[ad_1]

It happened, yet again!

And it’s going to keep happening until you’re ready to commit to moving forward in your trading.

Now, I am not ashamed to admit that I can’t produce WEEKLY trade ideas that move by hundreds of percent every time.

It’s simply NOT possible!!!

But when my trade ideas do move in a manner in which my analysis foretold, whether a monster mover or not, they need to be appreciated.

Not only that, but they need to be examined so that I can help my members learn from what I did right and what you did wrong.

Folks, I can’t tell you how many times I’ve heard people tell me…

“Jeff, every time I buy options, the value of those options usually deteriorates to nothing in the time that I am waiting for the stock to move.”

Well, for members of my Bullseye Trades service, or even all of my services for that matter, this is one of the MANY problems I help people solve.

This particular problem, which is one that MOST options traders have early on in their career, usually comes down to two key factors:

- You’ve chosen to purchase options where the implied volatility is so high, causing you to pay too much of a premium

- You lack the necessary screeners to help you understand when large traders have also been buying those options with urgency, and when the technicals have lined up in a manner that improves the odds for immediate price movement

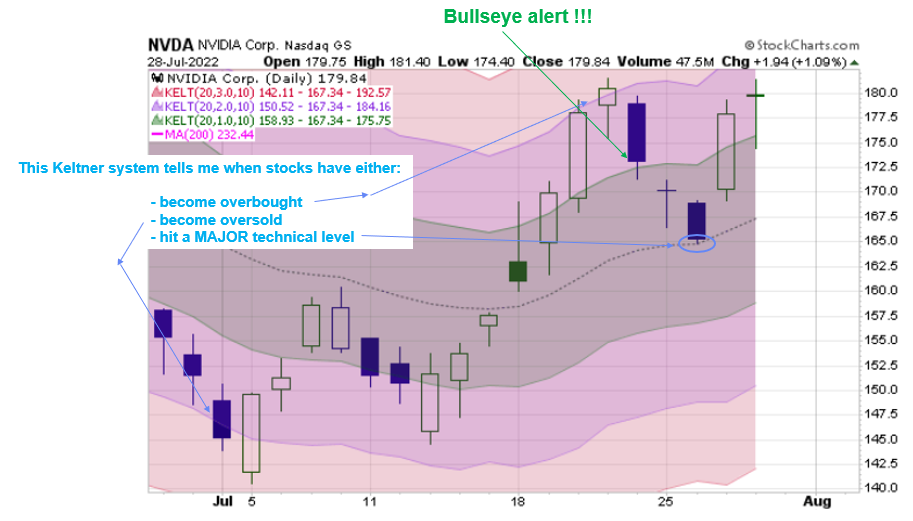

Well, enter this week’s Bullseye Trade idea to buy NVDA Puts at the start of the week.

As you can see from this chart of NVDA, a key reason I chose to buy puts (a bet that price would move lower without much hesitation) was due to the historically low implied volatility that existed prior to me placing the trade.

Folks, NVDA is known to have some CRAZY high volatility.

So to see volatility this low at the start of this week was a gift.

With volatility this low, not only was I betting that NVDA’s stock price would fall quickly, but also that volatility would increase to some degree from these low levels, thereby allowing the value of my puts to gain premium.

Now, if you’re still getting the feel for options, you might need more time to absorb this concept.

So before we continue, I have to let you know about something I am EXTREMELY proud of…

And that’s the extensive educational platform that my team and I have developed over the years.

Members can access all sorts of options content right from their Dashboard.

Once there, members are treated to articles teaching them about EVERYTHING there is to know about options!

I mean, just look at this index of topics:

Now, it is important to reiterate that my PRIMARY focus when selecting my weekly Bullseye Trade idea is to find stocks that are ready to move QUICKLY.

I can’t reiterate enough how important it is that, when I am buying options, immediate movement in the desired direction is CRITICAL to my being able to fight the negative effects of time decay.

In the end, the Aug 5 $170 NVDA Puts I presented as my idea moved as much as 64% in the first 48 hours of this week’s trading.

While NVDA did rally into the latter part of this week, causing the value of those puts to fall, it is also important to highlight that this rally started after a critical level in my strategy was reached.

Specifically, this next chart shows that the expected early week decline in NVDA shares that caused the puts to jump from the start stopped right at the 20-day exponential moving average.

Folks, this is the middle of the Kelner Band strategy I use to determine entry and exit points…

And it was also where I placed my target area for this week’s Bullseye Trade.

I hate to tell you this, but this coming week brings two MAJOR economic announcements (ISM Manufacturing and Employment data) that could influence the Fed’s next decision.

Needless to say, things could get a bit hairy in the market, but I’ve got my next Bullseye Trade plan ready to go.

If you DON’T want to miss it YET AGAIN, you’ve got to be here by Monday morning.

To YOUR Success!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.