[ad_1]

Inflation, war, recession fears, aggressive Fed rate hikes,

lingering supply chain issues, layoffs, earnings misses, and lingering pandemic

issues drove the market into official bear market territory last month.

Driven by hopes of a soft landing, a resilient labor market,

pockets of positive economic and corporate results, and some rather seriously

oversold conditions in big name tech and growth stocks the market has rallied

smartly off the June lows.

At the end of July DJIA was up 9.9% from the June lows,

S&P up 12.6% and NASDAQ up 16.4. Summer rally 2022 has worked the bulls

into a frenzy like a matador with his red muleta. DJIA logged its 7th

best July since 1950, up 6.7%, qualifying as a “Hot July Market.”

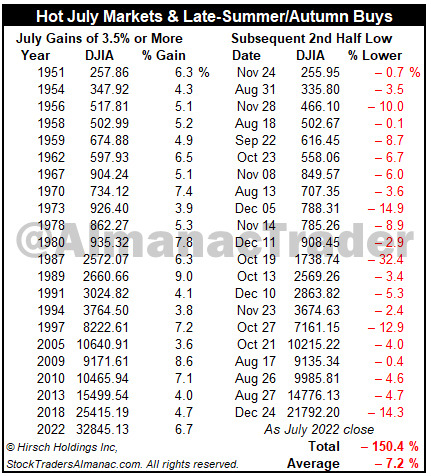

Gains of this magnitude for July, however, have frequently

been followed by late-summer or autumn selloffs and better buying opportunities

than now. In the past, full-month July gains in excess of 3.5% for DJIA have

been followed historically by declines of 7.2% on average in the Dow with a low

at some point in the last 5 months of the year.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.