[ad_1]

Japanese Yen Talking Points

USD/JPY appears to be reversing ahead of the June low (128.60) as it attempts to halt a four-day decline, and the exchange rate may stage a larger advance over the coming days as the Relative Strength Index (RSI) holds above oversold territory.

USD/JPY Rebounds Ahead of June Low to Keep RSI Out of Oversold Zone

USD/JPY bounces back from a fresh weekly low (130.39) to largely track the rebound in US Treasury yields, and the exchange rate may stage a larger rebound ahead of the US Non-Farm Payrolls (NFP) report as the recent decline fails to push the RSI below 30.

As a result, USD/JPY may snap the series of lower highs and lows carried over from last week as the bearish momentum abates, and fresh data prints coming out of the US may keep the exchange rate afloat as the economy is expected to add 250K jobs in July.

A further improvement in the labor market may lead the Federal Reserve to carry out a highly restrictive policy as the central bank struggles to tame inflation, but a dismal development may produce headwinds for the Greenback as the threat of a recession puts pressure on Chairman Jerome Powell and Co. to implement higher interest rates at a slower pace.

In turn, the RSI may continue to flirt with oversold territory as USD/JPY trades below the 50-Day SMA (134.43) for the first time since March, while the tilt in retail sentiment looks poised to persist in August as traders have been net-short the pair for most of the year.

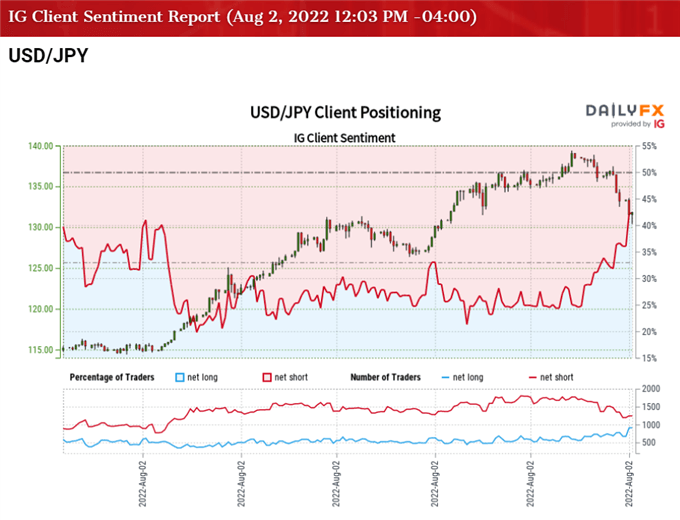

The IG Client Sentiment report shows 44.45% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 1.25 to 1.

The number of traders net-long is 11.34% higher than yesterday and 26.81% higher from last week, while the number of traders net-short is 12.97% lower than yesterday and 25.67% lower from last week. The jump in net-long interest has helped to alleviate the crowding behavior as only 33.16% of traders were net-long USD/JPY last week, while the decline in net-short position comes as the exchange rate bounces back from a fresh weekly low (130.39).

With said, USD/JPY may attempt to snap the series of lower highs and lows carried over from last week as it appears to be reversing ahead of the June low (128.60), but a move below 30 in the RSI is likely to be accompanied by a near-term decline in the exchange rate if the indicator reflects an oversold signal for the first time since November 2020.

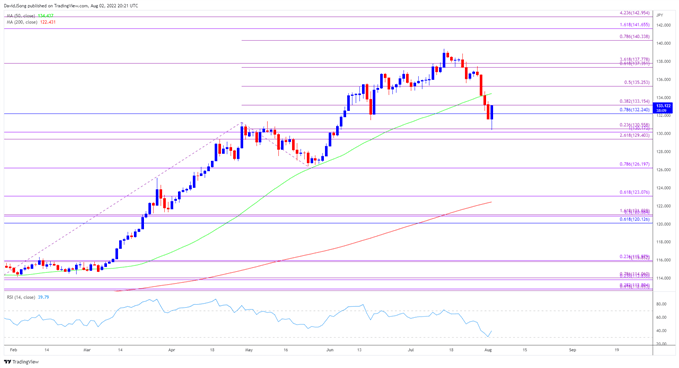

USD/JPY Rate Daily Chart

Source: Trading View

- USD/JPY trades below the 50-Day SMA (134.43) for the first time since March as it extends the series of lower highs and lows from last week, with a break/close below the 130.20 (100% expansion) to 130.60 (23.6% expansion) area opening up the 129.40 (261.8% expansion) region.

- Failure to defend the June low (128.60) may push USD/JPY towards 126.20 (78.6% expansion), but lack of momentum to break/close below the 130.20 (100% expansion) to 130.60 (23.6% expansion) area may lead to a larger rebound in USD/JPY as the Relative Strength Index (RSI) holds above 30.

- A move above the Fibonacci overlap around 132.20 (78.6% retracement) to 133.20 (38.2% expansion) brings the 135.30 (50% expansion) region back on the radar, with the next area of interest coming in around 137.40 (61.8% expansion) to 137.80 (361.8% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.