[ad_1]

The business of insurance tends to be characterised by low risk and impressive profit margins. This has been a time-tested thesis. Furthermore, insurance companies very rarely go bankrupt, especially compared to banks. Therefore, insurance stocks are in high demand by investors.

Today we will tell you in detail about Hengguang Holding Co., Limited, which is a Chinese insurance broker. It plans to go public on the NASDAQ exchange and the ticker of its stocks is HGIA. However, the exact date of the IPO is not yet known.

Brief information on Hengguang Holding

Hengguang Holding is an insurance broker that provides intermediary services in the Chinese market. The company’s clients can quickly find the most favourable property, health and life insurance terms in the country.

Founded in 2004, the firm is registered in the Cayman Islands and headquartered in Chengdu, China. It operates in China under the brand name Heng Guang Insurance.

The management team is headed by Zhang Jiulin, one of the founders of Hengguang Holding. He was previously sales director at Zijin Property Insurance Co.

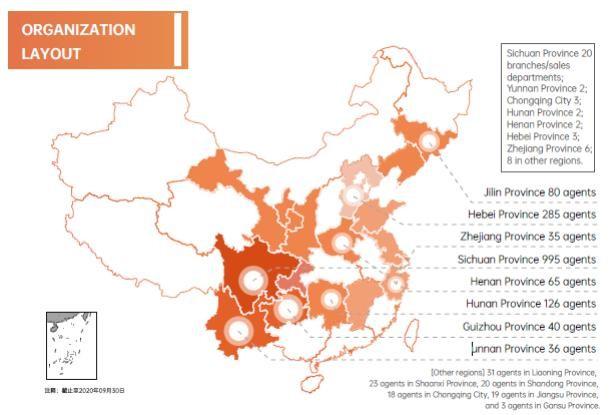

Hengguang Holding’s revenues are generated by commissions from insurance premiums earned by its partners. The issuer develops its activities both online and offline. It has 48 branches in 15 provinces in China. It has also launched a mobile app for its own digital platform, Heng Kuai Bao.

Hengguang Holding’s business is characterised by a relatively low level of client base diversification. More than 60% of the company’s revenue is generated by 5 key partners – The People’s Insurance Company (Group) of China Limited, Ping An Insurance (Group) Company of China, Ltd. In total, the Issuer has 70 partner companies in China.

As of 30 June 2021, the amount of investment raised by Hengguang Holding reached USD 7.2 million. The main investors were individuals Zhang Jiulin, Haibo Bai and Xuefeng Huang.

What are the prospects for the Hengguang Holding address market?

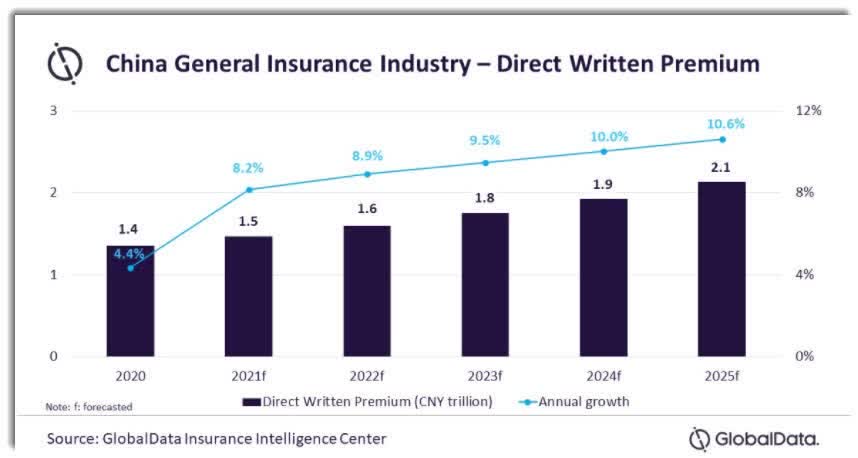

According to a GlobalData report, China’s insurance market will reach CNY2.13 trillion (USD 313 billion) in 2025. The average annual growth rate from 2020 to 2025 inclusive will be 9.5%.

It is predicted that the main driver of the anticipated growth of this industry in the PRC will be an increase in the popularity of motor insurance. In 2020 this type of insurance accounted for 61% of all insurance premiums.

There are thousands of different insurance brokers operating in the Middle Kingdom market. It is characterised by a high level of competition and a lack of major players with a dominant niche share.

What is the financial performance of Hengguang Holding

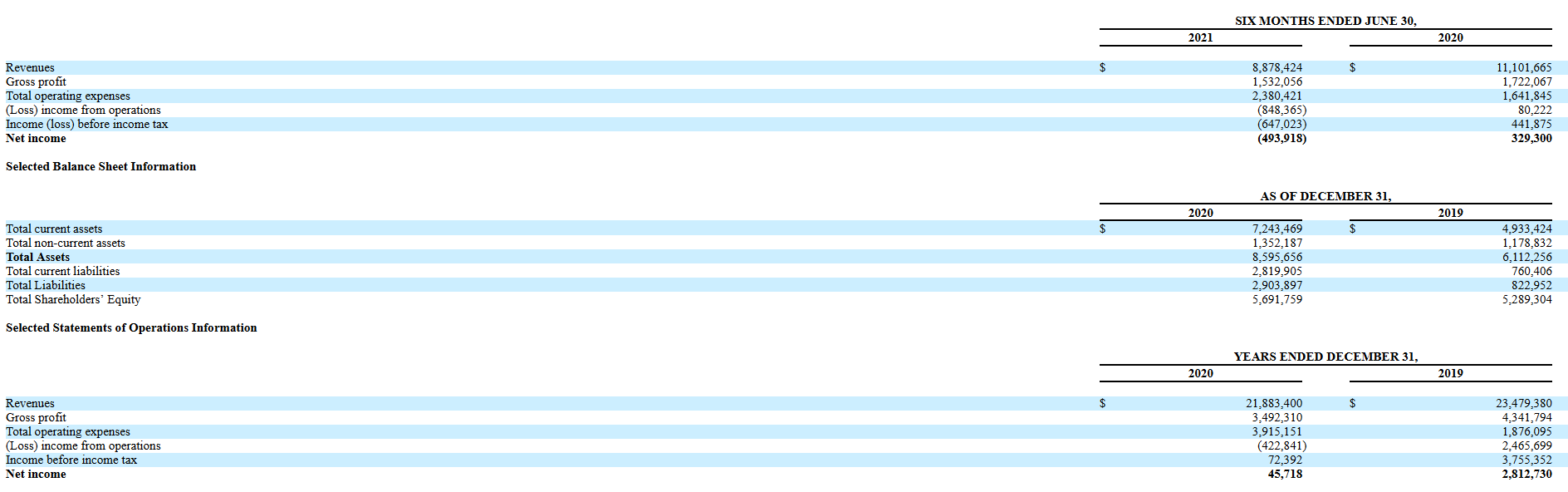

Hengguang Holding’s financial results presented on Form F-1 for 2020 show a 6052.5% drop in net profit compared to the statistics for 2019, to USD 45,720. The decrease in this figure is due to an increase in research and development expenses.

The issuer’s revenue for 2020 was USD 21.88 million, which is 6.8% less than the result for 2019. As we can see, sales growth lags behind the rate of increase in the addressable market.

At the end of the first half of 2021, revenue was 8.88 million USD, and net loss was 493,920 USD. In the same period of 2020, revenue reached 11.1 million USD, and net profit – 329,300 USD.

Net cash flow for the year 2020 was positive and reached 411,190 USD. As of December 31, 2020, the company had USD 810,000 in its accounts, with total liabilities reaching USD 2.81 million.

What are the strengths and weaknesses of Hengguang Holding?

Strengths:

- A promising addressable market

- The issuer invests heavily in brand promotion

- Having its own digital platform

- Qualified management

Weaknesses:

- A high level of competition

- The existence of a net loss

- Low level of diversification of the client base

What do we know about the Hengguang Holding IPO?

The underwriters for the IPO of Hengguang Holding Co., Limited were Network 1 Financial Securities, Inc. The issuer plans to sell 4 million ordinary stocks at the offered average price of USD 4 per unit. Gross proceeds from the sale of stocks will amount to USD 16 million, excluding the sale of options by the underwriter. The company may reach a capitalisation of USD 44.4 million.

The multiplier (ratio) of P/S (capitalisation/revenues) of the issuer can reach 2.25. The average P/S of Chinese insurance brokers is 3. The upside (upside potential) of these stocks could reach 33% ((3/2.25-1)*100%) during the period.

[ad_2]

Image and article originally from blog.roboforex.com. Read the original article here.