[ad_1]

According to Brand Essence Research, the global market for cryptocurrency mining equipment was valued at USD 2.3 billion in 2021. Today, we will tell you more about one of the sector’s players – Intchains Group Limited.

The company develops and manufactures components for mining equipment. Intchains Group Limited will list an IPO on the NASDAQ exchange on 5 January 2023. Its stock ticker is ICG.

Brief information on Intchains Group

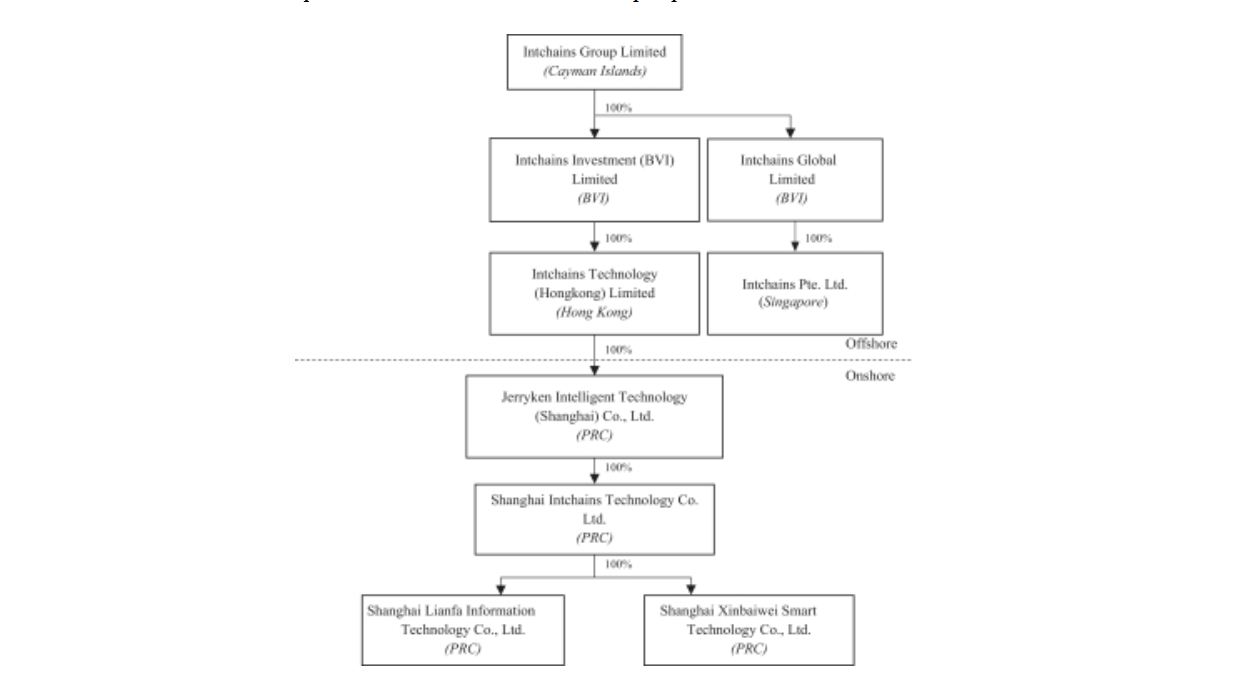

Intchains Group Limited develops Application-specific integrated circuits (ASICs) for the cryptocurrency mining industry and ancillary software and hardware for blockchain projects. Its main customers are manufacturers of cryptocurrency mining equipment.

The company was registered in 2017 in China. The founder and CEO is Qiang Ding, previously R&D director at Shanghai InfoTM Microelectronics Co.

Intchains Group has developed a technology platform, the ‘Xihe’ Platform, to create high-performance and energy-efficient ASIC chips; this has had a positive impact on the company’s revenues and profits.

A particular challenge for business development is the strong dependence on changing trends in the cryptocurrency market: in a falling trend, the level of sales of mining equipment decreases.

In addition, the increased regulation of cryptocurrencies in various countries, including China, poses additional risks to the sector.

As of 31 December 2021, the amount of investment raised by Intchains Group reached 29.5 million USD.

What are the prospects for Intchains Group’s target market?

According to Brand Essence Research, the global market for cryptocurrency mining equipment was valued at USD 2.3 billion in 2021. The estimate is expected to reach USD 5.3 billion by 2028. The projected compound annual growth rate (CAGR) from 2022 to 2028 is 28.5%.

The main driver for the anticipated growth could be the further expansion of cryptocurrency applications and the increase in the number of products that use blockchain technology.

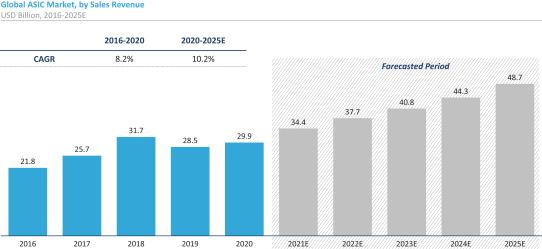

According to Frost & Sullivan, it is estimated that the global ASIC market could reach USD 48.7 billion in 2025. The projected compound annual growth rate (CAGR) from 2020 to 2025 inclusive is 10.2%.

The main competitors:

- BitMain Technologies Holding Company

- Hut 8 Mining Corp.

- ViaBTC Technology Limited

- HashFlare LP

- LIVIKA LP

Intchains Group’s financial performance

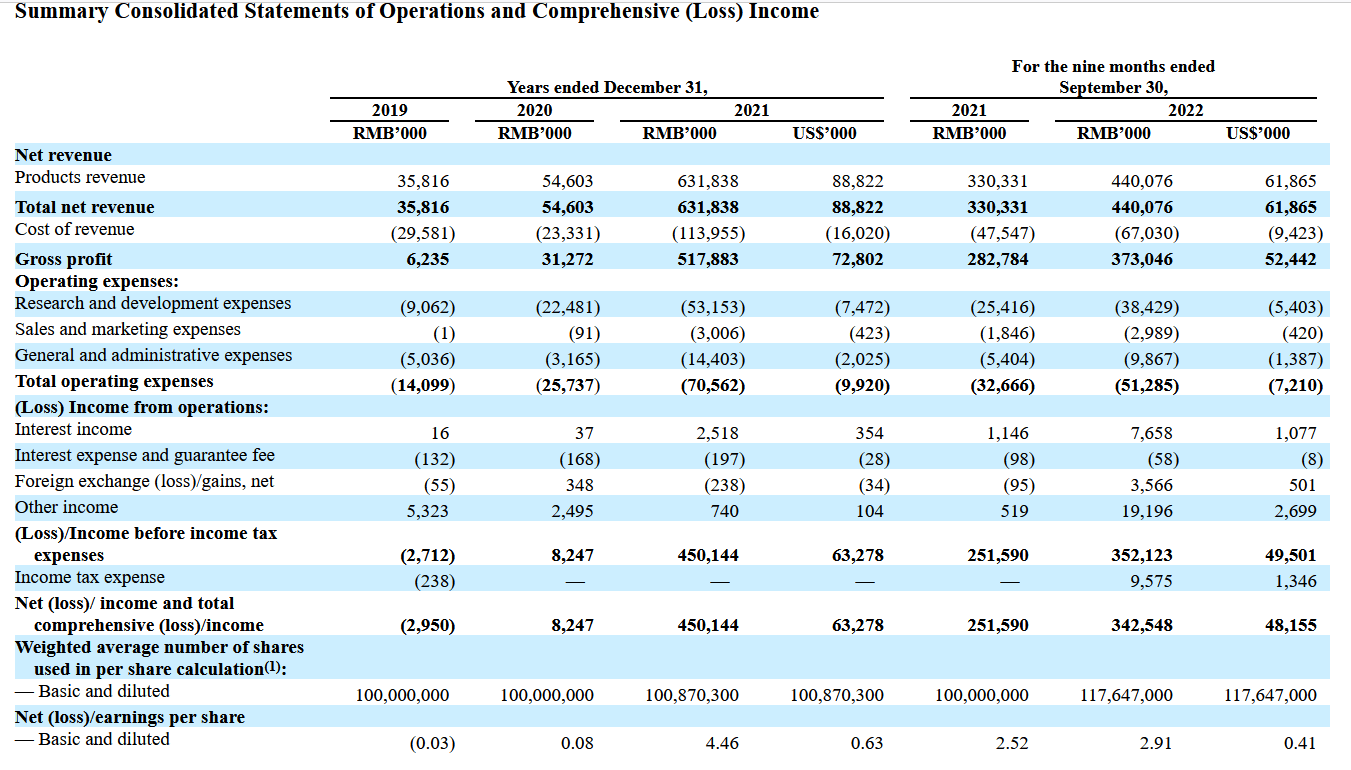

Intchains Group’s revenue for the year 2021 compared to the 2020 statistics increased by 1057.1% to 88.8 million USD, and for January-September 2022 it increased by 33.2% to 61.9 million USD compared to the statistics for the same period of 2021. From October 2021 to September 2022, the figure was 114.9 million USD.

Net profit for the year 2021 increased by 5358.3% to USD 63.3 million and for the period January to September 2022 by 36.2% to USD 48.2 million. From October 2021 to September 2022, the figure stood at USD 83.9 million.

As of 31 December 2021, the company had USD 78.8 million in accounts, with total liabilities of USD 5.2 million.

Intchains Group’s strengths and weaknesses

Strengths:

- Promising addressable market

- High growth rate of the addressable market

- High revenue growth rates

- High net profit growth rates

- Proprietary technology platform

Weaknesses:

- Strong competition

- Dependence on Chinese regulators

- No plans to pay dividends to shareholders

What we know about Intchains Group’s IPO

Intchains Group Limited’s IPO underwriter is Maxim Group LLC. The issuer intends to sell 3.6m ordinary shares. Gross proceeds from the sale of securities may amount to USD 28.6 million, excluding the sale of options by the underwriter. If the offering is successful, Intchains Group will be capitalised at USD 499.2 million.

We use a P/S (capitalisation/revenues) ratio to value this company. The issuer’s P/S value is 4.34. In the current market conditions, the P/S multiple of mining equipment manufacturers can reach five during the lock-up period. In this case, the upside of the issuer’s securities could be 15% ((5/4,34-1)*100%).

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

[ad_2]

Image and article originally from blog.roboforex.com. Read the original article here.