[ad_1]

USD, EUR/USD, AUD/USD Analysis and Talking Points

USD: The USD remains on the backfoot following last week’s surprise contraction in the most recent US PMI report. As such, while this has fuelled an unwind of the US Dollar’s recent strength, it is thus far a case of a tactical pullback as opposed to a meaningful pullback. Despite the ECB’s surprise with a 50bps hike to end the era of negative interest rates, the current narrative surrounding Europe remains bleak. For now, the growth story trumps the normalisation outlook, meaning that preference for Euro exposure is on the short side.

This week, we will get a first look at the US Q2 GDP report, consensus looks for a tepid rise of 0.4%. However, there is a heightened risk according to the Atlanta Fed GDPNow Model that the figure could show a contraction, which if realised would mark a technical recession following the 1.6% drop in Q1. Over the weekend, US Treasury Secretary Yellen weighed in on the upcoming GDP report, stating that even if the number is negative, the US is not in a recession now, referencing the fact that the labour market is “extremely strong”. I think this is noteworthy coming from a former Fed Chair, as this gives some insight into perhaps the thinking among the FOMC. Suggesting that the Fed will remain steadfast in tightening policy aggressively as they lean against the strength of the labour market.

The trend is the US Dollar has generally been defined by the 21 and 55DMA. While softer yields and a pick-up in risk sentiment have also weighed on the greenback, the latter is likely a bear market rally as the path of least resistance remains lower in the current backdrop.

US Dollar Chart: Daily Time Frame

Source: Refinitiv

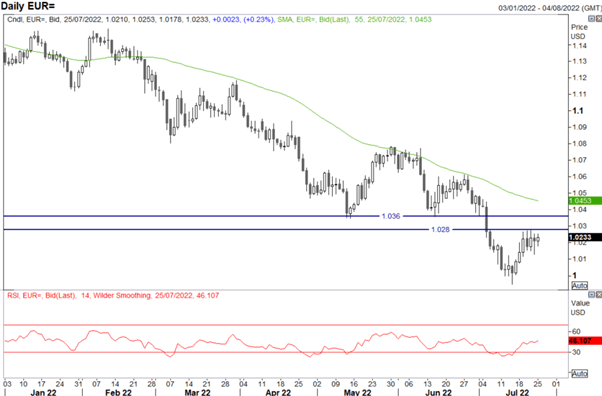

EUR: The worst-case scenario had been avoided last week as Russia resumed gas flows via the Nord Stream 1 pipeline after annual maintenance. Although, gas flows are only back to pre-maintenance levels of 40%, which will remain a drag on the Euro Area in the months ahead. As such, this makes it difficult to get on board with the view that the Euro can make a notable reversal and thus the bias remains to fade rallies, particularly with EUR/USD below key resistance at 1.0340-60 and its 55DMA (circa 1.0450). While hawkish comments from ECB’s Kazaks as well as the Kremlin stating they have no desire to cut off gas supply to Europe has helped lift the Euro above 1.0200, near-term resistance is situated at 1.0280, a level that saw multiple failures last week.

EUR/USD Chart: Daily Time Frame

Source: Refinitiv

Top Q3 Trade Idea – Euro May Break Parity

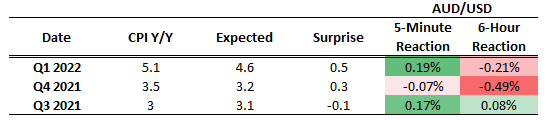

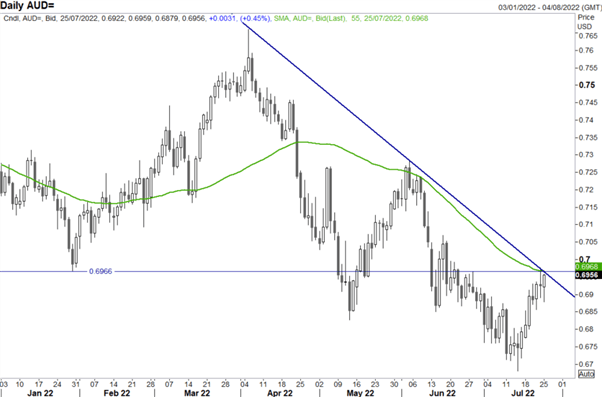

AUD: For Aussie traders’ eyes will be on local data with the Q2 Australian Inflation report released on Wednesday. As it stands, money markets are pricing in 50bps at the upcoming meeting, which would take the cash rate to 1.85%. Should we see a sizeable upside surprise in headline inflation, this could see markets price in a larger sized hike. Although, as shown in the table below, the initial impact on AUD/USD has often been unwound. Subsequently, risk sentiment and the USD may be the bigger factor for the pair this week. Resistance situated at 0.6965-70 and above at 0.7000.

Source: Refinitiv, DailyFx

AUD/USD Chart: Daily Time Frame

Source: Refinitiv

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.