[ad_1]

GBP/USD Price, Chart and Analysis:

Recommended by Zain Vawda

Get Your Free GBP Forecast

Most Read: US Dollar Soars as Rosy ADP Report Shapes High Expectations for NFPs Next

GBP/USD FUNDAMENTAL BACKDROP

Cable is facing a host of technical headwinds as it looks to recover yesterday’s losses against the greenback. The dollar continued its advance in early European trade pushing GBP/USD below the 1.1900 handle.

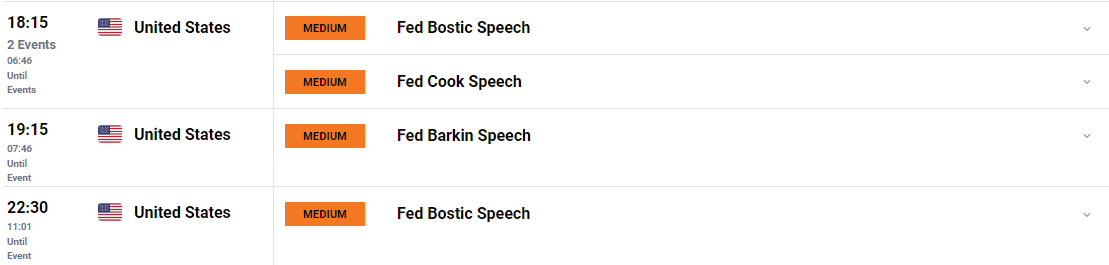

The dollar index has finally broken out of the wedge pattern that was in play since November 14 with yesterday’s rosy ADP data providing the catalyst. Today brings the NFP report which could further strengthen the dollar resulting in more losses for cable. Market expectations are for 200k new jobs added while the unemployment rate is expected to remain at 3.7%. However, market participants should be keeping a close eye on average hourly earnings as it remains one of the key contributors to sticky inflation within the US economy. Inflation has shown signs that it may have peaked but continued wage growth could pose a problem as it usually results in increased retail demand keeping prices elevated. There is also a host of Fed policymakers speaking later today with the recent hawkish rhetoric expected to continue.

For all market-moving economic releases and events, see the DailyFX Calendar

The UK economy remains constrained and UK Prime Minister Rishi Sunak’s first address of 2023 has done little to quell the negativity. This morning saw UK construction miss estimates and falling from last month’s 50.4 to a print of 48.8, in what may be seen as a further indication of the challenges facing PM Sunak.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

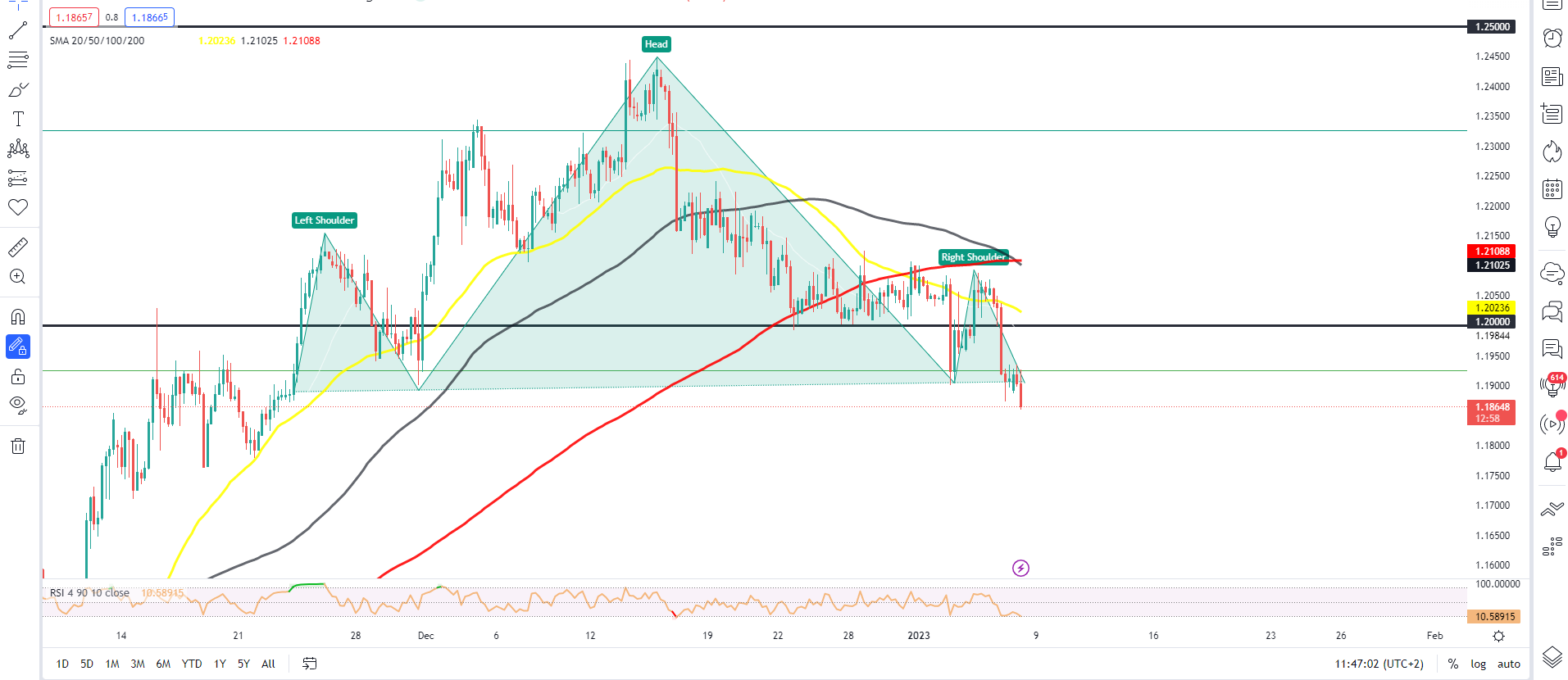

From a technical perspective, the 4h chart below has printed a new lower low this morning while breaking the neckline of the head and shoulder pattern hinting at further downside ahead. Further strengthening the bearish narrative is the death cross which had occurred last week coupled with today’s crossover of the 100-day MA and 200-day MA strengthening the downtrend momentum with immediate support resting around the 1.17850 area.

Alternatively, the RSI however is in oversold territory which could hint that a retracement may not be that far away. However, any push to the upside may just be an opportunity for would be sellers to get involved providing a better risk-to reward opportunity with resistance areas around the 1.19000 and 1.19500 areas.

GBP/USD Four-Hour Chart – January 6, 2023

Source: TradingView

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on GBP/USD, with 58% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that GBP/USD may continue to fall.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.