[ad_1]

photoman

Newmont (NYSE:NEM) reported adjusted 2Q22 earnings per share of $0.46 vs the Bloomberg consensus estimate of $0.64, a 40.8% drop in Q2 adjusted profits. Revenues came in at $3.1 billion, flat vs. the same quarter a year ago and about in line with estimates.

Free cash flow decreased to $514 million from $578 million in the prior year quarter primarily due to higher development capital expenditures, partially offset by higher operating cash flow, according to the company.

Shares traded lower this morning at $49.75, down 3.2% from Friday’s close.

According to the quarterly results filing press release, NEM produced 1.5 million attributable ounces of gold and 330 thousand attributable gold equivalent ounces from co-products, an increase of more than 130 thousand total gold equivalent ounces from the first quarter. The 1.5 million figure matches what analysts at Bank of America Global Research were forecasting.

Another key metric is NEM’s gold Costs Applicable to Sales (CAS) of $932 per ounce and All-In Sustaining Costs (AISC)* of $1,199 per ounce. That’s up from $1,035 reported previously.

Last Friday, the company declared a $0.55 quarterly dividend, consistent with the previous quarters. NEM also has in place a $1 billion share repurchase program this year.

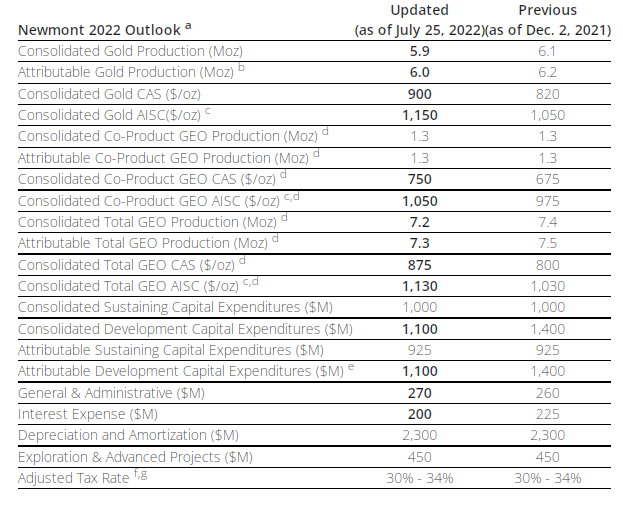

Newmont Updated Outlook

Newmont Mining

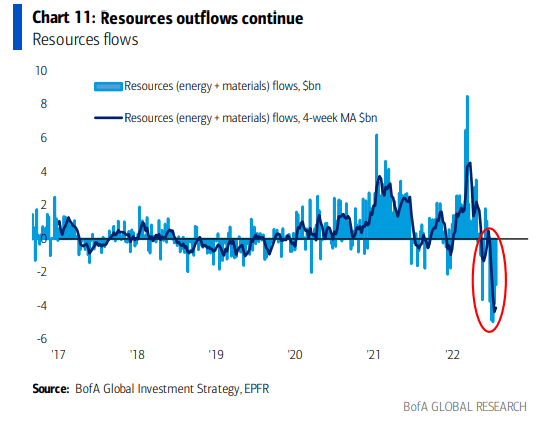

NEM is the biggest holding in the VanEck Gold Miners ETF (GDX). Shares of the global precious metals and mining fund are down sharply this year amid an extraordinarily strong dollar and investors’ rapid retreat away from resource-related stocks since April.

Major Outflows from Energy and Materials Stocks

BofA Global Research

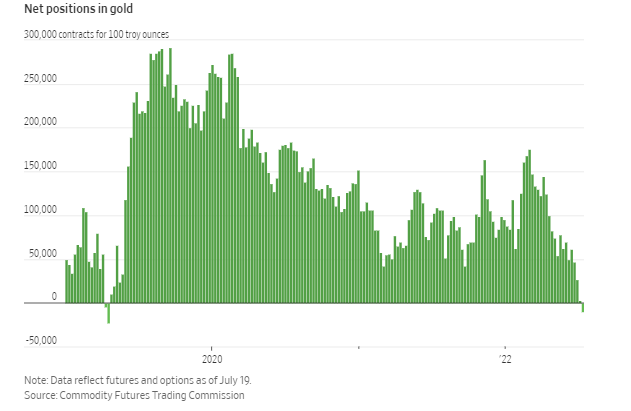

Moreover, the latest Commitment of Traders report from the CFCT plunged into bearish negative territory in terms of net positions in gold, according to The Wall Street Journal.

Net Positioning in Gold Futures Turns Bearish

WSJ

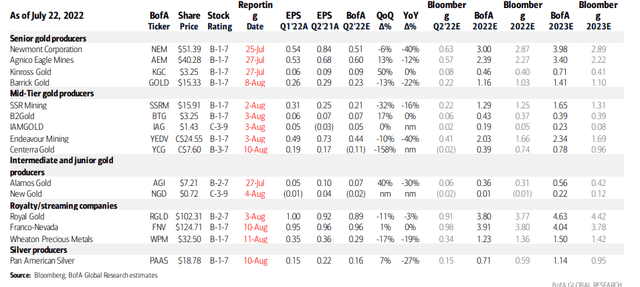

Looking ahead, NEM is just the kickoff to Q2 reporting season for major mining companies.

Gold/Silver Mining Industry Earnings On Tap

BofA Global Research

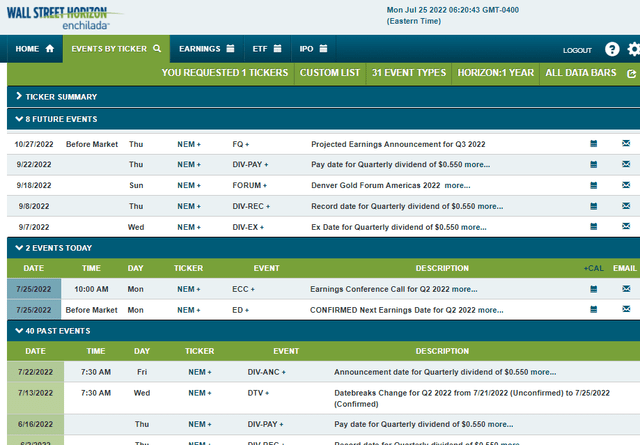

NEM is scheduled to present at the Denver Gold Forum America 2022, according to Wall Street Horizon.

NEM Corporate Event Calendar

Wall Street Horizon

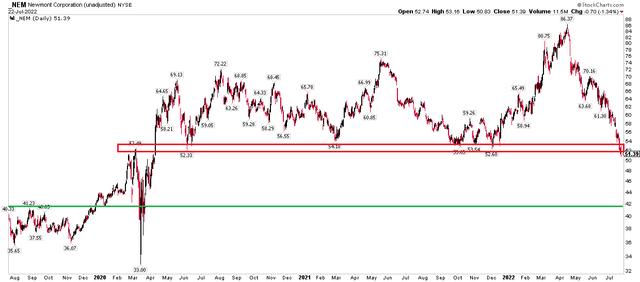

The Technical Take

NEM shares trade at their lowest level since April 2020. After rallying sharply off the COVID low, shares began to stall in the summer of 2020. The stock gained a second wind late last year through the first quarter of 2022 as investors flocked to inflation-sensitive securities. The bullish trend did not last, however, and NEM cratered from a 52-week high to a 52-week low in a matter of weeks. Today’s disappointing earnings report brings the stock decidedly below the key $52 to $54 range. Next support appears to be near $41.

NEM Breaks Critical Support

Stockcharts.com

The Bottom Line

After an earnings miss in its Q2 report, NEM shares are down today, continuing a trend off the early 2022 peak. The chart appears bearish with support in the low $40s while the low to mid-$50s is resistance.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.