[ad_1]

- Recession Woes, Firmer US Data Underpin Hawkish Fed Bets and Strong US Dollar.

- China’s Slowdown Adds to Downside Pressure on the Precious Metal.

- XAU Traders Eye Fedspeak from Brainard and Powell as Blackout Period Nears.

Starts in:

Live now:

Sep 13

( 02:09 GMT )

Recommended by Zain Vawda

Weekly Commodities Trading Prep

Gold’s Fundamental Backdrop

Gold extended its decline in early European trade before a bounce saw it push above the key $1700 level. Yesterday we had a better-than-expected US Headline ISM Services PMI which added to an already bullish dollar driving the US dollar index to a new two-decade top above 110.50. The Asian session saw Chinese data reveal a slowdown in exports and imports for the month according to China’s General Administration of Customs. This coupled with China’s covid-related woes continues to pose a threat to growth as investors fear a downturn in demand with China one of the largest gold importers in the world.

We have seen relentless US Dollar buying of late which has been a driving factor on dollar-denominated gold. This comes as market expectations have been growing for a more aggressive tightening policy from the US Federal Reserve. The current market pricing indicates over a 70% chance that the Fed will raise interest rates by 75 bps at the upcoming meeting on September 20-21. As a result, we have seen the yield on the benchmark 10-year US Treasury note surge to levels not seen since June 16this year at 3.361%.

Sentiment continues to shift as concerns remain which is evident in the generally weaker tone around equities of late. The flight to safety continues to assist gold as prices bounced back above the $1700 level today, yet any further recovery seems elusive. For any significant change to the overall downward trend, we would need a major market-moving economic release as the Federal Reserve is unlikely to retreat from its hawkish stance until it sees substantial progress on easing prices, and a US inflation update won’t come until September 13.

For all market-moving economic releases and events, see the DailyFX Calendar

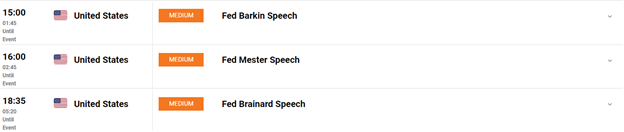

Later in the day we have a host of Fed members speaking with Thomas Barkin kicking us off. This is followed by two Fed voting members who may provide markets with an insight as to the overall thinking of the committee. Federal Reserve President Loretta Mester is set to deliver remarks at a Market News International webcast, and Vice Chair Lael Brainard is scheduled to speak at the House/Bank Policy Institute Annual Conference. Later this week, Fed Chair Jerome Powell will take part in a discussion during the Cato Institute’s 40th annual conference. That will wrap it up for Fed speak, as the FOMC blackout period begins on Saturday.

Foundational Trading Knowledge

Commodities Trading

Recommended by Zain Vawda

XAUUSD Daily Chart – September 7, 2022

Source: TradingView

From a technical perspective, we had a bearish close on the weekly timeframe which was the third bearish close in a row with the metal declining from August 15 highs around the $1800 level. We dipped below the key $1700 level before rallying on Friday to close at $1712.

On the daily timeframe we have had a nice bounce this morning which pushed prices back above the key $1700 level. The daily candle yesterday did however close as a shooting star candlestick after spiking above the 23.6% fib level before closing below. For a continued upside bounce we would need to see a candle close above the 23.6% fib level. On the flip side we need a daily candle close below $1700 but a close below $1696 would be preferred to see further downside. Should this come to pass, and downside momentum extenda, a test of the 2022 low of $1,681 will be inevitable. Further down, the 2021 low of $1,677 will be next on the bears’ radars.

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•1700

•1696

•1690

Resistance Areas

•1715

•1730

•1745

| Change in | Longs | Shorts | OI |

| Daily | -2% | 16% | 1% |

| Weekly | 7% | 3% | 7% |

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.