Options Traders Price In A 10% Swing

The Technical Take

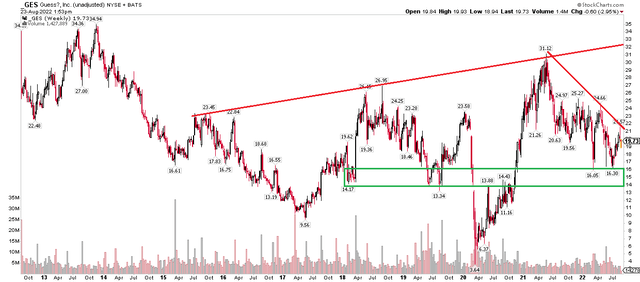

Taking an expected 10% share price move post-earnings into account, there’s a wide range of outcomes with Guess?. The $18 to $22 range is in play. I see near-term resistance off the mid-2021 highs – that downtrend line comes into play just above $22. Expect to see some selling pressure should shares jump on Thursday. There’s solid downside support in the $14 to $16 range when looking at the long-term weekly chart. I would be a buyer on a dip toward $16 with a stop under $14 (which is also a 61.8% Fibonacci Retracement level).

GES: Downtrend Resistance Line In Play, Support Seen Between $14-$16

The Bottom Line

Guess? shares appear cheap on an absolute valuation and when compared to its sector. Strong consumer spending trends continue to surprise many analysts. I see GES as a value play here but would prefer to build a position on a dip toward $16 or on a breakout above $22. The technicals are important on this earnings play given a big potential swing Wednesday night.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.