[ad_1]

Everyone has heard about the Big Bull of India, Rakesh Jhunjhunwala, an Indian business magnate, stock trader, and investor. In this article, we will have a look at the portfolio of his wife Rekha Jhunjhunwala, who also has sizable investments under her name in the Indian Stock Market.

As per the latest corporate shareholdings filed, Rekha Jhunjhunwala publicly holds 20 stocks with a net worth of over Rs. 9,611 Crores. We will also take a closer look at Rekha Jhunjhunwala’s Portfolio 2022 and further analyze her investments. Keep Reading to find out!

Top 5 Stocks in Rekha Jhunjhunwala’s Portfolio 2022 (Updated August 2022)

Now let us take a look at the top 5 holdings in her portfolio:

1. Metro Brands Ltd

Around 32.6% of Rekha Jhunjhunwala’s portfolio is dominated by the stocks of Metro Bands Ltd. In the March quarter of 2022, Rekha Jhunjhunwala held 9.60% of Metro Brands. In the first quarter of FY22-23, she added 4.80% more shares of the company to her portfolio. This makes her total stake in Metro Band add up to 14.40% or 39,153,600 shares. The company has one of the highest numbers of exclusive retail outlets in India

2. Titan Company

Titan Company makes up 24.5% of Rekha Jhunjhunwala’s portfolio. The number of Shares held by Rekha Jhunjhunwala has not changed in the past two years. As of Q1 to FY22-23, she holds a 1.1% stake which amounts to 9,540,575 shares of the company. Titan is a market leader in market capitalization.

3. Star Health and Allied Insurance Company Ltd.

Star Health and Allied Insurance Company Ltd got recently listed on the stock exchange in December 2021. This company makes up 13% of Rekha Jhunjhunwala’s portfolio. She has been holding a 3.10% stake in the company since its listing which amounts to 17,870,977 shares. Her stakes remain unchanged as of Q1 of FY22-23. This company is the largest private health insurer in India

4. Crisil Ltd.

The next Large-cap stock in her portfolio is Crisil Ltd. The shareholding has not changed Year-on-Year which is also another positive sign. She holds a 2.6% stake in the company with 18,70,750 shares. Around 6.45% of the total value of her portfolio is dominated by this stock. The company is India’s leading rating agency.

5. NCC Ltd.

NCC Ltd makes up 5.37% of its portfolio. In the 4th quarter of 2021, Rekha Jhunjhunwala had 12.80% of NCCs stocks. She has reduced her stake by 0.20% in Q1 of FY22-23. Currently, she holds a 12.60% stake in the company which amounts to 7,83,33,266 shares. The company has consistently shown good performance in the last few years.

ALSO READ

Analysis of Rekha Jhunjhunwala’s Portfolio 2022

Firstly let’s take a look at what sectors makeup Rekha Jhunjhunwala’s portfolio! As per our Sectoral analysis, Rekha Jhunjhunwalas has invested around 57% of her capital in the textile, apparel & accessories sector. Around 21% of her investments are in the Banking and Finance sector. We also found that Construction & Real Estate has covered around 7.1% of her portfolio.

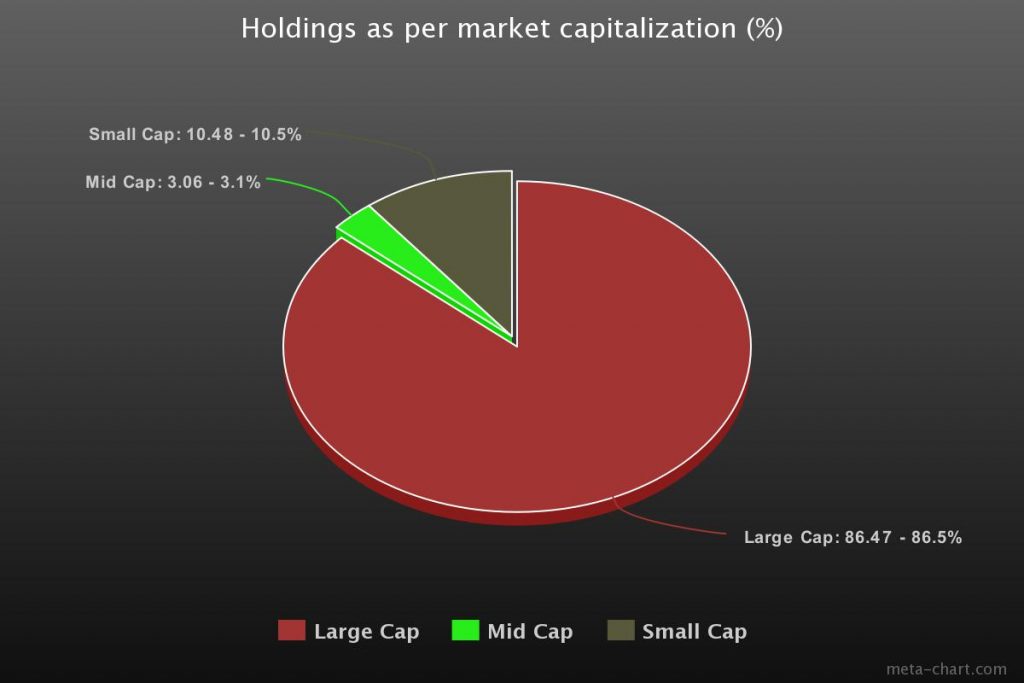

With 7 out of 19 stocks in her portfolio being large-cap stocks, it shows that a significant portion of her investments is made in established companies with potential that have a lower risk. These include the like Titan, Metro Brands, Star Health, Indian Hotels, Tata Communications, Crisil Ltd, Federal Bank, and Metro Brands

Mid-cap stocks are known to have a scope of growth and diversity. 2 out of 19 stocks in Rekha Jhunjhunwala’s portfolio have a market capitalization of Rs. 5,000 – 20,000 Crore i.e, Mid-cap stocks. Jubilant Ingrevia and Jubilant Pharmova are the MId-cap stocks she chose to invest in.

Few of the stocks in her Portfolio which earlier in the mid-cap category have moved to the small-cap category due to the recent market correction

10 of the 19 stocks in her portfolio are small-cap stocks. These Small-cap stocks are generally fairly priced and have huge room for growth.

Rekha Jhunjhunwala’s Portfolio 2022

| STOCK | Investment (Rs in Crores) |

|---|---|

| Metro Brands Ltd. | 3120.5 |

| Titan Company Ltd. | 2359.9 |

| Star Health and Allied Insurance Company Ltd. | 1250.4 |

| Crisil Ltd. | 620.7 |

| NCC Ltd. | 516.2 |

| Indian Hotels Company Ltd. | 389.6 |

| Tata Communications Ltd. | 336.4 |

| Federal Bank Ltd. | 232.8 |

| Jubilant Pharmova Ltd. | 172.8 |

| Va Tech Wabag Ltd. | 122.9 |

| Jubilant Ingrevia Ltd. | 121.2 |

| Rallis India Ltd. | 118.9 |

| Aptech Ltd. | 108.4 |

| Agro Tech Foods Ltd. | 68.2 |

| Dishman Carbogen Amcis Ltd. | 29.1 |

| D B Realty Ltd. | 28.2 |

| Prozone Intu Properties Ltd. | 7.8 |

| Autoline Industries Ltd. | 5.4 |

| Bilcare Ltd. | 1.7 |

In conclusion

Taking a look at the portfolios of investors like Rekha Jhunjhunwala who have huge research teams and brains behind their investments gives us better insights. To start with as an investor in the stock markets, following a super-star portfolio can help you earn good returns too. These investors do extensive research and make decisions based on the myriad of information they have.

You too can replicate a super-stars portfolio! You just need to follow 3 simple steps:

- Log on to your account on the Trade Brains portal page.

- On the top right side of your screen, select Product.

- Click on Superstar portfolios.

That’s all for this post. Let us know what you think about her portfolio in the comments below. Happy Investing!

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.