[ad_1]

Today we tell you in detail about OKYO Pharma Limited. The company develops drugs for the treatment of ophthalmic diseases. Its IPO on the NASDAQ exchange is set for December 15, 2022. The stock ticker is OKYO.

Brief information on OKYO Pharma

The biopharmaceutical company OKYO Pharma Limited was incorporated in the UK in 2007 and its stocks have been traded on the London Stock Exchange since 2018.

Gary Jacob has been an executive director since January 2021. He previously held the same position at Immuron Limited, an Australian biopharmaceutical company. He was co-inventor of the US Food and Drug Administration (FDA)-approved drug Trulance, which is used totreat functional gastrointestinal disorders.

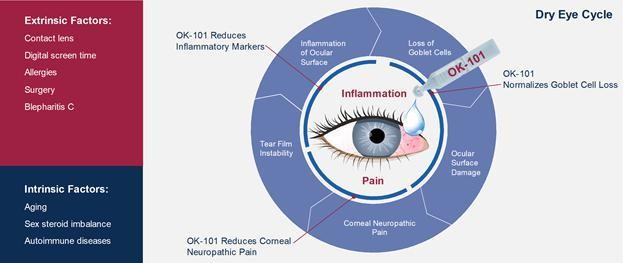

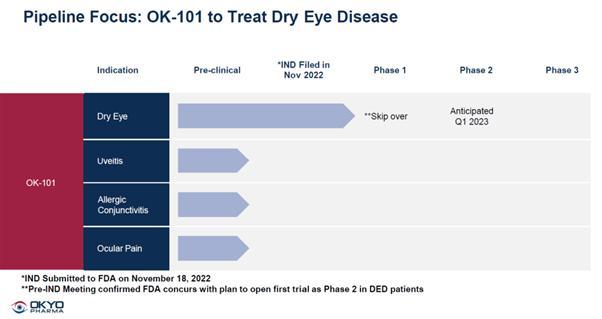

The issuer develops products for the treatment of dry eye syndrome, uveitis and conjunctivitis. The company aims to create a generic drug that is suitable for the majority of patients and does not cause allergic reactions. All OKYO Pharma products are in pre-clinical trials and have not yet been approved by US and UK regulatory bodies.

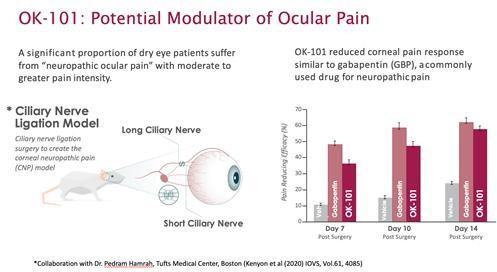

OK-101 is designed to treat xerophthalmia (dry eye syndrome), allergic conjunctivitis and uveitis. Another drug, OK-201, is intended to effectively treat ocular neuropathic pain.

OKYO Pharma believes that OK-101 will meet all xerophthalmia treatment needs and will be suitable for the majority of patients. In addition, it can be used for a long period of time, which should increase the likelihood of a positive treatment outcome. Xerophthalmia is one of the most common ophthalmic conditions worldwide.

OK-201 is made from bovine adrenal glands and is a potent analgesic. The drug has shown impressive results in tests on mice.

As of 30 September 2021, the amount of investment raised by OKYO Pharma Limited reached 123 million USD. The main investor was Panetta Partners Ltd.

What are the prospects for the OKYO Pharma addressable market?

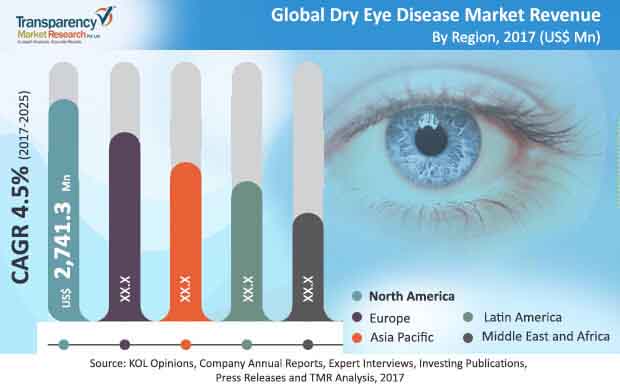

According to Transparency Market Research, the global dry eye syndrome treatment market was valued at USD 5.04 billion in 2016. The estimate is expected to increase to USD 7.78 billion by 2025. The projected compound annual growth rate (CAGR) from 2017 to 2025 is 4.5%.

North America was the largest market in 2017, with a valuation of USD 2.7 billion. Transparency Market Research analysts predict that this region will maintain its dominant position over the period from 2017 to 2025. For this reason, it is extremely important for the issuer that the US regulatory authority approves further trials of OK-101 and OK-201.

Main competitors:

- Santen Pharmaceutical Co., Ltd.

- Novartis AG

- Valeant Pharmaceuticals International, Inc.

- Allergan plc

- TRB Chemedica International SA

- Sun Pharmaceutical Industries Ltd.

- Senju Pharmaceutical Co.

- Sentiss Pharma Pvt. Ltd.

- Otsuka Pharmaceutical Co.

What is OKYO Pharma’s financial performance?

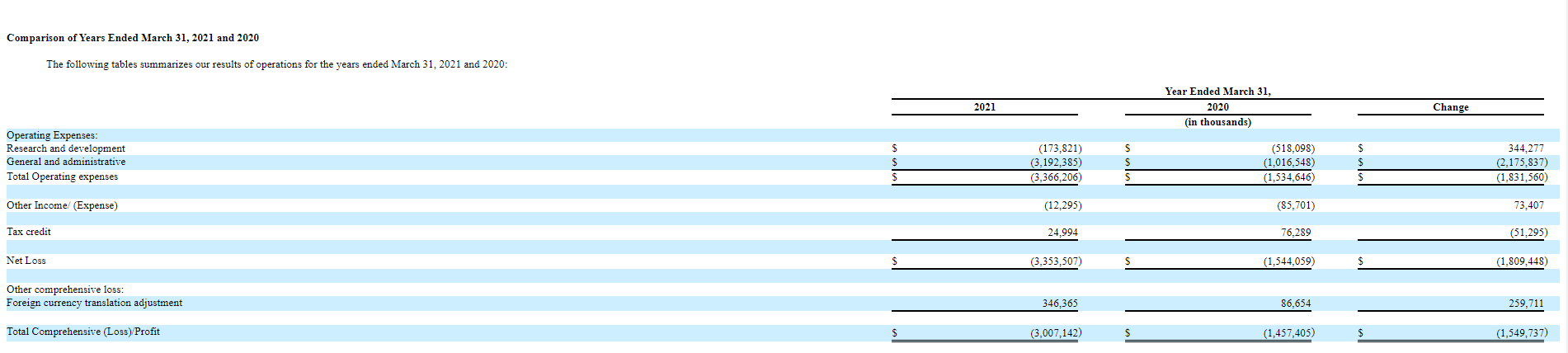

OKYO Pharma Limited does not yet sell its products, as the drugs are in the pre-clinical trials phase. The company’s cost structure is shown in the table below.

What are OKYO Pharma’s strengths and weaknesses?

Benefits:

- promising addressable market

- qualified research scientists

- investing large sums in research and development

The downside:

- a high level of competition

- lack of revenue and net profit

- no plans to pay dividends to shareholders

What do we know about OKYO Pharma’s IPO

OKYO Pharma Limited’s IPO underwriter is ThinkEquity LLC. The issuer intends to sell 4.48 million American Depositary Shares (ADSs). 1 ADS corresponds to 65 ordinary stocks. The gross proceeds from the sale of stocks may amount to USD 10.2 million, excluding the sale of options by the underwriter. If the offering is successful, the capitalisation of OKYO Pharma Limited will amount to USD 62.7 million.

Three similar IPOs took place in 2022: Amylyx Pharmaceuticals Inc., CinCor Pharma Inc. and PepGen Inc. At the time of writing, the first company’s stocks were trading 95% above the IPO price, the second at 16%, but the third was down 31%.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

[ad_2]

Image and article originally from blog.roboforex.com. Read the original article here.