[ad_1]

USDCAD, Crude Oil and Interest Rate Talking Points:

- The Market Perspective: USDCAD Bearish Below 1.3500

- USDCAD’s violent reversal this past Friday amid US and Canadian employment data led to a clear break of trendlines support and the 100-day SMA

- With the midpoint of the August to October advance in view, follow through will need to draw upon relative rate forecasting – which holds far more US potential

Recommended by John Kicklighter

Get Your Free Top Trading Opportunities Forecast

There is no shortage of Dollar-based crosses that have suffered significant hits for the benchmark currency to start the new trading week. Yet, there are some unique and interesting qualities to the USDCAD backdrop that should be considered. As far as the fundamental landscape goes, the United States and Canada have very similar backdrops. Like the Eurozone and UK or Australian and New Zealand, the economic connections between the two tends to reduce the discrepancies between the major themes that tend to drive the relative valuations of the FX market. After last week’s simultaneous release of employment data from the two countries, it was clear that Canada’s numbers were more impressive relative to expectations. Yet, it was the implications for interest rates that seemed to ultimately guide the market’s next move. It’s worth taking that reaction to guide prioritization for this pair’s next steps moving forward.

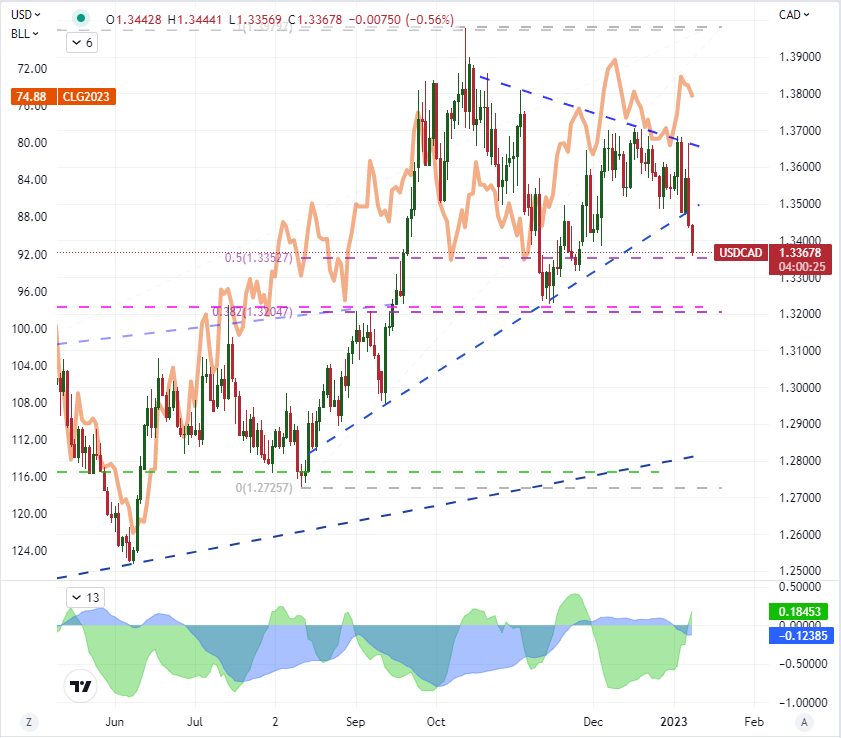

Before diving into the fundamental side of the equation, it is worth looking at the technical picture USDCAD has carved out. An expanded wedge that really formed over the past three months was ultimately cleared with a bearish break this past Friday. The volatility through that particular session was extreme with a 1.7 percent range (relative to spot) and the biggest ‘upper wick’ since October 13th. That translates into extreme activity for a pair that tends to go through long periods of consolidation interspersed with dramatic directional moves. Friday’s close would clear the trendline support and 100-day moving average, but this session’s follow through 1.3400 is where the progress is cemented. There remains critical support below with the midpoint of the August to October leg higher standing just above 1.3350. Of greater weight is the area around 1.3200 where the 61.8 percent Fibonacci of the same range meets a pivot level (area of both former support and resistance) as well as the 38.2 percent retracement of the May 2021 low to the October 2022 high.

| Change in | Longs | Shorts | OI |

| Daily | 39% | 13% | 27% |

| Weekly | 58% | -9% | 22% |

Chart of USDCAD with 50 and 200-Day SMAs, 1-Day Rate of Change (Daily)

Chart Created on Tradingview Platform

In looking for motivations for future market movements, one of the most frequently referenced motivators is the ebb and flow of commodity prices. Historically, Canada is a significant exporter of raw materials to the United States, but it is really a measurement of how much commodities represents a percentage of exports to rest of world in total that sets this relationship up. For convenience, many traders will simply consider crude oil a stand in for commodity influence, which has seen a fairly strong correlation in previous years. At present, the relationship is less relevant given the United States own production levels but also the unmooring of the correlations themselves. Below the 20 and 60-day (1 and 3 month) relationships have significant deflated and the shorter time frame has even flipped positive. That said, should crude oil manage a really from its six-month bear trend, it could bolster the relationship meaningfully (though the opposite development is less likely to urge a USDCAD rebound).

Chart of USDCAD Overlaid with US WTI Crude Oil Futures with 20, 60-Day Correlations (Daily)

Chart Created on Tradingview Platform

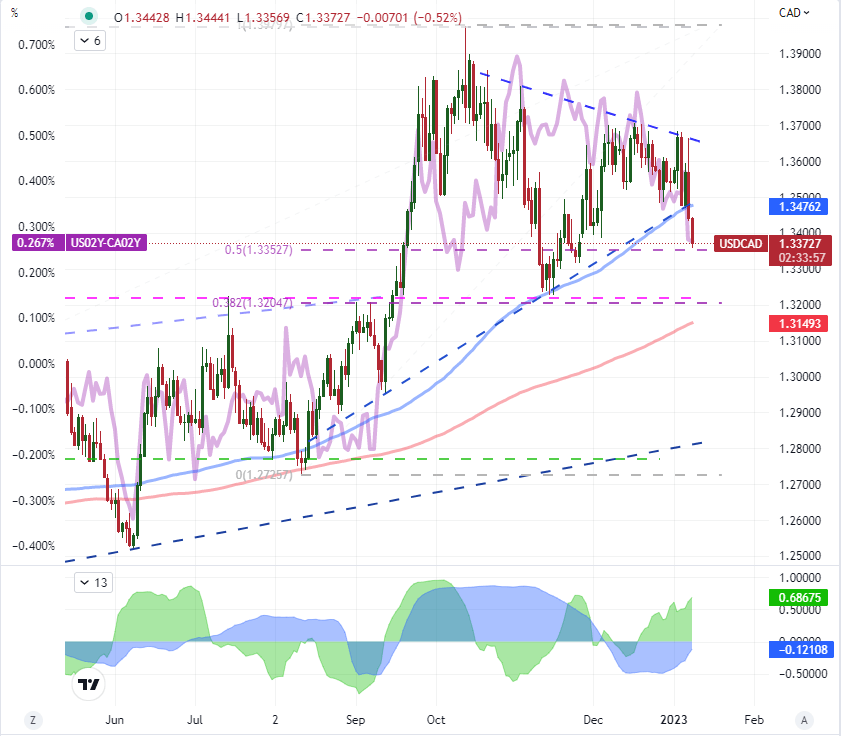

A more productive fundamental driver for USDCAD as of late seems to be interest rate expectations. One of the impressive similarities between the United States and Canada is their monetary policy regime. The Fed hiked its benchmark to a 4.25-4.50 percent range by the end of last year while the Bank of Canada ended 2022 with a modest 25bp hike to 4.25 percent itself. Both benchmarks are seen as slowing the cadence of tightening into this year, but the nuance around next meeting lift and the ‘terminal rates’ seems to be generating significant response from the markets. Using the 2-year government bond yields as reasonable assessments of market expectations, we can see the US-CA differential is aligning well to the recent drop in USDCAD. Looking to the economic docket, the there isn’t much on the Canadian calendar that would meaningfully be expected to alter the BOC rate forecast. That said, Fed Chairman Powell is due to speak tomorrow and the December US CPI is due on Thursday. As usual, look to the US side of things to monitor USDCAD potential.

Chart of USDCAD Overlaid with US-Canada 2-Year Yield Spread with 20, 60-Day Correlations (Daily)

Chart Created on Tradingview Platform

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.