[ad_1]

Nastassia Samal

Evolution is usually required for survival. Adopting to an environment that a person or investors has become used to usually isn’t overly challenging, but learning how to thrive when circumstances change is often more difficult.

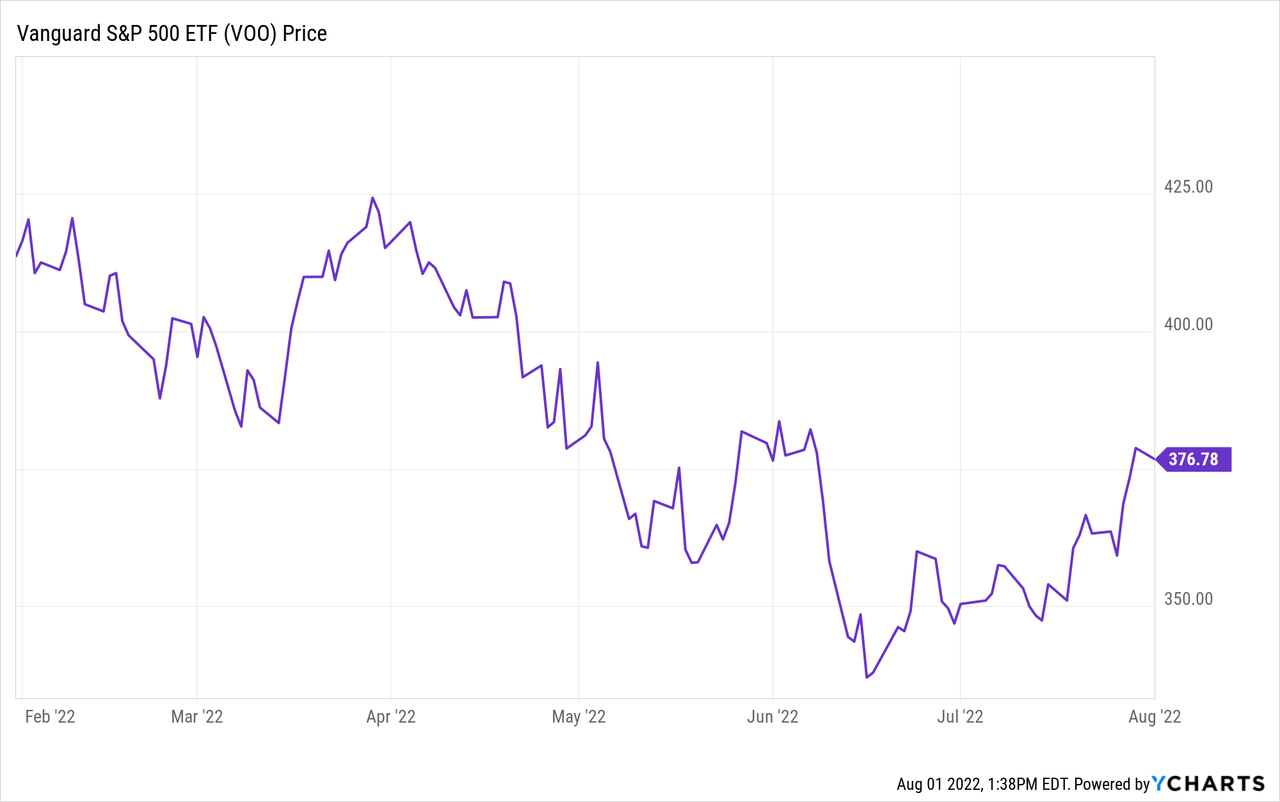

The market isn’t going straight up anymore. Inflation, rising rates, flatling earnings, and a rising dollar, all have resulted in funds indexed to the S&P 500 (SPY) such as the Vanguard S&P 500 ETF (NYSEARCA:VOO) selling off hard over the first six months of this year.

VOO is an ETF that is indexed to the S&P 500 which holds the following sectors. The fund allocates assets 24.11% to technology, 15.14% to health care, 12.84% to the financials, 10.24% to consumer cyclicals, 8.82% to the communication sector, 8.26% to industrials, 7.36% to consumer defensives, 4.33% to the energy sector, 3.09% to utilities, 2.9% to the real estate sector, and 2.27% to basic materials. The fund has good expense ratio of .45% and $832.52 billion in assets under management. The fund’s 5 biggest holdings are Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOGL), Apple (AAPL), and Tesla (TSLA).

I think this fund should be sold for 3 main reasons; Falling earnings, slowing growth, and a rising dollar. All issues that should remain challenges for most large cap companies through the next year.

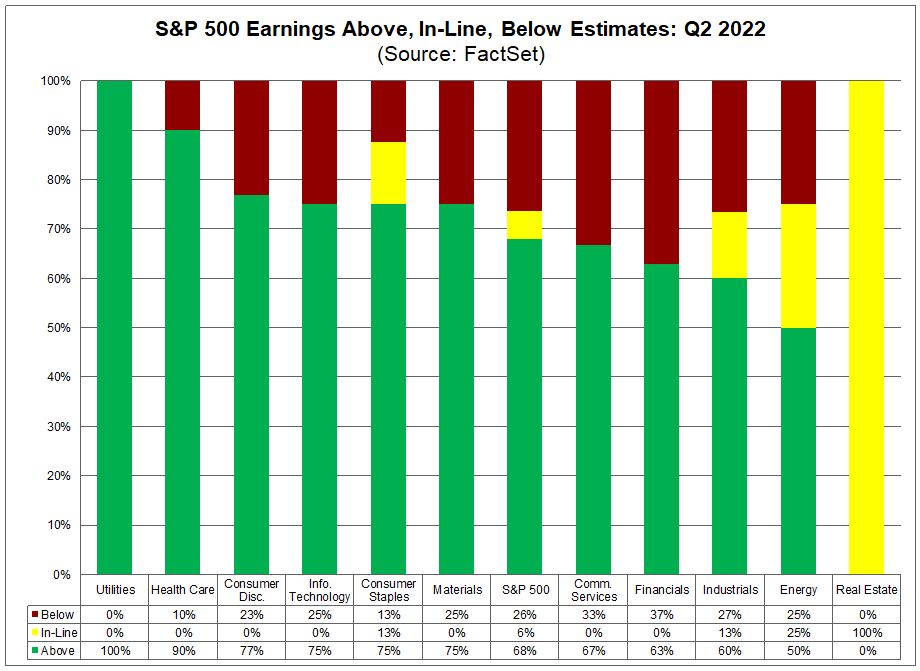

With inflation levels still at near record highs and the dollar rising fast against most major currencies over the last several months, earnings expectations for the S&P 500 and most major indexes have fallen as well. S&P 500 earnings have been well below 5-year averages so far with most reports nearly 5% below 4-year average earnings reports when it comes to beating analyst expectations.

An Earnings Table (FactSet)

Even though the Fed recently suggested the future interest rate raises may be slowed as inflation expectations have eased, inflation levels remain near 40-year highs.

There are also a number of signs the US economy is at least going to enter a period of an extended slowdown. Jobless claims have risen to 8-month highs, the number of small businesses defaulting on leases have reached alarming levels with nearly 35% of small businesses having issues paying their rent. Growth estimates for China and many other leading emerging market economies such as India continue to fall as well. China’s economy is expected to grow at less than 4.4% this year after growing at 8.1% in 2021. Consensus estimates for growth in India have already fallen by nearly 2% since the beginning of the year primarily because of inflation and Covid related issues.

The slowing economy and consistently high levels of inflation the companies continue to face have largely resulted in earnings expectation flatlining over the last 6 months.

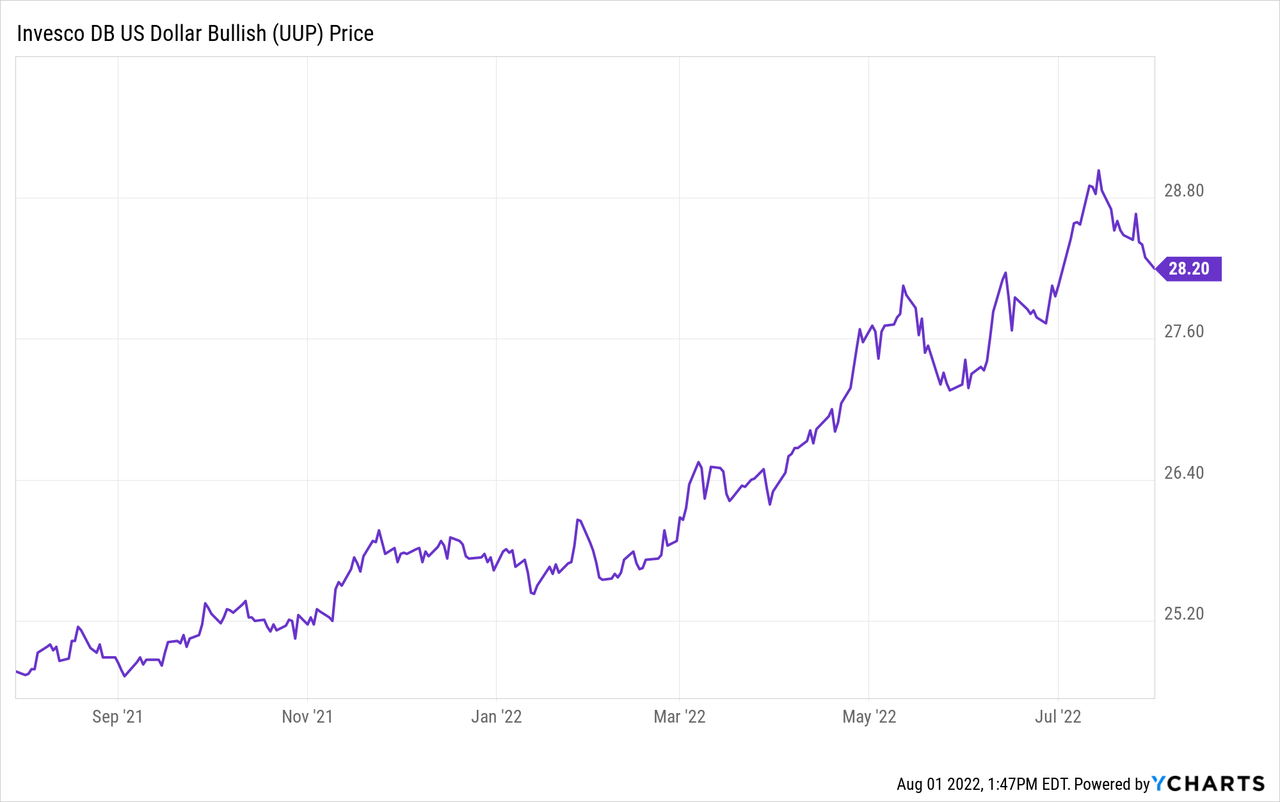

Inflation and slower expectations for growth in the US and abroad aren’t the only issues most large-cap companies that comprise funds such as VOO are facing. The rising dollar is also hurting large-cap companies significantly.

The dollar has risen significantly against most major currencies since September of 2021. About 37% of S&P 500 earnings come from outside of the United States, so a 10% rise in the dollar usually equates to a near 4% drop in earnings expectations. The dollar has risen well over 10% against most major currencies just since early May.

With inflation, a slowing economy, and falling earnings expectations likely to continue for some time, the market is more than likely to remain range-bound for an extended period of time in this uncertain environment. With VOO yielding just 1.49%, most investors seeking income or capital gains are likely to be disappointed with the returns this fund can offer over the next year.

Given the Uncertain times and higher than average volatility levels that should be in the market for some time, investors will likely get better returns using more creative strategies that target funds that can thrive even if the market remains range bound. Funds that use a covered call strategy, which is selling calls against the underlying securities the funds hold, are capable of generating significant income even in a market that flatlines. The Amplify CWP Enhanced Dividend Income ETF (DIVO), The Global X S&P 500 Covered Call Exchange Traded Fund (XYLD), and the Global X Russell 2000 Covered Call Fund (RYLD), have all consistently returned at least 9% a year, and each fund offer monthly payouts as well. Since these ETFs use a covered call strategy to generate income that is paid out monthly, these funds perform well even when markets remain range-bound.

The best investing strategy for most investors primarily concerned with overall returns over the last 5 years has been to buy broad-based funds such as VOO that are overweight large-cap companies. Today the investing environment is very different. With a rising dollar, flatling earnings, and increasing signs of a wide slowdown, most investors will have to seek new and more targeted strategies to achieve their objectives.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.