[ad_1]

I’ve got a stock I am watching closely right now that I am about to share with you.

But before I do that, I’ve got to ask…

Do you know when it’s time to “back up the truck” and start buying stocks hand over fist?

In this new world where the Fed is actively popping the bubble it single-handedly created, if you can answer “yes” to that question with 100% certainty, well, then you’re a better trader than most.

I’ve got to tell ya, it took me years to devise a system that helps me answer that question.

And just yesterday, I spent the entire 1-hour session teaching my members just how I go about doing this during my LIVE training.

RIGHT NOW, I am about to reveal a large portion of this process to you.

If you don’t know by now, I have been fortunate enough to have two amazingly talented and successful mentors teach me how markets work.

As part of the learning process, I developed a love for analyzing the market with a combination of fundamental, technical and quantitative tools.

In particular, trying to analyse when the market has made a major bottom and selecting the right stocks to trade out of that bottom is among my favorite things to do.

So, without further ado, here are two critical steps in this process:

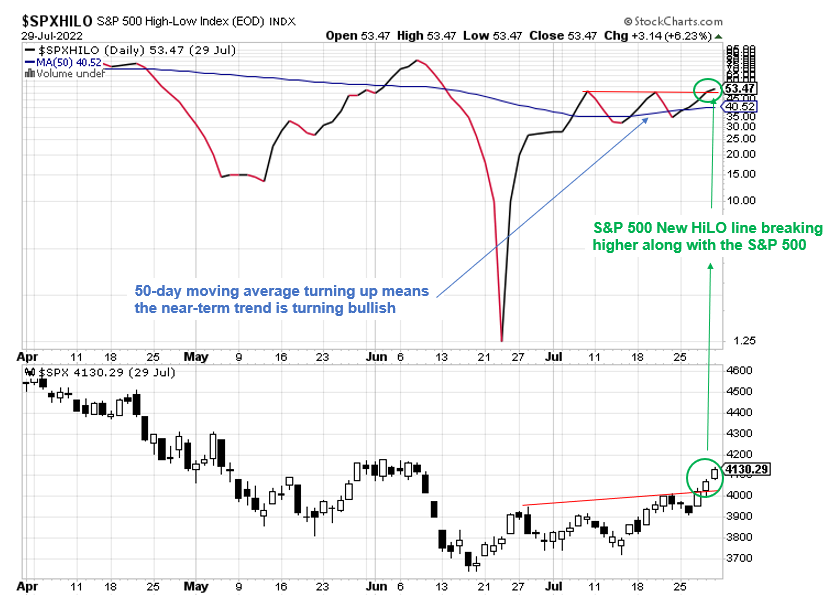

First, I look at something called the S&P 500 New HILO indicator.

You can access this for free on Stockcharts.com by using the ticker $SPXHILO.

Once you get to the stockcharts.com homepage, simply type that ticker right in the search window at the top of the page and hit enter.

Here’s how I use this indicator…

If the $SPXHILO line is making new highs as the S&P 500 is also working higher as it has been in recent days, I view that as a sign of confirmation.

In other words, this is a sign that the breadth of the market advance is confirming the S&P’s movement.

Bottom line, this is now a trend I want to trade with until the market tells me differently.

So how do I go about finding the stocks I want to be trading as this rally develops?

I look for stocks that are showing relative outperformance (i.e., strong relative strength) vs. the market.

To do that, I turn to a tool on my TD Ameritrade thinkorswim platform called RelativeStrength (SPX).

No, this is not the relative strength index (RSI) momentum indicator that so many traders like to use.

Instead, RelativeStrength (SPX) measures the strength of whatever stock you are searching for relative to the S&P 500 (by default).

As this chart of KO shows, the red line at the bottom of the page is the S&P 500 relative to KO.

So with KO well above that red line, the stock (KO) is stronger than the market (the S&P 500).

This leadership and strength is where I am interested in risking my money with a bullish trade.

Think about it…if the market is rallying, why in the world would I want to buy a stock that is underperforming the market?

This is the same methodology I used before I alerted my members to F Calls last week…

And just look at what that stock has been doing!!!

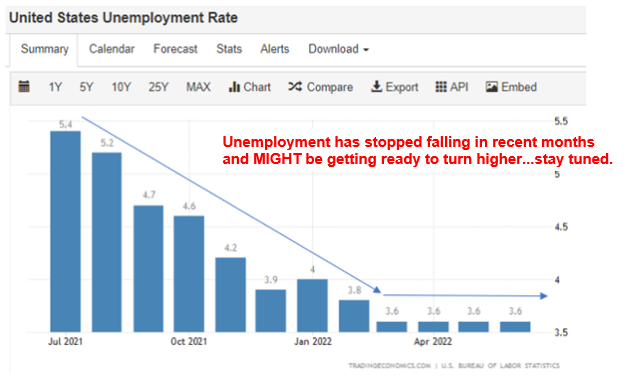

You might not realize it but this is the edge you need ahead of this Friday’s US Bureau of Labor Statistics Jobs Report!

This is an incredibly important economic report that has the potential to cause increased volatility.

But for members of my LIVE Mobile Closer trading room, any increase in volatility brings opportunities!!!

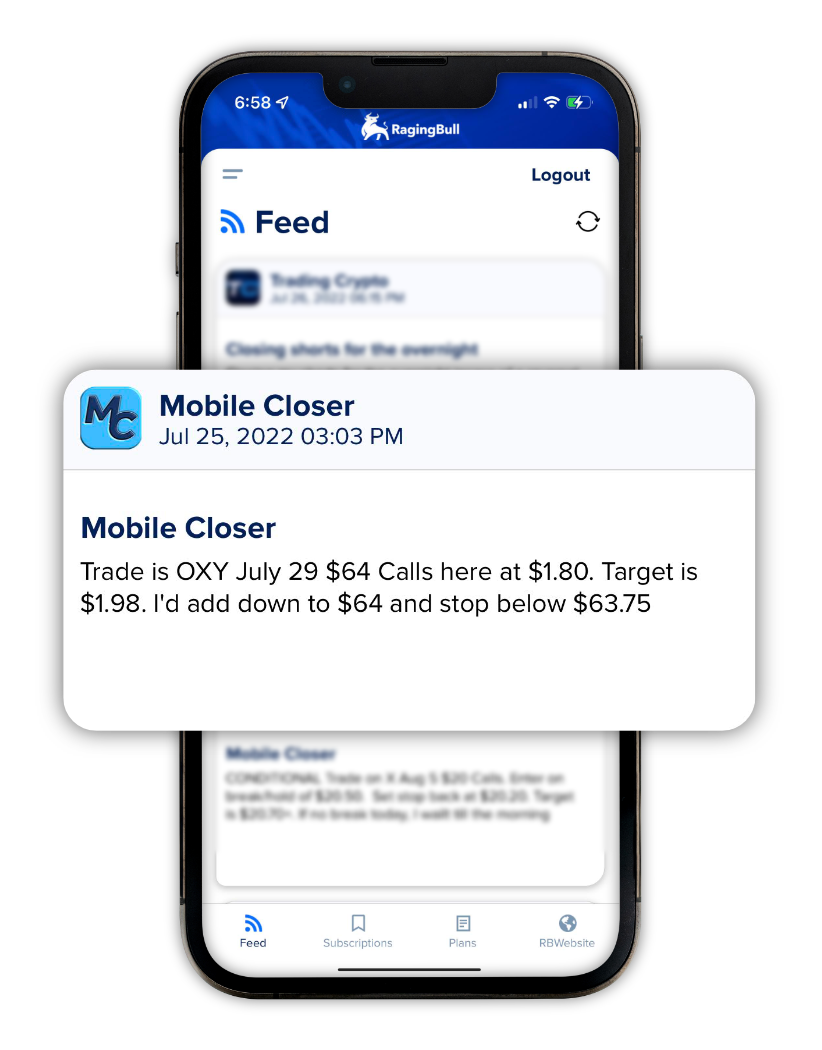

Members get to watch and learn as I walk them through my highest-conviction swing trade at 3:00pm every trading day leading up to and following this event…

But whether they make it live or not, they get real-time trade alerts from me through the RagingBull App the moment I drop the trade live!

As you see in this sample, each trade alert contains the ticker, the exact options contract I’m eyeing, plus my profit target and stop — the complete package!

I’m not just pulling ideas from a hat here…these are my absolute favorite ideas that I’ve developed through a process that includes key indicators like the $SPXHILO and RelativeStrength SPX indicators that helped me find Ford’s (F) big rally.

Let’s have a great rest of the week and until next time…

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.