[ad_1]

John Li

Note: I have written about Prudential previously, Investors should see this as an update to my earlier article on the company

Prudential plc’s (NYSE:PUK) pivot into Asian insurance markets isn’t exactly following the blueprint. On Wednesday, the company reported a fall in New Business Profit (NBP) as China lockdowns hamper Prudential’s expansion efforts. The results demonstrate how exposed Prudential is to China and Hong Kong. Considering these troubles aren’t expected to alleviate anytime soon, I am still bearish on the name.

Q2 Overview

Annual Premium Equivalent (APE) sales grew 9% to $2,213B, however on an actual exchange basis the figure was 6%. A lot of this was driven by Prudential’s ‘growth markets’ where sales jumped 20% – these markets now make up circa 36% of total sales and have helped Prudential to somewhat mitigate the losses in China and Hong Kong.

Nonetheless, this ‘China drag’ on results is more than noticeable when looking towards the bottom line. Despite sales growth, NBP fell 7% to $1,098M, this was largely driven by a steep decline in Hong Kong. APE sales fell just 10% to $277M in Hong Kong, but this drove NBP down 31% YoY. This was really poor considering that Hong Kong historically provides the most profit to Prudential. Following this decline China has now pipped Hong Kong, that comes despite China also seeing declines in NBP (-5%).

Naturally, a lot of uncertainty surrounds Prudential, as the company has undergone a radical strategic change to refocus on the Asian insurance market. This has come with a fair amount of turbulence since the onset of the pandemic, therefore seeing two of Prudential’s most important markets perform poorly is concerning. Particularly considering Hong Kong is a relatively mature market, insurance penetration in the country is over 17%, a lot higher than other nations such as India (3.2%).

On a more positive note, the demerger of the Jackson life business has allowed prudential to effectively cut costs. Savings as a result of this totaled $180 million. This helped support the growth of adjusted operating profit, which hit $1.7B. Despite this, to grow and maintain strong margins over the long run, Prudential needs to focus on growing APE. The company is having success in the growth markets, but is faltering in its key cornerstone markets.

The China Issue

Prior to the pandemic, profit from mainland Chinese customers that bought insurance policies in Hong Kong was $694M, this figure is now practically nil. This is because the border between China and Hong Kong has now been closed for two years. China’s geopolitical tensions with numerous other countries are heightening, therefore, the likelihood of the border reopening anytime soon is very low.

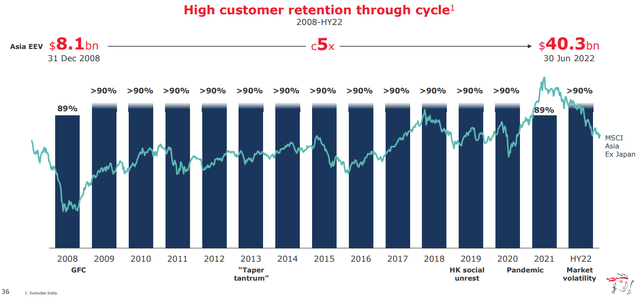

China and Hong Kong have both taken a strong stance on Covid-19. This was the driving force behind decline in NBP in both segments. On the investor presentation, the company was quick to point out the high levels of customer retention

Prudential retention rates over time (Investor presentation)

However, this matters very little when your business has refocused to pursue Growth opportunities. The insurance market in Asia is attractive because it’s largely untapped. Prudential has had some success realizing growth and value in certain markets (such as India) but the core is suffering.

Valuation

At current market prices, Prudential trades on a Fwd P/E of 10x and a Fwd EV/EBITDA ratio of 6.91x. This is similar to Aviva (OTCPK:AIVAF) which trades on a P/E of 8.29x and with EV/EBITDA at 10.5x. I believe the risks associated with Prudential’s new strategy warrant a larger discount to peers than it is currently trading at. Over the long run, prudential is expected to grow faster than Aviva, however there is a lot of uncertainty associated with that growth. From here, it’s very difficult to predict how quickly Hong Kong’s performance will bounce back and whether prudential can still that division back to previous levels of profit. As shown by the latest results, sales growth doesn’t necessarily mean profit growth when there are headwinds in certain key markets.

The Bottom Line

The Asian insurance market is large, diverse, and untapped, if Prudential can successfully execute its growth strategy in the region, shareholder value will undoubtedly be unlocked. This remains a big IF, so far, the numbers show that Prudential is feeling the pressure in its key markets and there isn’t any expectation that will improve any time soon – ‘sell’.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.