[ad_1]

EUR/USD News and Analysis

- ‘Fed pivot’ in the rear-view mirror as USD retakes the driving seat

- EUR/USD approaches parity once again – move appears unlikely to unfold this week

- Main risk events: Jackson Hole (pseudo Fed meeting), US PCE inflation data

‘Fed Pivot’ in the Rear View Mirror as USD Retakes the Driving Seat

With euro fundamentals seemingly unchanged for now, markets turned their attention to a whole host of Fed officials as they remain united in the direction of future rate hikes but divided on the terminal rate.

George, Kashkari, Daly and Bullard all had their say with Daly perhaps the most cautious in her message of not wanting to “overdo policy”, while Bullard remained true to his hawkish tag, stating that he is keen on 75 bps in September.

European Central Bank (ECB) board member Isabel Schnabel was also interviewed by Reuters yesterday, where she expressed concern over the unchanged risks to the long-term inflation outlook and the depreciation of the euro. Typically, the ECB does not comment on forex levels but there are instances when a general trend of appreciation or depreciation can affect monetary policy objectives. Schnabel expressed concern regarding the weaker euro against the dollar as a large share of euro area energy imports are invoiced in US dollars – making those purchases more expensive when EUR/USD declines.

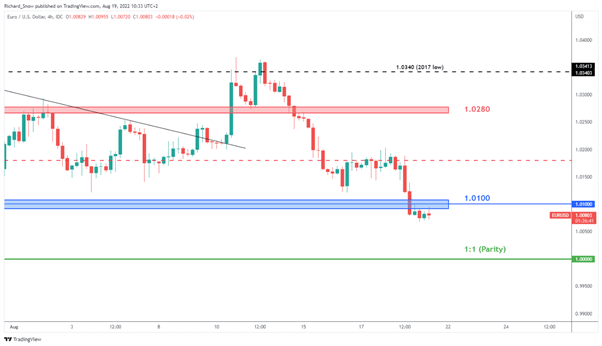

The daily EUR/USD chart shows yesterday’s rather large drop in the pair, beyond the 1.0100 mark. This level seemed to prop up prices as the pair consolidated largely between 1.0100 and 1.0200. Now, the pair looks to have parity in its sights but a rather slow follow through from yesterday appears to be preventing such a move this week.

Spare a thought for the seasonally lower liquidity experienced around the summer months particularly when considering major risk events towards the end of next week. Lower liquidity has the potential to facilitate short bursts of volatility so keep an eye out for scheduled and unscheduled risk events/themes.

Support lies at 1.000 (parity), while 1.0100 remains the nearest level of resistance followed by 1.0180 and 1.0280.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

The 4-hour chart highlights yesterday’s move after we saw a number of upper wicks around that 1.0180 level (red dotted line) suggesting a rejection of higher prices.

EUR/USD 4-Hour Chart

Source: TradingView, prepared by Richard Snow

Main Risk Events for the Week Ahead

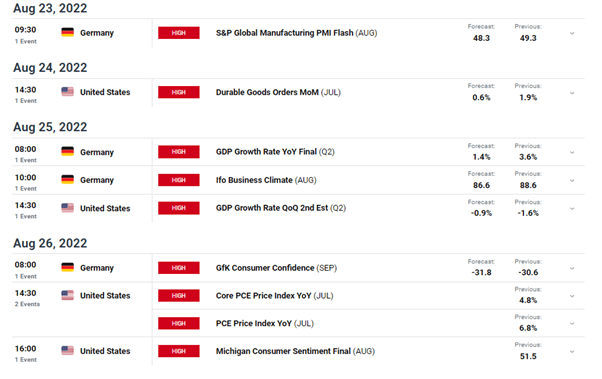

The week starts off with a slew of PMI data then on Wednesday we have the final print of German GDP for Q2 and the 2nd estimate of US Q2 GDP which is forecast to have improved but still remains negative.

However, the big-ticket item of US PCE inflation data is due on Friday and will be monitored with great interest after we saw a slightly cooler CPI print last week. Another softer print could see more short-term USD selling after the dollar more than recovered from its last dip.

Not to forget that Thursday marks the start of the annual Jackson Hole Economic Symposium which has ben seen by some as a pseudo-Fed meeting as it has previously provided a platform for some of the world’s top central bankers to share their views. Jerome Powell is scheduled to speak on Friday the 26th of August.

Customize and filter live economic data via our DaliyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.