[ad_1]

KEY POINTS:

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: EUR/USD Outlook: Doji Candlestick Highlights Messy Price Action

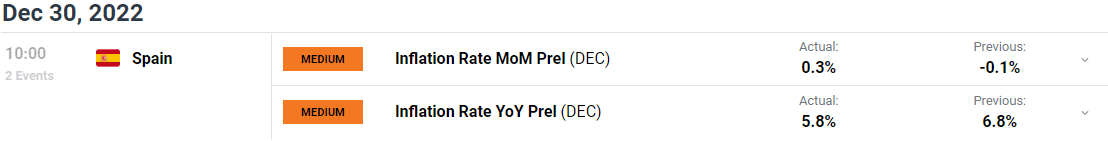

EUR/USD OUTLOOK

EUR/USD enjoyed its best day of gains in 2 weeks with an 80-odd pip upside rally yesterday before finding resistance at the top of its recent trading range around the 1.0700 handle. The dollar index enjoyed a modest bounce as well from its lows around 103.50 which helped push the pair back below 1.0650 in early European trade.

As we enter the last trading day of 2022 the rebound in the dollar index could be partly attributed to investor repositioning, as markets remain cautious ahead of the long weekend. A lack of data this week has seen markets driven by renewed tension between Russia and Ukraine as well as mixed sentiment around China’s rising Covid numbers.

Currency Strength Meter

Source: FinancialJuice

We do have some data releases from Europe this morning, however the thin liquidity is likely to cap any significant moves for EURUSD. The US calendar is relatively quiet today with focus likely shifting toward data releases early next week to provide a potential catalyst for the pair.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

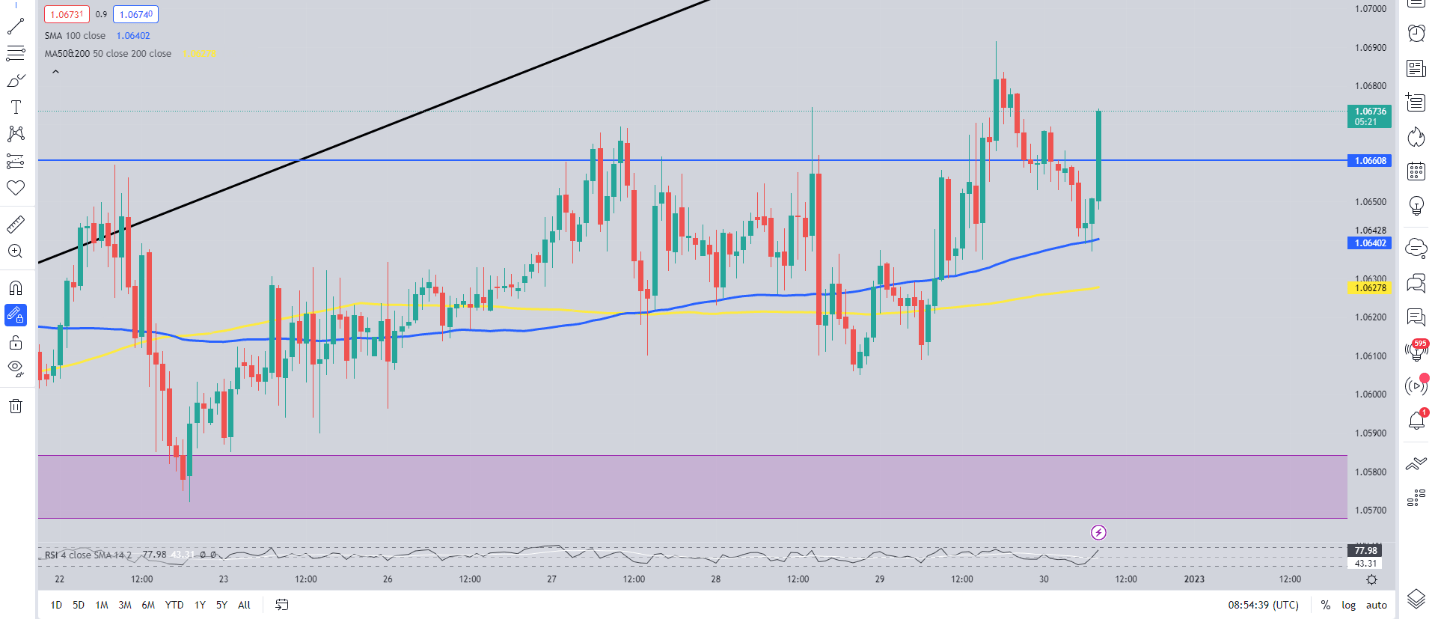

From a technical perspective, price action remains messy with the recent range between 1.0580-1.0700 holding firm. This morning saw us push lower toward the 100 and 200-day MA before bouncing 25 pips higher to trade just above the 1.0650 handle.

Recommended by Zain Vawda

The Fundamentals of Range Trading

At present the 1.0700 level and recent high at 1.0740 provide resistance which I expect to hold ahead of the weekend. I would be surprised should we see a break and hold above the 1.0700 handle and expect price action to remain messy and indecisive. Alternatively, a further push lower could see a retest of the MAs with further support found at 1.0600 as well as the range low around the 1.0580 level.

EUR/USD H1 Chart – December 30, 2022

Source: TradingView

IG CLIENT SENTIMENT: BULLISH

IG Client Sentiment Data (IGCS) shows that retail traders are currently SHORT on EUR/USD with 66% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests EUR/USD prices may continue to rise.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.