[ad_1]

In today’s article, we’ll take a closer look at GigaCloud Technology, Inc., the company that has developed comprehensive solutions for the B2B ecommerce. On 19 August, it is planning to go public by listing on the NASDAQ under the “GCT” ticker symbol.

What we know about о GigaCloud Technology

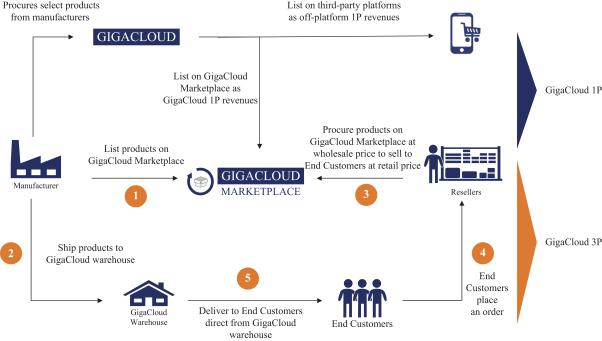

GigaCloud Technology develops and sells all-in-one B2B ecommerce solutions for large shipments, such as furniture, household appliances, or fitness equipment. The issuer’s platform connects manufacturers from Asia with commercial intermediaries from the US and Europe.

GigaCloud Technology was established in Hong Kong. Larry Lei Wu has been the company’s CEO since 2006. Prior to that, he was holding a similar position at New Oriental Education & Technology Group and proved himself to be a highly trained professional.

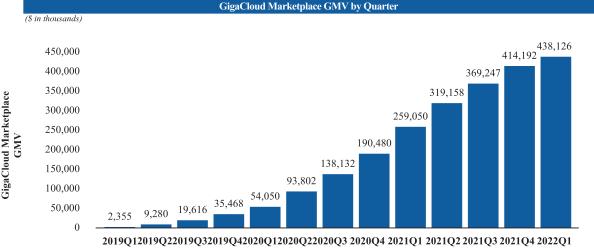

The company helps clients handle cross-border transactions by transporting goods and products from warehouses to ultimate customers at a fixed price. In 2021, GigaCloud Marketplace’s gross product worth was almost $414 million.

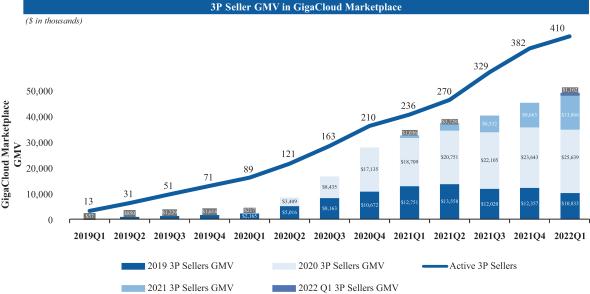

As of 31 March 2022, the company had 21 warehouses in the US, Japan, the United Kingdom, and Germany. In the 12-month period that ended on 31 March 2022, the platform’s trade volume was $438 million; the numbers of active merchants and clients were 410 and 3,782, respectively.

The amount of investment already raised by GigaCloud Technology is $65 million. The anchor investors were DCM Ventures and JD.com.

The prospects of GigaCloud Technology’s target market

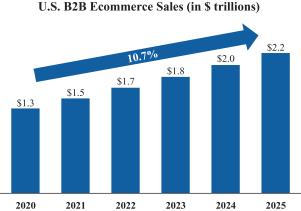

According to market research published by Frost & Sullivan, the US B2B ecommerce market was estimated at $1.3 trillion in 2020. By 2025, it is expected to reach $2.2 trillion.

Consequently, the Compound Annual Growth Rate (CAGR) could be 10.7% from 2020 to 2025. The main catalysts for this growth are the increasing usage of smartphones for shopping online, the rise of new ecommerce platforms, and the development of alternative payment solutions.

The key competitors are:

- AliExpress

- Amazon

- Target

- Tmall

- Rakuten

- Taobao

How GigaCloud Technology performs financially

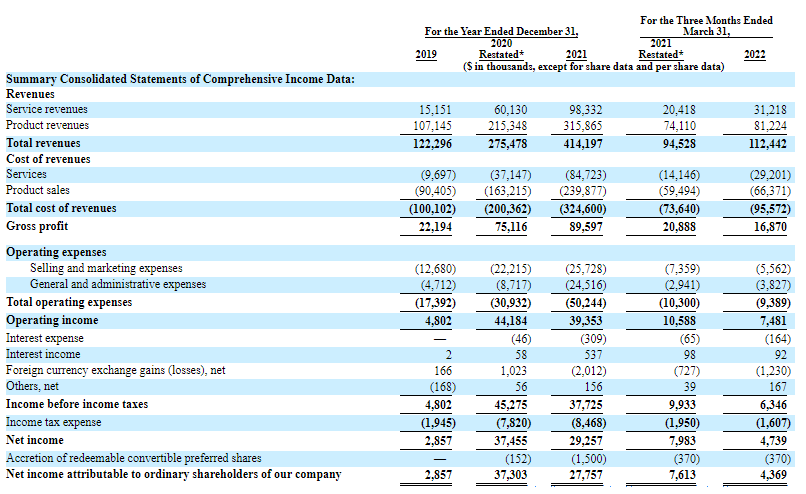

The financial data from the S-1 form shows a 21.89% decline in the company’s net profit in 2021 in comparison to 2020 – meaning down to $29.26 million. However, in 2020 net profit soared 1,200%, so the decline came as no surprise.

In the 12-month period that ended on 31 March 2022, GigaCloud Technology’s net profit was $26.02 million. In the first three months of 2022, this indicator was $4.74 million. In the same period of 2021, it was $7.98 million.

In the first three months of 2022, the issuer’s revenue was $31,22 million, representing a 52.89% growth in comparison to the same period in 2021 ($20.42 million). From April 2021 through March 2022, sales were $109.13 million.

The issuer’s cash position for the above-mentioned period was negative – $0.8 million. As of 31 March 2022, GigaCloud Technology’s total liabilities were $216.5 million, while the cash equivalents on its balance sheet were $49.5 million.

Strengths and weaknesses of GigaCloud Technology

I believe the company’s advantages are:

- Prospective target market

- Revenue growth rate is over 50% annually

- Vast geographic footprint

- Proprietary software for attracting clients

- Net profits

Among investments risks, I would name:

- Strong competition

- Decline in net profits

- Negative cash position

What we know about the GigaCloud Technology IPO

The underwriter for the IPO is Aegis Capital Corp. The issuer is planning to sell 3.5 million common shares at the price of $11.25 per share. Gross revenue is expected to be above $39 million, not including conventional options sold by the underwriter. None of the active or would-be shareholders showed any interest in acquiring new shares at the IPO price.

Assuming the IPO is successful at the proposed price, the issuer’s value at the IPO excluding underwriter options might be approximately $337 million. The Price-to-Sales ratio (P/S ratio) multiplier might reach a quite acceptable value of 3.46, a bit below the average value in this industry (5). Bearing all this in mind, the upside for the company’s shares during the lock-up period might be 44.5%.

Buying GigaCloud Technology shares might be considered a risk-weighted investment.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

[ad_2]

Image and article originally from blog.roboforex.com. Read the original article here.