[ad_1]

porcorex

It can be hard for value investors to see their targeted income stocks move up in price. I don’t believe in looking backwards though, as circumstances change and no one can predict an absolute bottom. Moreover, one may not necessarily have sufficient dry powder to buy at every price point.

That’s why it’s important to focus on the now, and assess whether if the stock is still trading in value territory. Such may be the case for Manulife Financial (NYSE:MFC), and in this article, I highlight why it remains a high-yielding value buy, so let’s get started.

Why MFC?

Manulife Financial is one of the Big 3 life insurance companies in Canada, sitting alongside peers Sun Life (SLF) and Great-West Lifeco (OTCPK:GWLIF). Beyond life insurance, MFC also provides wealth management products and services to individuals and group customers in Canada, the U.S., and Asia.

MFC has a long operating history of 130 years and at present, has C$807 billion in global wealth and assets under management, making it a top 10 asset manager in Canada. MFC’s track record as a reliable asset manager gives it a competitive moat, as this results in sticky customer relationships.

This trend continued during the second quarter, as MFC’s global wealth and asset management saw net inflows of C$1.7 billion. Also encouraging, MFC is demonstrating greater efficiency as general expenses declined by 3% and its expense efficiency ratio ended at 49.2%, below management’s target of 50%.

However, MFC isn’t immune to the global equity market downturn, as its core earnings were down by 9% YoY to $1.6 billion in the second quarter. This was partially offset by favorable 8% core earnings growth in MFC’s home market of Canada, and this is encouraging considering challenges faced by competitors such as Great-West Lifeco in Canada’s individual customer segment.

Moreover, MFC is a cash-rich business that’s aggressively returning capital to shareholders in the form of dividends and buybacks. It currently pays a healthy 5.3% dividend yield that’s well covered by a 38% payout ratio and has a 5-year dividend CAGR of 11.2%. Management also took advantage of the depressed share price and bought back an impressive 2% of outstanding shares during the second quarter alone.

Looking forward, MFC’s growing presence in Asia represents a significant opportunity for the company. This is considering the growing aging population there, representing an opportunity for them to be served by Manulife’s investment management arm. This is reflected by a 24% increase in retirement net inflows in Hong Kong, which strengthened MFC’s number one position in Hong Kong’s MPF (Mandatory Provident Fund) market.

Furthermore, China and Southeast Asia represent large and fast-growing markets which MFC is well-positioned to capture. These strengths as well as challenges were highlighted by Morningstar in its recent analyst report:

Asia has been a big focus for Manulife and currently generates around 30% of the firm’s profit. Manulife’s Asia business stretches across the continent as the firm provides insurance and wealth products in Japan, Hong Kong, Singapore, mainland China, and Southeast Asian countries. In addition, Manulife recently entered into a joint venture to provide asset and wealth management solutions in India.

The Asian market is a competitive one with domestic companies often having leading market share and firms are subject to various regulations. As an example, Manulife, along with other insurers, suspended selling company-owned life insurance policies in Japan because of uncertainty regarding the tax treatment of these policies. Revenue growth in Asia has been strong but we’d focus on profits as it has slipped and we believe growth is only accretive if it generates sufficient returns on equity.

Meanwhile, MFC sports a strong A rated balance sheet and maintains a strong LICAT ratio of 137%, including $23 billion of capital above the supervisory target. I also continue to see value in MFC at the current price of $18.82. This represents a 5% discount to book value of $19.73 (translated to USD from C$25.56).

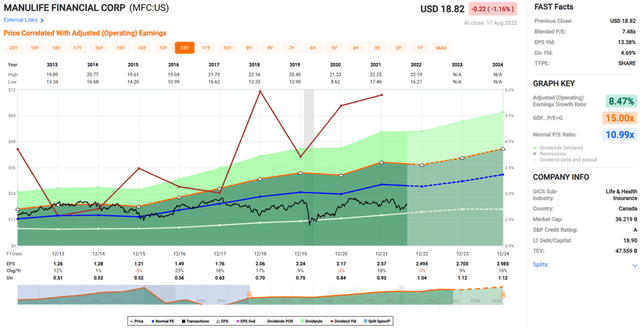

MFC also appears to be attractively valued from an earnings standpoint with a PE of just 7.6, sitting well below its normal PE of 11.0 over the past decade. Morningstar has a fair value estimate of $21, and sell-side analysts have an average price target of $20.69, implying a potential one-year total return in the mid-teens.

Investor Takeaway

In conclusion, I believe Manulife Financial is an attractive income stock that’s well-positioned to benefit from the growing demand for insurance and wealth management products in Asia. The company also has a strong balance sheet and is returning capital to shareholders via buybacks and dividends. I believe the shares are attractively valued at the current price and offer investors a respectable total return potential over the next year.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.