[ad_1]

Ever since June’s CPI index was released on July 13, where

headline, year-over-year inflation reached a new high for the current cycle of

9.1%, the question has been, will the Fed raise rates by 0.75% or a full 1%?

Currently (~1pm est.), the CME

Group’s FedWatch Tool is

indicating a 75.1% probability of a 0.75% increase and a 24.9% chance of 1%.

Tomorrow, the answer will be known when the Fed concludes this month’s meeting.

With the Fed so far behind the inflation curve, a full 1% increase might

actually be better received by the market. It would accelerate the Fed’s well

telegraphed timeline and potentially shorten the duration of pain and

uncertainty.

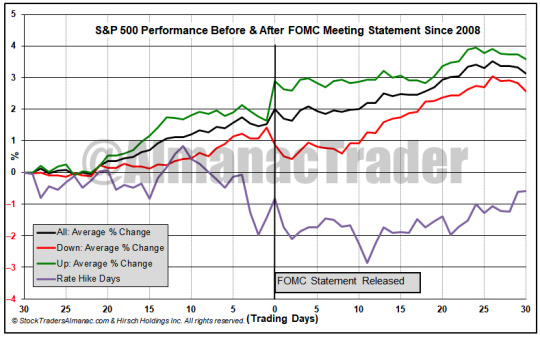

In the chart above the 30 trading days before

and after the last 114 Fed meetings (back to March 2008) are graphed. There are

four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500

finished announcement day with a gain, down it finished with a loss or

unchanged. In 114 Fed meetings, there have been just 12 rate increases. Three occurred

this year. These 12 increases are represented by Rate Hike Days. Of the 12 hike

days, S&P 500 was down 7 times and up 5 times with an average gain of 0.46%

on all 12. This year’s rate hikes were well received by S&P 500 with gains

over 2% in March and May and a near 1.5% gain in June. On the day after the

last 12 rate hike announcements, S&P 500 has declined 0.90% on average.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.