[ad_1]

POUND STERLING TALKING POINTS

- UK housing statistics and railway strikes cast shadow on UK economy.

- FOMC and ISM data in focus.

- Threatening rectangle breakout on daily cable chart.

Recommended by Warren Venketas

GET YOUR EXCLUSIVE GBP Q1 GUIDE

GBP FUNDAMENTAL BACKDROP

The British pound garnered some support this Wednesday ahead of the December FOMC minutes. Casting back to the last Fed interest rate decision, there was a hawkish slant to the announcement with Fed Chair Jerome Powell reducing pivot concerns, leaving the cable exposed to the downside should the minutes reinforce this narrative. With the Bank of England (BoE) far more dovish, the interest rate differential favors the USD.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

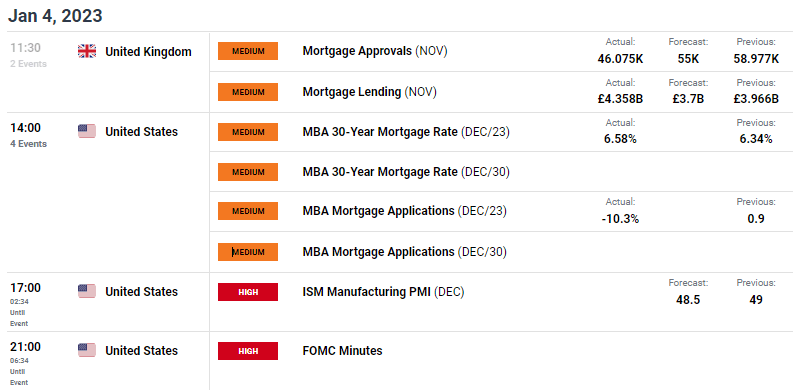

The UK economy has been handicapped of recent but railway strikes beginning today have added to the nations woes. Looking at the economic calendar today, housing data for both the UK and U.S. are showing signs of decline with interest rates climbing higher hurting mortgage applications. Market reaction to these data points were muted as high impact ISM manufacturing data and FOMC minutes take precedence for today. While the ISM manufacturing print is expected to come in lower than the November figure and remain in contractionary territory, the U.S. is primarily a services driven economy giving more weight to Friday’s non-manufacturing release.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

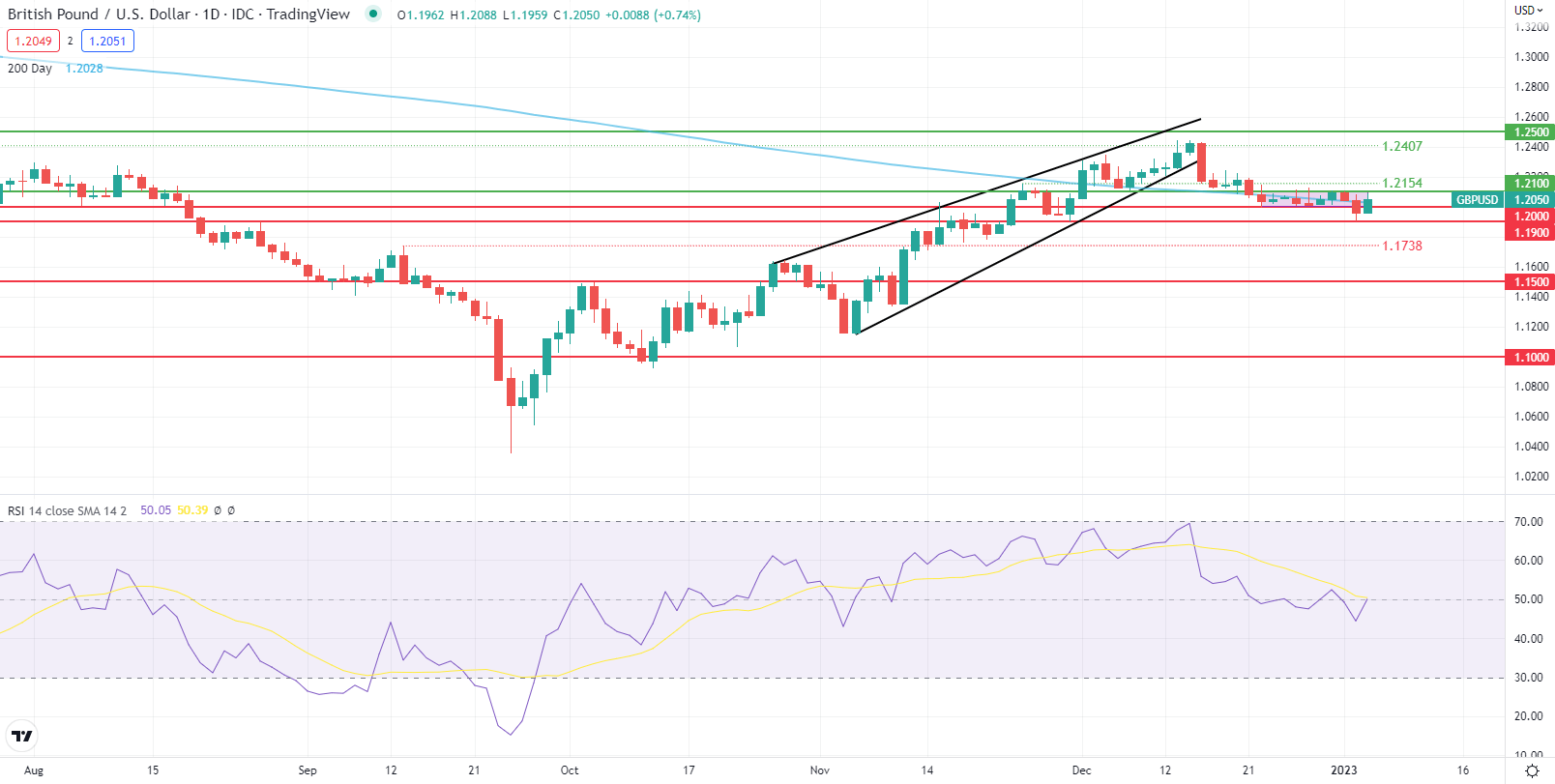

Chart prepared by Warren Venketas, IG

The daily GBP/USD chart shows yesterday’s rectangle pattern (pink) support breakout not following through just yet however, key economic data later today could provide the catalyst required. Current price action still flirts with the 200-day SMA (blue) and trades marginally above the 1.2000 psychological level. A second daily candle close below rectangle support coinciding with 1.2000 could spark a move lower towards subsequent support zones.

Key resistance levels:

- 1.2154

- 1.2100

- 200-day SMA

Key support levels:

- 1.2000

- 1.1900

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently SHORT on GBP/USD, with 52% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.