[ad_1]

RAND TALKING POINTS

- Commodity prices buoying rand.

- ZAR remains stable awaiting NFP stimulus.

USD/ZAR FUNDAMENTAL BACKDROP

The South African randheld up against the greenback after global markets feared U.S. House Speaker Nancy Pelosi’s visit to Taiwan would spark a grander response from China. Although military drills and Chinese exports to Taiwan came under threat, the expected magnitude was greater than actuality. Coinciding with this geopolitical event, Fed speakers turned surprisingly hawkish stating that tackling inflation remains at the forefront of their agenda. This was followed by a muted reaction by markets who left rate hike pricing relatively unchanged.

Today the rand is trading marginally lower against the U.S. dollar after yesterdays strong PMI data from both South Africa and the U.S.. What could be supporting the ZAR could be the fact that China’s services PMI data beat expectations which could garner support for currencies from commodity exporting countries with close ties to China simply based on an upbeat print.

On the commodities front, iron ore is in the red today but the rest of the South African linked commodities are trading largely higher. The mix of fundamental factors are reflected in USD/ZAR price action as we await the focal economic data issue for the week in the form of Non-Farm Payrolls (NFP) – see economic calendar below.

USD/ZAR ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

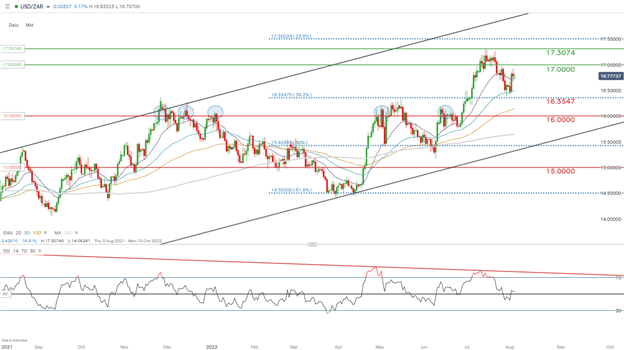

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Technically, there’s not much going on echoing the lack of fundamental catalysts today so I do not expect much change throughout the day. The Relative Strength Index (RSI)supports this notion with a read roughly around the midpoint 50 area which favors neither bullish nor bearish momentum.

Resistance levels:

Support levels:

Contact and follow Warren on Twitter: @WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.