[ad_1]

Sensex has lost more than 30 percent

so far this year, that’s nearly 13,000 points and is down about 33 percent

from its record high of 42,273 registered on January 20.

The average market capitalization of

BSE-listed companies have come down by more than Rs 40 lakh cr in the same

period. Tracking the sell-off in markets, nearly 30 companies have turned into

midcaps from large-caps in the same period as fears of economic slowdown gripped

equity markets across the globe.

BSE-listed companies have come down by more than Rs 40 lakh cr in the same

period. Tracking the sell-off in markets, nearly 30 companies have turned into

midcaps from large-caps in the same period as fears of economic slowdown gripped

equity markets across the globe.

We have categorized large-caps as

companies with a market capitalization of over Rs 20,000 cr as on January 1. As

per the Amfi calculations, the top 100 stocks in terms of market capitalization

are classified as large-caps and the market-cap is usually over Rs 20,000 cr.

companies with a market capitalization of over Rs 20,000 cr as on January 1. As

per the Amfi calculations, the top 100 stocks in terms of market capitalization

are classified as large-caps and the market-cap is usually over Rs 20,000 cr.

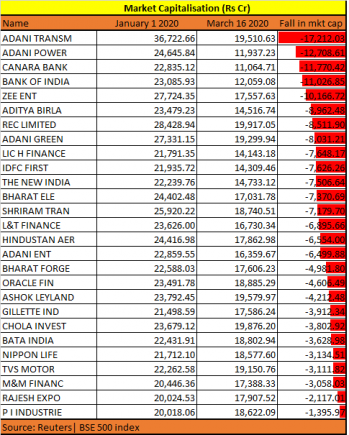

There are as many as 27 companies in

BSE500 index whose market capitalization has fallen below Rs 20,000 cr as on

March 16, 2020, data from AceEquity showed. The list includes names like Adani

Transmission, Adani Power, Canara Bank, Bank of India, LIC Housing, Shriram

Transport, Bharat Forge Ashok Leyland, etc. among others.

BSE500 index whose market capitalization has fallen below Rs 20,000 cr as on

March 16, 2020, data from AceEquity showed. The list includes names like Adani

Transmission, Adani Power, Canara Bank, Bank of India, LIC Housing, Shriram

Transport, Bharat Forge Ashok Leyland, etc. among others.

So what should investors do now? After the recent decline which is primarily led by external factors, massive wealth erosion has happened on D-Street. Does that make some of these stocks an attractive buy?

Well, experts are of the view that some of the companies which have turned midcaps from large-caps can be looked at as a buy candidate but not every stock or a company is looking attractive.

A lot of large-caps have seen their market caps drop, purely driven by the market sentiment and external shocks. However, not all of them are Buys currently, because some of them also have lost out due to governance issues and other uncertainties.

Only those that are fundamentally strong and with higher localized business may be considered for accumulation in this market scenario.

Specifically, if someone is looking to

buy in some of the companies from the list then Bata and PI Industries along

with Gillette are looking attractive, suggest experts.

Talking about the specific stocks from

the list we like Bata India, PI Industries and Gillette India. We would advise

investors to start accumulating these 3 stocks from the list.

the list we like Bata India, PI Industries and Gillette India. We would advise

investors to start accumulating these 3 stocks from the list.

We don’t believe markets have bottomed out and do

not recommend to make an entire investment in one go. There is a panic in the

markets and long terms investors will definitely get a good bargain till the

dust settles.

not recommend to make an entire investment in one go. There is a panic in the

markets and long terms investors will definitely get a good bargain till the

dust settles.

What to avoid:

- Now the question is – what should they avoid

especially at a time when every stock is available at a steep discount when

compared to their record highs or even 52-week highs.

- Only selective companies have turned into midcap

companies due to loss of valuation. Travel stocks should be avoided for the

next one year, financial markets will take time to recover from the scare of

deadly coronavirus. The best bid is to avoid stocks of travel companies,

especially, focusing on Southeast Asian countries.

- Nair of Geojit Financial Services is of the view that export-oriented business should be avoided because of the reduction in

demand and trade restrictions or those companies that depend on raw materials

from abroad because of supply chain issues (especially from China), will be

impacted materially in the near term.

- These include sectors like Pharma, Automobiles &

Ancillaries and Metals. FMCG sector is likely to see limited impact while the

smaller Public Sector Banks are also likely to underperform, given the

uncertainty in Investor’s mind post the Yes Bank issue and the proposed the amalgamation of smaller banks.

Get More:-

For Quick Trial: +91 62329-88986 |

[ad_2]

Image and article originally from the-grs-solution.blogspot.com. Read the original article here.