[ad_1]

Welcome Back to The Wall Street Hustle!

This week, I’ll be covering:

- RIOT – Trailblazing The 0-DTE Room!

- Nasdaq – Price Level Update.

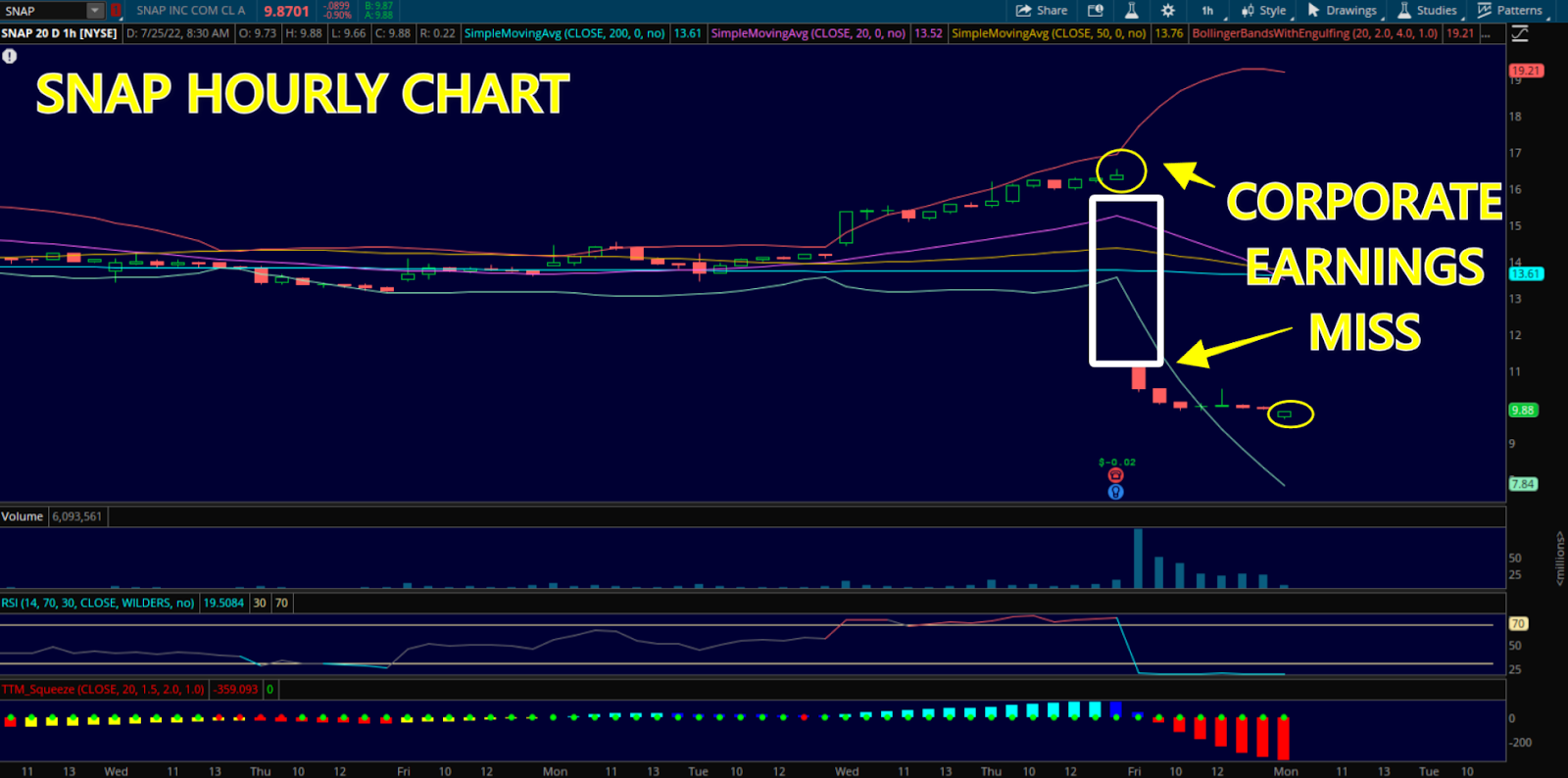

- SNAP – Is The Selling Over?!

Read this week’s Wall Street Hustle

Last week I alerted to levels in the Nasdaq that the index has approached with last weeks price action playing out to the upside.

We saw a high on the Nasdaq last week on 7/22 at 12,698.50 with the index opening up relatively flat this morning.

It has been quiet all weekend and into today as corporate earnings are playing out with little to no upside or downside surprises, as most stocks have been reporting in line and if there was a miss, there was not much in the way of selling.

That is of course the exception for SNAP which sold off more than 20% after reporting corporate earnings on 7/21.

This confirms my belief that there could be more to come in tech as the weak hands are washed out and only the ‘Cash Tech’ names that are able to innovate, consistently show a profit, and have sound long term business plan can not just survive but also thrive.

Now let’s look at some recent smart-money plays that I brought to my readers attention:

Back on 7/21/22 I alerted my LottoX Members to:

RIOT Long

Contract: $7.50 Calls

Ben sees what Bitcoin is doing and sees that this stock could benefit. These are trading at .28.

And sure enough, the contract saw price action that brought the options contracts to .45+ each.

Now, THIS throwback came from Thursday’s LottoX Live session. If you aren’t a member yet, consider saving on a year of access today.. CLICK HERE TO JOIN LottoX

Okay, that’s enough looking back… Because as much as I hope these helped you find some winning trade ideas, I want to talk about what’s cooking now in the Fat Cat Kitchen…

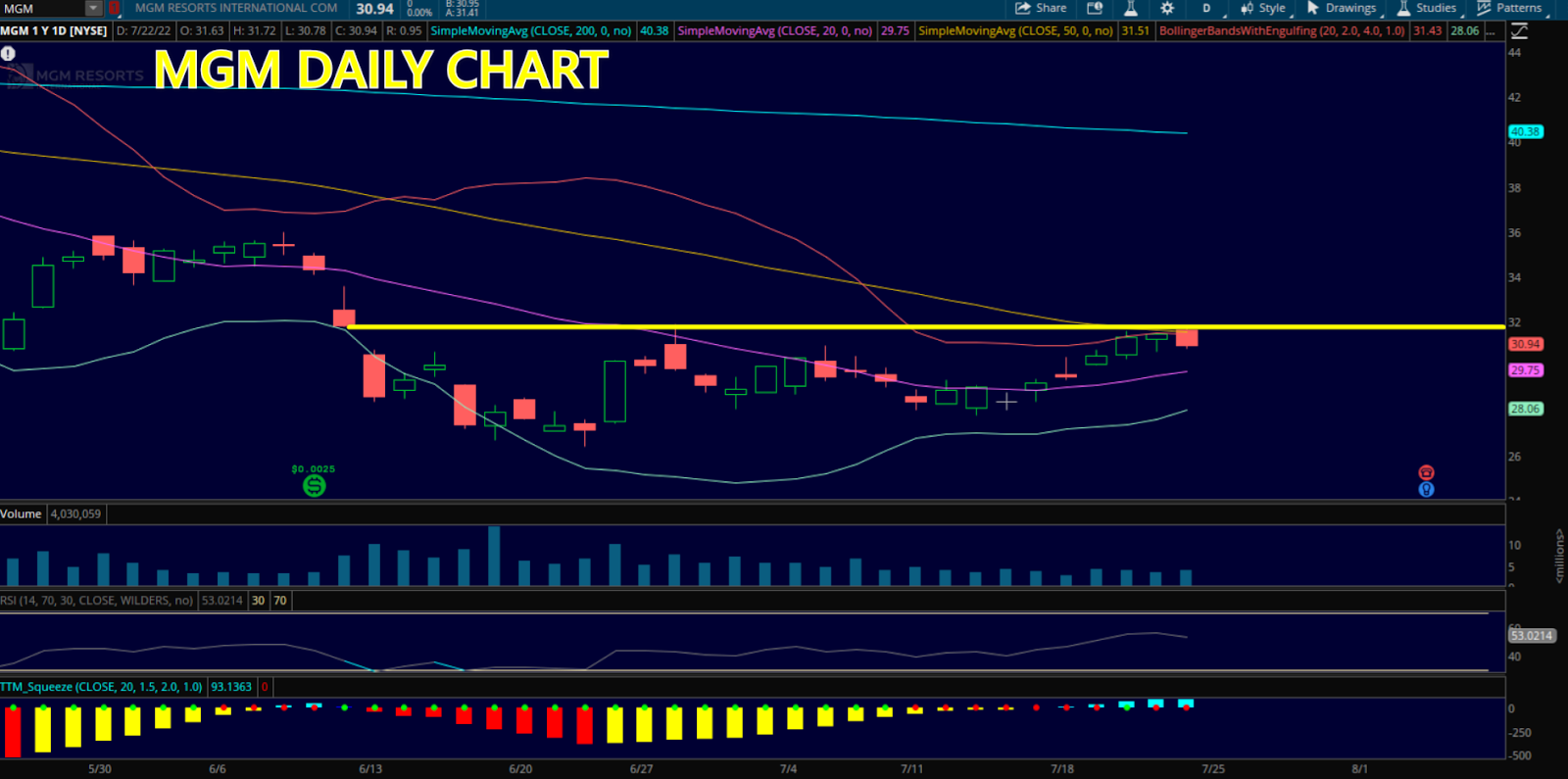

MGM, which made a low on 6/23 at $26.41 a share reports corporate earnings on 8/2/2022 after the bell into what looks like a strong pattern that could release to the upside.

Despite a weak consumer…

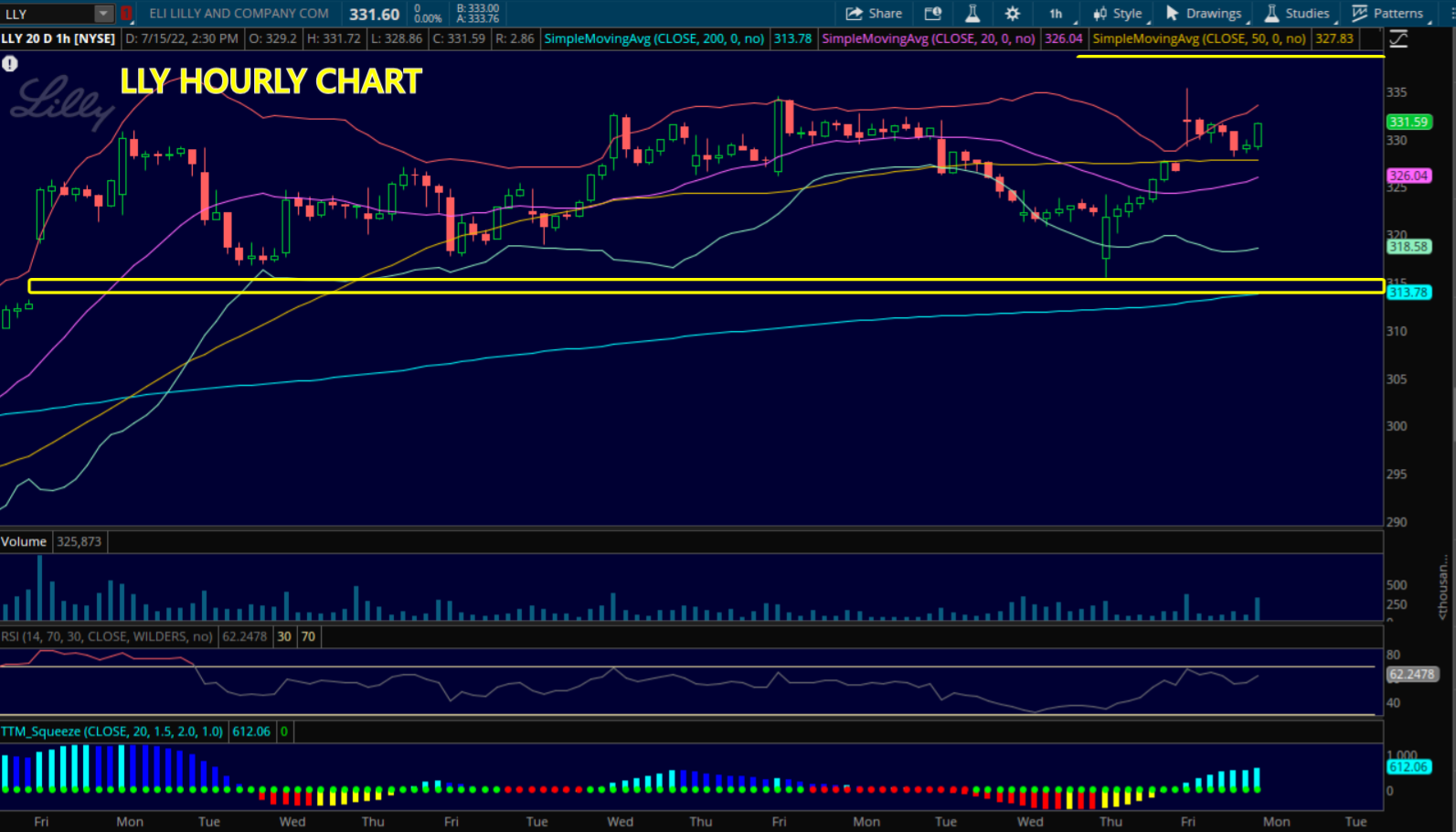

Another day with the market opening higher after a week of soft economic data. Perhaps stocks like LLY, which are at the forefront of any potential market rally in my opinion, can start the rebound to a higher market for the second half of this month.

Despite a weak consumer and the general sentiment that the US economy is in a recession, the expectations for a miss on corporate earnings here could be set too low and therefore give MGM the potential to close some gaps above where the stock is currently trading.

MGM is in a daily squeeze here leading up to earnings, had made lower lows and is approaching a key resistance level at $31.50. It has a gap above it on the chart. I’d like the Aug 19 $34 calls if we could break and hold above the $31.50 level and I would use a tight stop of $31 as that is a $25 million dollar dark pool level.

And don’t forget that my Dark Pool Picks Scanners stream LIVE every single day.

More On My Dark Pool Picks Scanner Can Be Found Here

Well that’s it for today – Happy trading, Full-Scopers – I’ll be in touch!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.