[ad_1]

US Dollar (DXY) Price and Chart Analysis

- US non-farm payrolls beat expectations but wages drop.

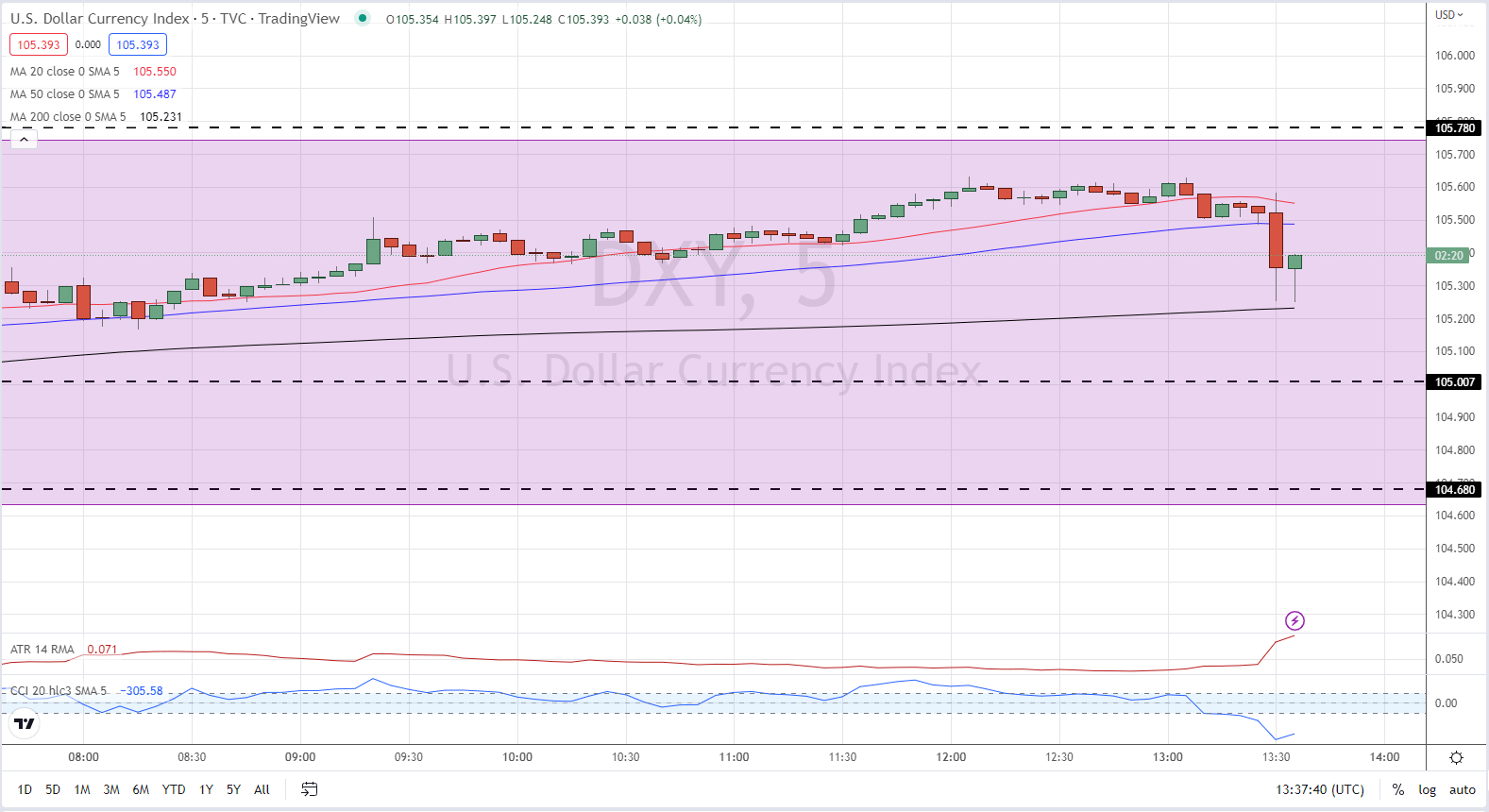

- The US dollar (DXY) is struggling to keep hold of recent gains.

Recommended by Nick Cawley

Trading Forex News: The Strategy

The US dollar is finding it hard to keep earlier gains after the latest US labor report showed that 223k new jobs were created in December, compared to market forecasts of 200k and a revised prior month’s 256k. The unemployment rate fell to 3.5% from a prior reading of 3.7%, while average hourly wages y/y fell to 4.6% from a revised lower 4.8% and a 5% forecast. A marginally mixed bag that may see the US dollar struggle at its current elevated levels.

Yesterday’s ADP labor data showed that private employers added 235k jobs in December, sharply higher than market expectations of 150k and the 182k added in November. According to ADP, ‘hiring was strong across small and medium establishments while large establishments saw a drop in employment of 151k jobs’.

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

Recommended by Nick Cawley

Download our brand new Q1 trading guide

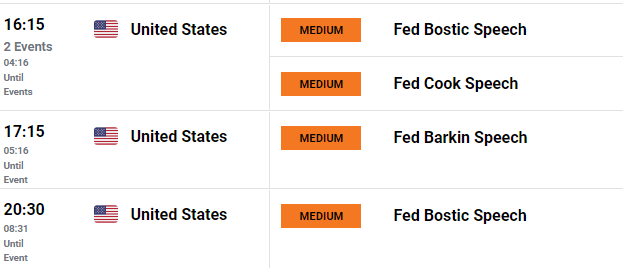

With the US jobs market seemingly resilient, the Federal Reserve may look to hike US rates higher, and for longer, in an effort to contain inflation. Recent commentary from Kansas City Fed President Esther George suggested that rates may have to be raised to 5%+ for some time to fight inflation, while other Fed officials have recently railed against market expectations that interest rates will fall this year. Later today, three Fed officials are set to speak and their opinions on rates and the labor market could well dictate price action going into the weekend.

The US dollar is currently struggling to hold its recent gains with the market reasonably well bis after Thursday’s ADP release.

US Dollar (DXY) 5-Minute Price Chart – January 6, 2023

Chart via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.