[ad_1]

If you are hesitant to trade because of what the Fed is doing to this market, or because you simply are not used to trading in a bear market, then you’ve got to listen closely!

I am about to share one of my favorite ideas that I am looking to trade RIGHT NOW!

But before I do that, I need to tell you about one of the best resources you can use RIGHT NOW to help you find actionable market insights and trading ideas, throughout every trading day.

Raging Bull has put its most seasoned veteran gurus in one place to share their market insights and ideas.

Each trading day these MASTERS are popping in to share their views on the market, as well as their best ideas.

I’m thrilled to be part of this offering, and man let me tell you it’s becoming incredibly popular!

Do yourself the best favor possible and take a few seconds to simply sign up, at no cost to you!

Also, tune in for the amazing Scanner sale that Raging Bull’s cofounder, Jason Bond, will be hosting starting at 11:45 am ET on Thursday.

Just like the character Mike Damone declared in Fast Times At Ridgemont High, “You won’t regret it.”

So what am I looking at in the market right now?

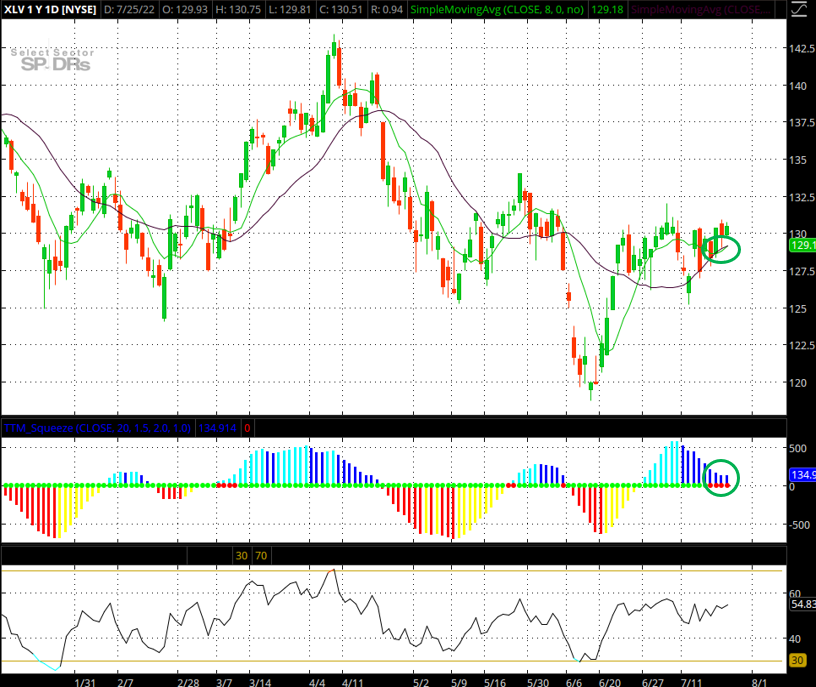

I’ve got to tell you, I really like how the Healthcare sector is looking.

Specifically, XLV.

This Healthcare sector ETF has been consolidating nicely the past few weeks and it’s now on a daily squeeze as some of my favorite short and near-term moving averages are now starting to support price to the upside.

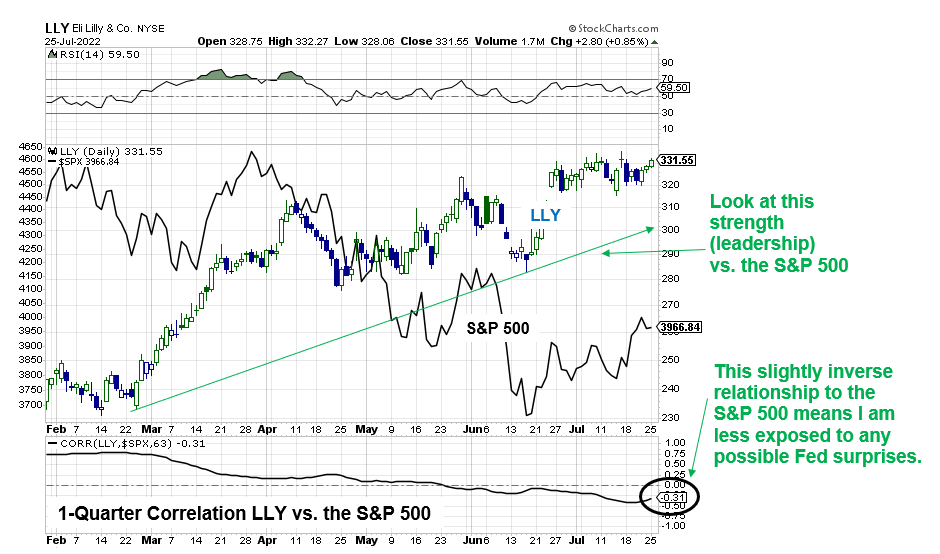

With this in mind, I am watching shares of LLY very closely.

LLY is in a strong uptrend leading into the company’s next earnings report, which it will hold next Thursday.

With LLY and XLV both trending and squeezing higher and maintaining a sustained trend of market leadership, I like this trend to continue leading into earnings.

So I am watching the Jul 29 $340 Calls as LLY pushes above the $330 level.

But I also like this idea because LLY has been leading the market for quite some time now.

In addition, I like this idea because the stock does not trade with a strong correlation to the broader market (see bottom of chart directly above).

Look, I know the broader market has been rising of late, but it still may be too soon to bet heavily that there won’t be more hiccups from time-to-time.

That’s why I like the idea of LLY giving me a little less exposure to the broader market.

Lastly, I am keeping a close eye on my “smart money” Dollar Ace and Dark Pool Scanners for signs that big money traders are trying to hide their moves into LLY.

Let’s have a great rest of the week and until next time…

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.