[ad_1]

SARB Hikes by 75 Basis Points

- 3 out of 5 MPC members voted in favor of 75 basis points

- Restoring inflation back to the 6-5% target remains central to the Bank’s objectives despite worsening growth outlook

- UZD/ZAR outlook: ZAR has benefitted from recent dollar weakness but worsening local fundamentals may limit the near-term reprieve

Customize and filter live economic data via our DaliyFX economic calendar

A Fundamental Note: Rolling Power Cuts and Above Target Inflation Weigh on Growth

Growth

The SARB forecasts Q3 GDP growth to amount to 0.4% with Q4 growth at a disappointing 0.1%, mainly due to rolling power cuts. The picture gets marginally better with 1.1%, 1.4% and 1.5% GDP growth in 2023, 2024 and 2025 respectively.

Inflation

Inflation breached the upper side if the 3-6% target in May this year and has proven difficult to reign in ever since. The welcomed global drop in oil prices have been offset by a weaker ZAR resulting in very little change in prices at the fuel pumps contributing to higher inflation, although, prices have risen steadily across the board. Headline inflation is expected to return to the midpoint of the target only in the 2nd quarter of 2024.

Electricity Supply

A major factor adding to the meagre levels of GDP growth is the fluctuating state of electricity supply. Eskom has issued a warning that power cuts will persist into the holiday season and beyond with outages to continue for another six to twelve months as the countries sole electricity provider embarks on major repairs and capital investment projects that are set to reduce an already constrained supply.

Recommended by Richard Snow

Trading Forex News: The Strategy

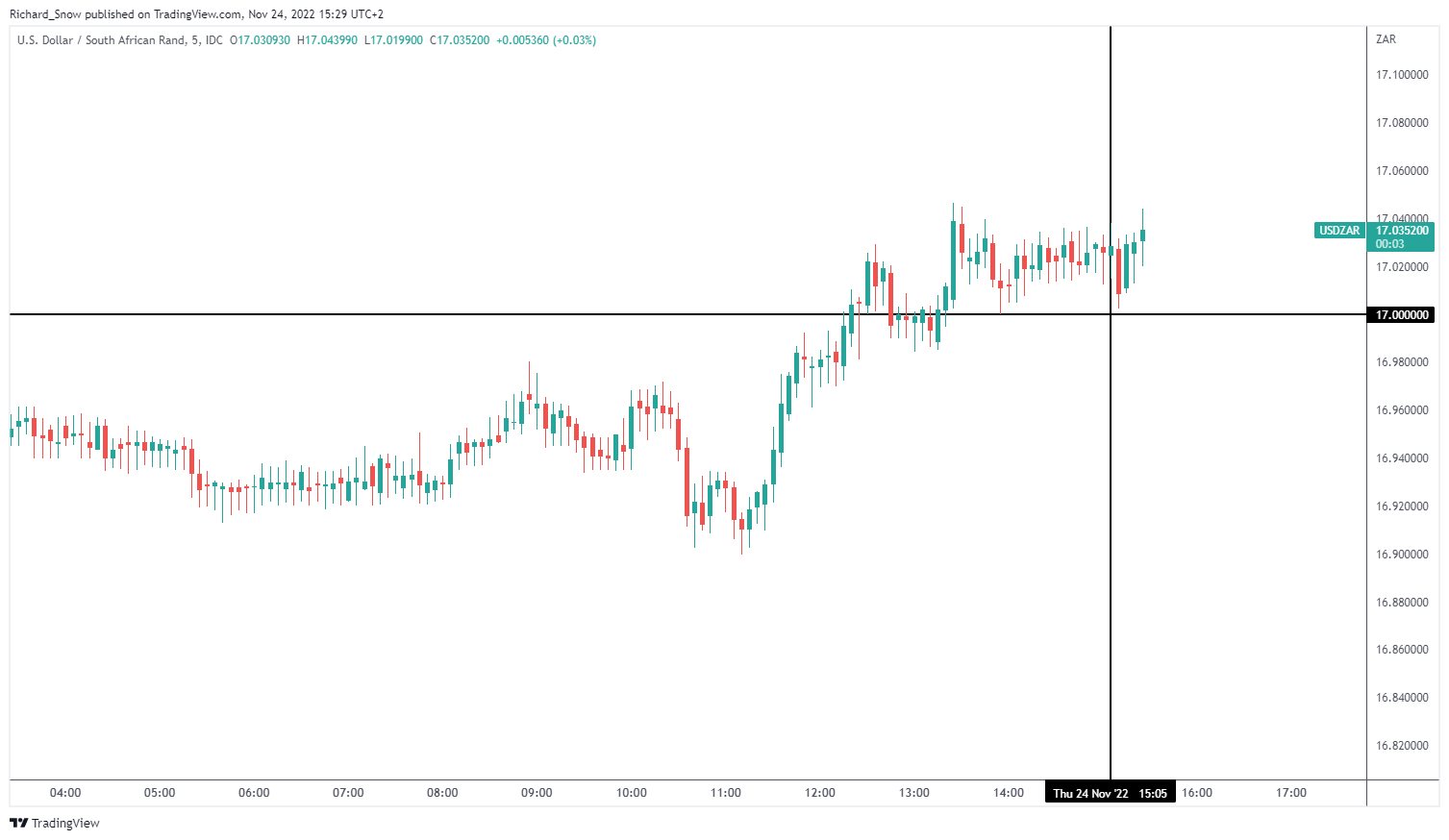

USD/ZAR dropped at the time of the announced rate hike but price action swiftly recovered to trade around the high of the day. With the US on holiday for Thanksgiving today and limited trade tomorrow, liquidity is likely to remain low. Therefore, extended moves appear unlikely on the lighter volume.

USD/ZAR 5-Minute Chart

Source: TradingView, prepared by Richard Snow

South African Rand (ZAR) Outlook

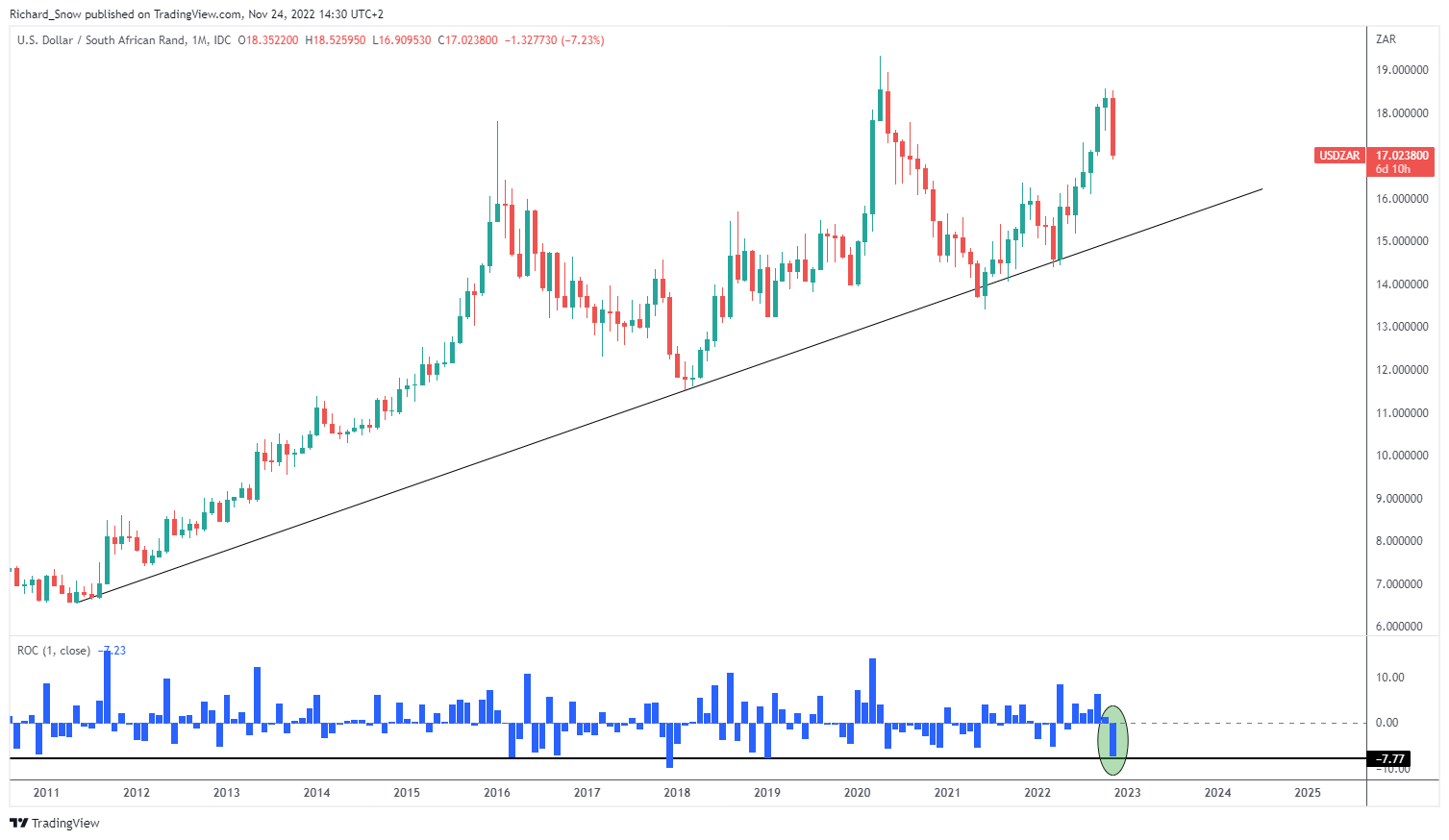

The ZAR is currently having its best month since January 2019 which has been largely driven by yesterday’s dovish FOMC minutes and the softer dollar. The minutes provided markets with confirmation of the changing narrative within the Fed from aggressive rate hikes to moderate future hikes becoming more suitable. The most notable takeaway from the minutes was the quote, “a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate”, which resulted in the typical ‘risk on, dollar off’ adjustment that favors an uptick in emerging market currencies like the rand. The rate of change indicator (blue) reveals that November is proving to be the best month for the ZAR against the greenback since January 2021. The rand is down around 6% to the high-flying USD year to date, meaning the possibility of a longer-term reversal will certainly grab the attention of ZAR bulls from the current, elevated levels.

USD/ZAR Monthly Chart

Source: TradingView, prepared by Richard Snow

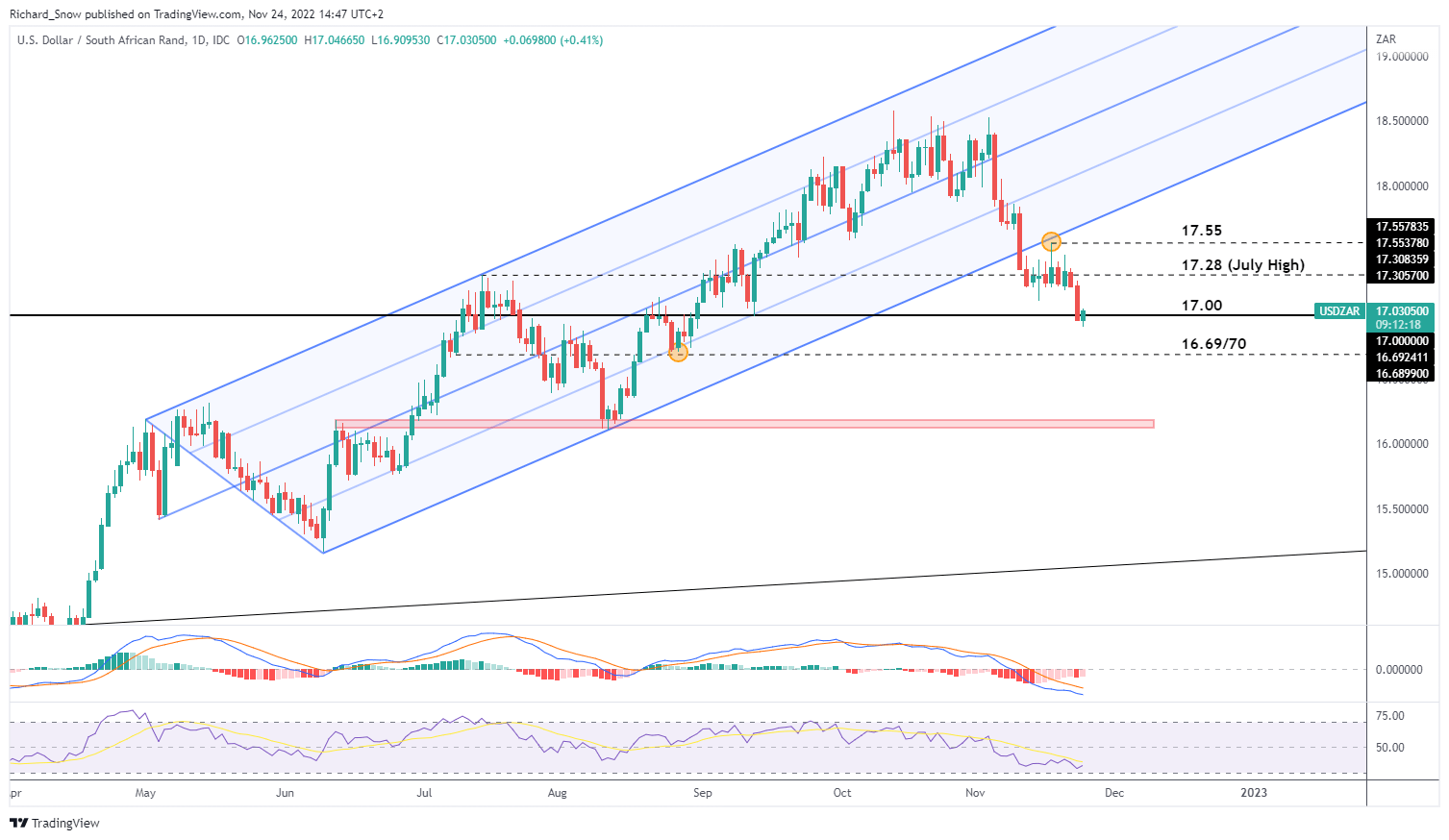

The daily chart reveals the bullish fatigue that has emerged throughout October and November this year with a failure to make a higher high while also exhibiting a number of extended higher wicks – hinting at a rejection of higher prices.

The bearish move broke below the ascending pitchfork and now tests the psychological 17.00 level and the prior July high. The next level of support appears at 16.70 with the next major zone of support coming in at 16.20. However, lower Thanksgiving volume is likely to result in a moderate move until US traders return on Monday.

USD/ZAR Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Building Confidence in Trading

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.