[ad_1]

Coming off of two straight weeks where my members started the trading week being treated to trade ideas that were big movers, well, we were at it again this week.

And here’s what members have been saying about Bullseye Trades:

But enough of the past, it is time for you to stop missing out on these ideas!

Unless you like hiding from your significant other, STRUGGLING to find your next trading ideas over the weekend, I’m the one helping find great trades ideas every week for you.

Folks, my Bullseye Trades are either in your inbox OR on your phone app, READY TO GO at the start of every trading week.

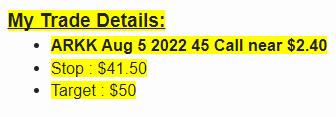

As this screen grab from this past Monday’s Bullseye Trade alert shows, this week’s ideas was:

Unlike other gurus on competing services, however, I actually traded this idea with my own money!!!

And I made a quick 38% IN JUST 1 DAY.

![]()

Trading my real money is what I do regularly, not only because I believe in my system but also because I want to be “in the game” with my members whenever possible.

This trade shows 5 great lessons that you really should pay attention to as you grow your abilities:

- I am always looking for ideas that will outperform the broader market indices like the S&P 500.

- I practice patience and avoid chasing trades

- The ideas I generate have the potential for big moves

- I focus on ideas with the best potential to see movement happen quickly

- I never second guess myself and always remain true to my process

Here’s what I mean…

-

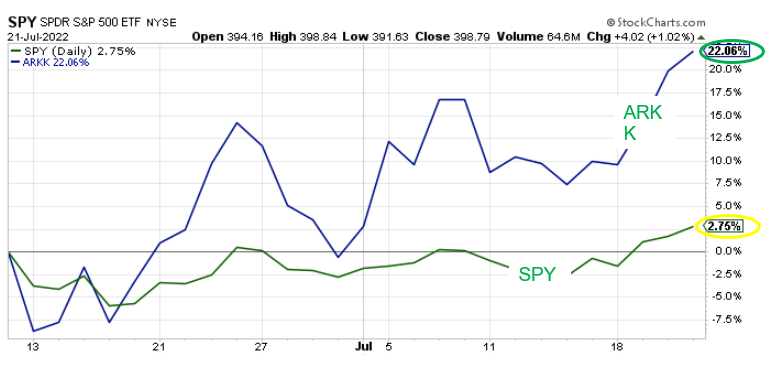

- As this chart shows, ARKK has far outpaced the S&P 500 since the market began to bounce back in mid June.

Why is this?

Well, even though I absolutely detest this stock (ETF), because, in my opinion, it is made up of the worst companies out there…

My 20+ years’ trading experience tells me that higher risk assets like this will lead the market in risk-on environments.

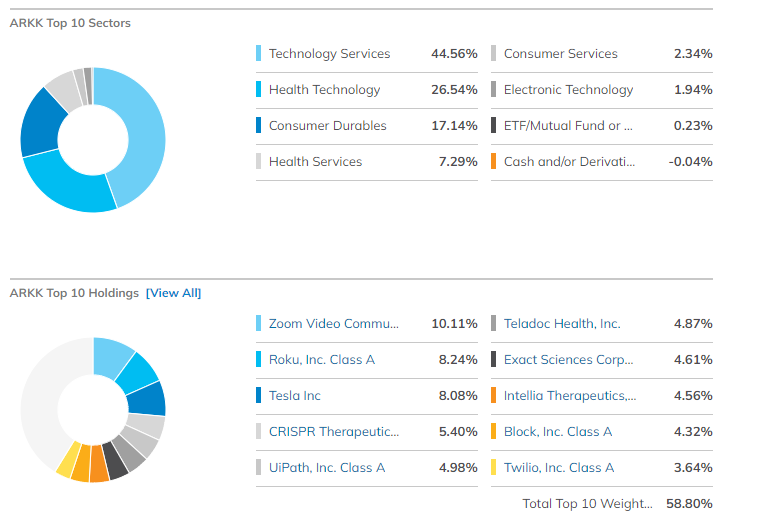

You can see here that ARKK is very tech heavy…

And tech tends to lead when the market bounces.

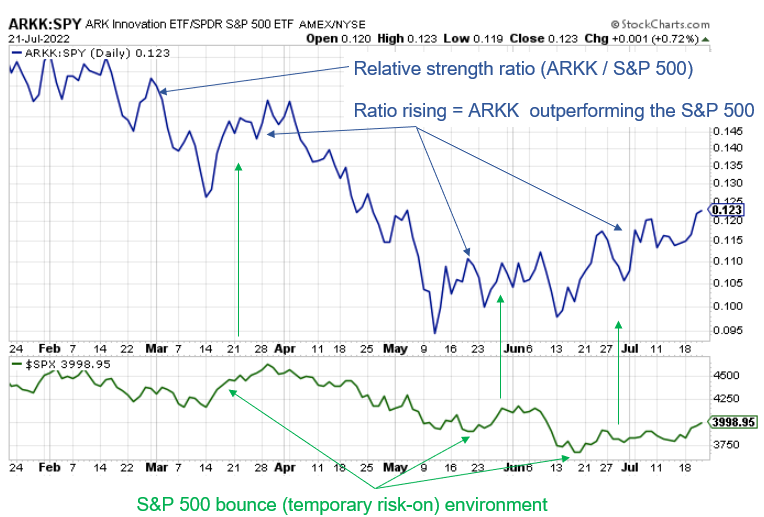

Next, this chart of the actual options contract I traded explains points 2, 3, 4 and 5:

Folks, NEVER beat yourself up if you’ve made money on a trade and the trade continues to run without you.

This has been a difficult market where rallies have been fizzling left and right.

With that in mind, I took profits where I saw best.

Now, Jim Cramer may be a terrible stock picker, but he did have one great quote, which is, “Bulls make money, bears make money, pigs get slaughtered.”

My next best idea is almost here, folks, and it comes in less than 24 hours.

To YOUR Success!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.